ICICI Bank 2010 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F102

Collateral management

Overview

The Bank defines collateral as the assets or rights provided to the Bank by the borrower or a third party in

order to secure a credit facility. The Bank would have the rights of secured creditor in respect of the assets/

contracts offered as security for the obligations of the borrower/obligor. The Bank ensures that the underlying

documentation for the collateral provides the bank appropriate rights over the collateral or other forms of credit

enhancement including the right to liquidate, retain or take legal possession of it in a timely manner in the event

of default by the counter party. The Bank also endeavours to keep the assets provided as security to the Bank

under adequate insurance during the tenor of the Bank’s exposure. The collateral is monitored periodically.

Collateral valuation

As stipulated by the RBI guidelines, the Bank uses the comprehensive approach for collateral valuation. Under

this approach, the Bank reduces its credit exposure to a counterparty when calculating its capital requirements

to the extent of risk mitigation provided by the eligible collateral as specified in the Basel II guidelines.

The Bank adjusts the value of any collateral received to adjust for possible future fluctuations in the value of

the collateral in line with the requirements specified by RBI guidelines. These adjustments, also referred to as

‘haircuts’, to produce volatility-adjusted amounts for collateral, are reduced from the exposure to compute

the capital charge based on the applicable risk weights.

Types of collateral taken by the Bank

ICICI Bank determines the appropriate collateral for each facility based on the type of product and risk profile of

the counterparty. In case of corporate and small and medium enterprises financing, fixed assets are generally

taken as security for long tenor loans and current assets for working capital finance. For project finance,

security of the assets of the borrower and assignment of the underlying project contracts is generally taken.

In addition, in some cases, additional security such as pledge of shares, cash collateral, charge on receivables

with an escrow arrangement and guarantees is also taken.

For retail products, the security to be taken is defined in the product policy for the respective products. Housing

loans and automobile loans are secured by the security of the property/automobile being financed. The valuation

of the properties is carried out by an approved valuation agency at the time of sanctioning the loan.

The Bank also offers products which are primarily based on collateral such as shares, specified securities,

warehoused commodities and gold jewellery. These products are offered in line with the approved product

policies which include types of collateral, valuation and margining.

The Bank extends unsecured facilities to clients for certain products such as derivatives, credit cards and personal

loans. The limits with respect to unsecured facilities have been approved by the Board of Directors.

The decision on the type and quantum of collateral for each transaction is taken by the credit approving

authority as per the credit approval authorisation approved by the Board of Directors. For facilities provided

as per approved product policies (retail products, loan against shares etc.), collateral is taken in line with

the policy.

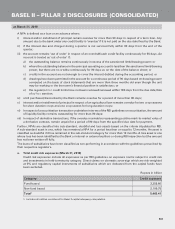

Credit risk mitigation techniques

The RBI guidelines on Basel II allow the following credit risk mitigants to be recognised for regulatory capital

purposes:

z Eligible financial collateral which include cash (deposited with the Bank), gold (including bullion and

jewellery, subject to collateralised jewellery being benchmarked to 99.99% purity), securities issued by

Central and State Governments, Kisan Vikas Patra, National Savings Certificates, life insurance policies

with a declared surrender value issued by an insurance company which is regulated by the insurance

sector regulator, certain debt securities rated by a recognised credit rating agency, mutual fund units

where daily net asset value is available in public domain and the mutual fund is limited to investing in

the instruments listed above.

z On-balance sheet netting, which is confined to loans/advances and deposits, where banks have legally

enforceable netting arrangements, involving specific lien with proof of documentation.

z Guarantees, where these are direct, explicit, irrevocable and unconditional. Further, the eligible guarantors

would comprise:

– Sovereigns, sovereign entities stipulated in the RBI guidelines on Basel II, bank and primary dealers

with a lower risk weight than the counterparty; and

– Other entities, which are rated AA(-) or better.

BASEL II – PILLAR 3 DISCLOSURES (CONSOLIDATED)

at March 31, 2010