ICICI Bank 2010 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F39

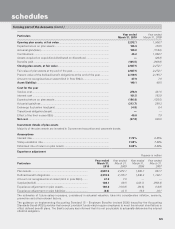

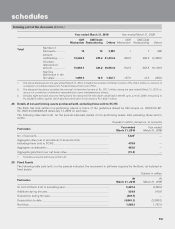

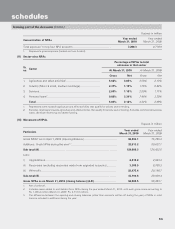

Year ended March 31, 2010 Year ended March 31, 2009

CDR

Mechanism SME Debt

Restructuring Others CDR

Mechanism SME Debt

Restructuring Others

Total Number of

Borrowers ............. 14 12 3,907 1 7 988

Amount

outstanding .......... 14,826.8 475.4 41,414.2 928.0 406.4 13,496.2

Of which:

restructured

amount ................. 13,068.7 329.2 39,681.0 912.2 263.9 10,130.9

Sacrifice

(diminution in the

fair value) .............. 1,086.6 10.8 1,432.7 107.0 12.2 208.0

1. The above disclosure for the year ended March 31, 2010, includes the reversal of interest income of Rs. 704.3 million on account of

conversion of overdue interest into Funded Interest Term Loan (FITL).

2. The aforesaid disclosure excludes the reversal of derivative income of Rs. 303.1 million during the year ended March 31, 2010 on

account of conversion of derivative receivables into term loan/preference shares.

3. Includes eight borrowal accounts restructured for a second time with asset classification benefit upto June 30, 2009, amounting to

Rs. 24,280.8 million against which sacrifice (diminution in fair value) is Rs.1,498.1 million.

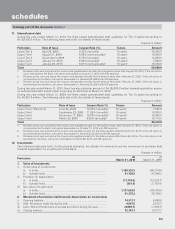

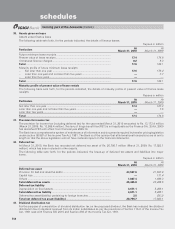

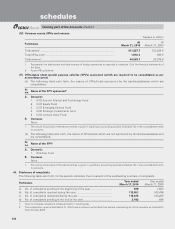

28. Details of non-performing assets purchased/sold, excluding those sold to SC/RC

The Bank has sold certain non-performing assets in terms of the guidelines issued by RBI circular no. DBOD.No.BP.

BC.16/21.04.048/2005-06 dated July 13, 2005 on such sale.

The following table sets forth, for the periods indicated, details of non-performing assets sold, excluding those sold to

SC/RC.

Rupees in million, except no. of accounts

Particulars Year ended

March 31, 2010

Year ended

March 31, 2009

No. of accounts ................................................................................................... 7,4281—

Aggregate value (net of provisions) of accounts sold,

excluding those sold to SC/RC ........................................................................... 479.0 —

Aggregate consideration ..................................................................................... 463.6 —

Aggregate gain/(loss) over net book value ......................................................... (15.4) —

1. Excludes accounts previously written off.

29. Fixed Assets

The following table sets forth, for the periods indicated, the movement in software acquired by the Bank, as included in

fixed assets.

Rupees in million

Particulars At

March 31, 2010

At

March 31, 2009

At cost at March 31st of preceding year ............................................................ 5,267.4 4,448.8

Additions during the year .................................................................................... 824.9 818.6

Deductions during the year................................................................................. (239.7) —

Depreciation to date ........................................................................................... (4,043.3) (3,509.5)

Net block ............................................................................................................. 1,809.3 1,757.9

schedules

forming part of the Accounts (Contd.)