ICICI Bank 2010 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F37

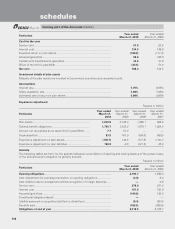

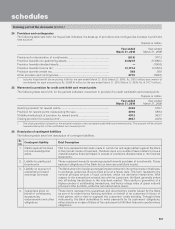

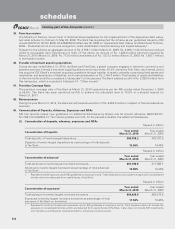

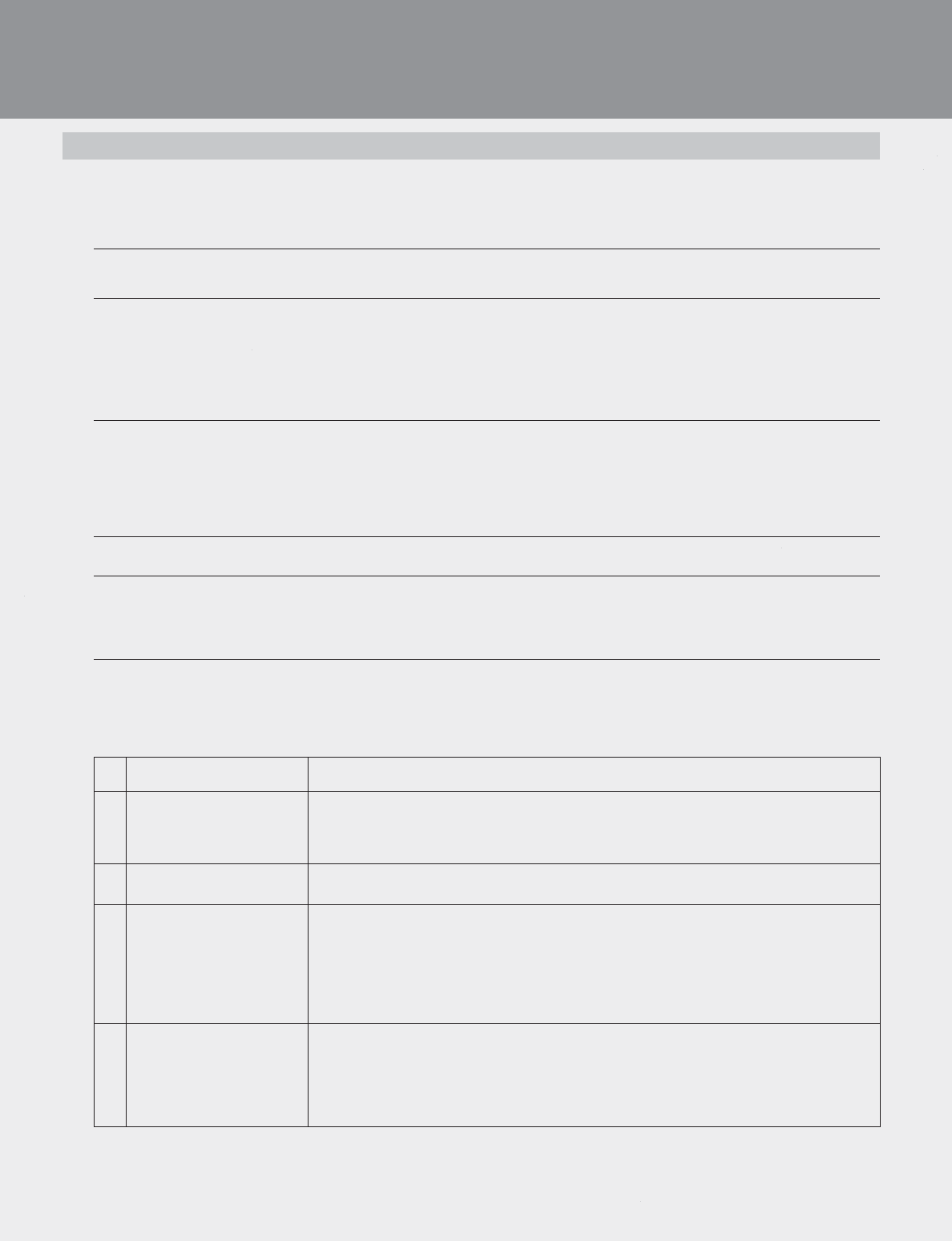

24. Provisions and contingencies

The following table sets forth, for the periods indicated, the break-up of provisions and contingencies included in profit and

loss account.

