ICICI Bank 2010 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196

|

|

F82

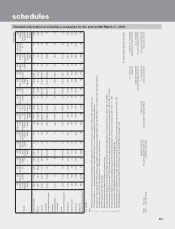

schedules

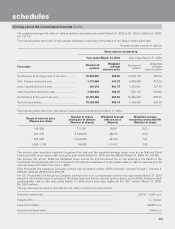

forming part of the Consolidated Accounts (Contd.)

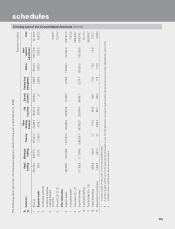

The following table sets forth, the business segment results for the year ended March 31, 2010.

Rupees in million

Sr.

no. Particulars Retail

banking Wholesale

banking Treasury Other

banking

business

Life

insurance General

insurance Venture fund

management Others Inter-

segment

adjustments Total

1. Revenue 177,244.1 192,541.3 248,297.5 34,898.1 185,378.0 28,511.1 1,832.7 32,576.6 (305,281.7) 595,997.7

2. Segment results (13,335.1) 36,451.0 27,444.4 7,733.8 2,776.5 1,583.1 744.1 6,814.2 (4,425.6) 65,786.4

3. Unallocated expenses —

4. Income tax expenses

(net)/(net deferred

tax credit) 17,352.3

5. Net profit1 (2)- (3) - (4) 48,434.1

Other information

6. Segment assets 737,339.9 1,184,314.3 1,641,699.5 610,350.8 584,434.3 65,597.7 2,532.2 183,265.0 (181,571.7) 4,827,962.0

7. Unallocated assets265,511.0

8. Total assets (6) + (7) 4,893,473.0

9. Segment liabilities 1,186,393.0 915,021.2 1,525,509.03604,992.43587,425.8366,798.532,569.53185,621.43(181,571.7) 4,892,759.1

10. Unallocated liabilities 713.9

11. Total liabilities (9) + (10) 4,893,473.0

12. Capital expenditure 1,721.0 635.8 2.9 102.6 228.3 189.7 107.5 866.5 (187.6) 3,666.7

13. Depreciation & amortisation 3,749.0 996.4 16.3 1,616.1 596.9 277.1 120.3 325.6 (69.0) 7,628.7

1. Includes share of net profit of minority shareholders.

2. Includes assets which cannot be specifically allocated to any of the segments, tax paid in advance/tax deducted at source (net), deferred tax asset (net).

3. Includes share capital and reserves and surplus.