ICICI Bank 2010 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

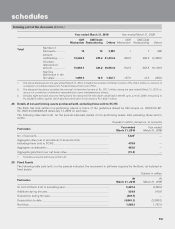

F33

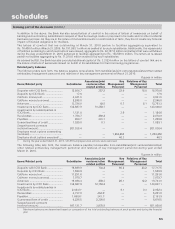

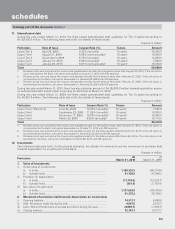

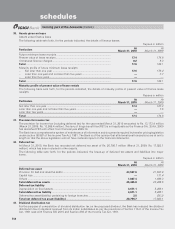

ii) Non-performing investments in securities, other than government and other approved securities

The following table sets forth, for the periods indicated, the movement in gross non-performing investments in securities,

other than government and other approved securities.

Rupees in million

Particulars Year ended

March 31, 2010

Year ended

March 31, 2009

Opening balance ..................................................................................... 3,829.1 3,689.6

Additions during the year ........................................................................ 2,626.3 278.7

Reduction during the year ....................................................................... (1,236.1) (139.2)

Closing balance ....................................................................................... 5,219.3 3,829.1

Total provision held ................................................................................. 3,599.8 3,213.8

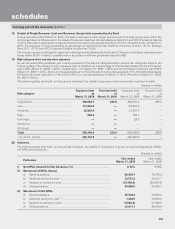

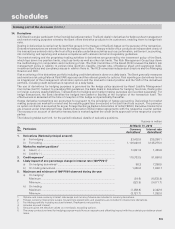

14. Repurchase transactions

The following table sets forth, for the periods indicated, the details of securities sold and purchased under repos and reverse

repos.

Rupees in million

Minimum

outstanding

balance during

the year

Maximum

outstanding

balance during

the year

Daily average

outstanding

balance during

the year

Balance at

year end

Year ended March 31, 2010

Securities sold under repurchase transaction ............. — 304,922.4 160,895.7 27,301.0

Securities purchased under reverse

repurchase transaction ................................................ — — — —

Year ended March 31, 2009

Securities sold under repurchase transaction ............. — 145,875.0 66,861.3 22,092.3

Securities purchased under reverse

repurchase transaction ................................................ — 10,499.7 31.5 —

1. The above figures do not include securities sold and purchased under Liquidity Adjustment Facility (LAF) of RBI.

2. The above figures are for Indian branches only.

3. Minimum, maximum & average outstanding is based on first leg of transaction & balance outstanding is based on book value.

4. Corporate debt securities sold and purchased under repo and reverse repo transactions is Nil.

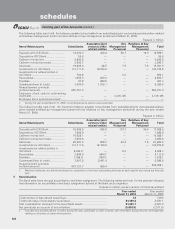

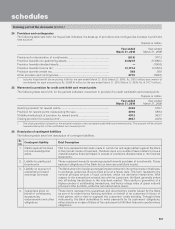

15. Reconciliation of nostro account

In terms of RBI circular no. DBOD.BP.BC.No. 133/21.04.018/2008-09 dated May 11, 2009, Rs. 10.4 million representing

outstanding credit balances of individual value less than USD 2,500 or equivalent lying in nostro account, which were

originated up to March 31, 2002 and parked in blocked account, was transferred to profit and loss account during the year

ended March 31, 2010.

16. CBLO transactions

Collateralised Borrowing and Lending Obligation (CBLO) is a discounted money market instrument, developed by The Clearing

Corporation of India Limited (CCIL) and approved by RBI which involves secured borrowings and lending transactions. At

March 31, 2010, the Bank had outstanding borrowings amounting to Nil and outstanding lending amounting to Nil in the

form of CBLO. The amortised book value of securities given as collateral by the Bank to CCIL for availing the CBLO facility

was Rs. 44,699.4 million at March 31, 2010.

17. Lending to sensitive sectors

The Bank has lending to sectors, which are sensitive to asset price fluctuations. The sensitive sectors include capital markets

and real estate.

schedules

forming part of the Accounts (Contd.)