Rupees in million

Year ended

March 31, 2010 Year ended

March 31, 2009

Provisions for depreciation of investments ........................................................ (26.5) 977.3

Provision towards non-performing assets .......................................................... 43,621.6 37,690.3

Provision towards standard assets ..................................................................... — (190.0)

Provision towards income tax1 ........................................................................... 13,173.4 13,558.4

Provision towards wealth tax .............................................................................. 30.0 30.0

Other provision and contingencies ..................................................................... 273.5 (395.0)

1. Includes fringe benefit tax amounting to Nil for the year ended March 31, 2010 (March 31, 2009: Rs. 342.0 million) and creation of

net deferred tax asset amounting to Rs. (2,804.4) million for the year ended March 31, 2010 (March 31, 2009: Rs. (4,716.7) million).

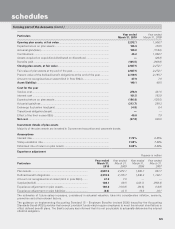

25. Movement in provision for credit card/debit card reward points

The following table sets forth, for the periods indicated, movement in provision for credit card/debit card reward points.

Rupees in million

Year ended

March 31, 2010 Year ended

March 31, 2009

Opening provision for reward points .................................................................. 232.0 576.3

Provision for reward points made during the year ............................................. 476.0 599.4

Utilisation/write-back of provision for reward points .......................................... 438.3 943.7

Closing provision for reward points1 ................................................................... 269.7 232.0

1. The closing provision is based on the actuarial valuation of accumulated credit/debit card reward points. This amount will be utilised

towards redemption of the credit/debit card reward points.

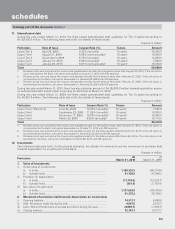

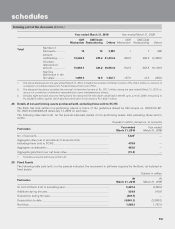

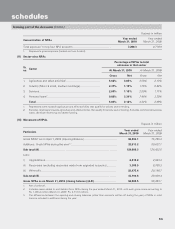

26. Description of contingent liabilities

The following table sets forth description of contingent liabilities.

Sr.

no. Contingent liability Brief Description

1. Claims against the Bank

not acknowledged as

debts

This item represents demands made in certain tax and legal matters against the Bank

in the normal course of business. The Bank does not consider these matters to have a

material adverse financial impact in excess of provisions already made in the financial

statements.

2. Liability for partly paid

investments These represent amounts remaining unpaid towards purchase of investments. These

payment obligations of the Bank do not have any profit/loss impact.

3. Liability on account of

outstanding forward

exchange contracts

The Bank enters into foreign exchange forward contracts in its normal course of business,

to exchange currencies at a pre-fixed price at a future date. This item represents the

notional principal amount of such contracts, which are derivative instruments. With

respect to the transactions entered into with its customers, the Bank generally enters

into off-setting transactions in the inter-bank market. This results in generation of a

higher number of outstanding transactions, and hence a large value of gross notional

principal of the portfolio, while the net market risk is lower.

4. Guarantees given on

behalf of constituents,

acceptances,

endorsements and other

obligations

These items represent the guarantees and documentary credits issued by the Bank

as part of its trade finance banking activities, on behalf of its customers in favour of

third parties, with a view to augment the customers’ credit standing. Through these

instruments, the Bank undertakes to make payments for its customers’ obligations,

either directly or in case of failure of the customers to fulfil their financial or performance

obligations.

schedules

forming part of the Accounts (Contd.)