ICICI Bank 2010 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F85

schedules

forming part of the Consolidated Accounts (Contd.)

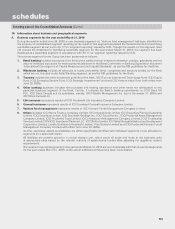

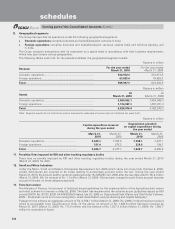

14. Credit derivative instruments

The Group deals in credit derivative instruments including credit default swaps, credit linked notes, collateralised debt

obligations and principal protected structures. The notional principal amount of these credit derivatives outstanding at

March 31, 2010 was Rs. 27,995.2 million (March 31, 2009: Rs. 33,703.4 million) in funded instruments and Rs. 32,880.9

million (March 31, 2009: Rs. 38,712.6 million) in non-funded instruments which includes Rs. 224.5 million (March 31, 2009:

Rs. 253.6 million) of protection bought by the Group. At March 31, 2010, the total outstanding mark-to-market position of

the above portfolio was a loss of Rs. 878.4 million (March 31, 2009: Rs. 6,327.3 million). The profit and loss impact on the

above portfolio on account of mark-to-market and realised gains/losses during the year ended March 31, 2010 was a net

profit of Rs. 5,080.3 million (March 31, 2009: net loss of Rs. 3,640.5 million).

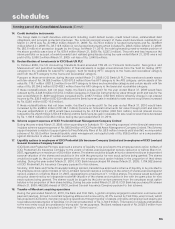

15. Reclassification of investments in ICICI Bank UK PLC

In October 2008, the UK Accounting Standards Board amended FRS 26 on ‘Financial Instruments: Recognition and

Measurement’ and permitted reclassification of financial assets in certain circumstances from the ‘held for trading (HFT)’

category to the ‘available for sale (AFS)’ category, ‘held for trading (HFT)’ category to the ‘loans and receivables’ category

and from the AFS category to the ‘loans and receivables’ category.

Pursuant to these amendments, during the year ended March 31, 2009, ICICI Bank UK PLC has transferred certain assets

with fair value of Rs. 34,028.0 million (USD 670.9 million) from the HFT category to the AFS category, certain assets of fair

value Rs. 116.7 million (USD 2.3 million) from HFT category to loans and receivables category and certain assets with fair

value of Rs. 20,394.5 million (USD 402.1 million) from the AFS category to the loans and receivables category.

If these reclassifications had not been made, the Bank’s pre-tax profit for the year ended March 31, 2009 would have

reduced by Rs. 2,448.8 million (USD 53.3 million) [expense on financial instruments fair value through profit and loss for the

year ended March 31, 2009 would have increased by Rs. 2,687.7 million (USD 58.5 million) offset by change in net interest

income by Rs. 238.9 million (USD 5.2 million)] and the Bank’s pre-tax gain in available for sale reserve would have increased

by Rs. 532.6 million (USD 10.5 million).

If these reclassifications had not been made, the Bank’s pre-tax profit for the year ended March 31, 2010 would have

increased by Rs. 2,285.4 million (USD 48.1 million) [income on financial instruments fair value through profit and loss for

the year ended March 31, 2010 would have increased by Rs. 2,518.2 million (USD 53.0 million), and net interest income

reduced by Rs. 232.8 million (USD 4.9 million)] and the Bank’s pre-tax gain in available for sale reserve would have decreased

by Rs. 1,180.9 million (USD 26.3 million) during the year ended March 31, 2010.

16. Scheme support expenses of ICICI Prudential Asset Management Company Limited

During the year ended March 31, 2009, other expenditure in Schedule 16 – ’Operating expenses’ of the financial statements

includes scheme support expense of Rs. 920.2 million of ICICI Prudential Asset Management Company Limited. The Scheme

support expense consists of support given to Fixed Maturity Plans of Rs. 26.8 million towards yield shortfall, money market

scheme of Rs. 55.2 million towards liquidity crisis management and equity funds of Rs. 838.2 million as a compensation

against diminution in value of certain investments.

17. Liquidity options to employees of ICICI Prudential Life Insurance Company Limited and to employees of ICICI Lombard

General Insurance Company Limited

ICICI Bank and Prudential Plc have approved a scheme of liquidity to be provided to the employee stock option holders of

ICICI Prudential Life Insurance Company to the extent of shares exercised against options vested on or before March 31,

2007, aggregating to a maximum of 2.5 million shares. The shares would be bought at a price determined by an independent

external valuation of the shares and would be in line with the grant price for new stock options being granted. The shares

would be bought by the joint venture partners from the employee stock option holders in the proportion of their share

holding. During the year ended March 31, 2010, ICICI Bank has purchased Nil shares (March 31, 2009: 1,704,062 shares)

of ICICI Prudential Life Insurance Company pursuant to this scheme.

Similarly, ICICI Bank and Fairfax Financials Holdings Limited, Canada have approved a scheme of liquidity to be provided to

the employee stock option holders of ICICI Lombard General Insurance Company to the extent of shares exercised against

options vested on or before March 31, 2007, aggregating to a maximum of 1.1 million shares. The shares would be bought

at a price determined by an independent external valuation of the shares and would be in line with the grant price for new

stock options being granted. The shares would be bought by the joint venture partners from the employee stock option

holders in the proportion of their share holding. During the year ended March 31, 2010, ICICI Bank has purchased Nil shares

(March 31, 2009: 442,950 shares) of ICICI Lombard General Insurance Company pursuant to this scheme.

18. Transfer of Merchant acquiring operations

During the year ended March 31, 2010, the Bank and First Data, a global company engaged in electronic commerce and

payment services, formed a merchant acquiring alliance and a new entity, 81.0% owned by First Data, was formed, which

has acquired ICICI Bank’s merchant acquiring operations through transfer of assets, primarily comprising fixed assets and

receivables and assumption of liabilities, for a total consideration of Rs. 3,744.0 million. This transfer of assets and liabilities

to the new entity would be considered a ‘slump sale’ for tax purposes. The Bank realised a profit of Rs. 2,029.0 million from

this transaction, which is included in Schedule 14 – “Other income”.