ICICI Bank 2010 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F9

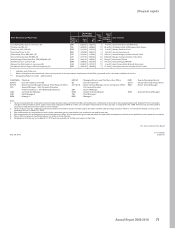

schedules

forming part of the Balance Sheet (Contd.) (Rs. in ‘000s)

At

31.03.2010 At

31.03.2009

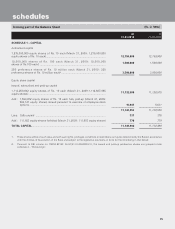

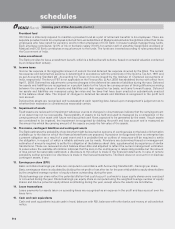

SCHEDULE 8 – INVESTMENTS

I. Investments in India [net of provisions]

i) Government securities ............................................................................. 683,991,406 633,774,902

ii) Other approved securities........................................................................ 45,009 93,405

iii) Shares (includes equity and preference shares) ...................................... 27,557,381 17,031,332

iv) Debentures and bonds ............................................................................ 36,353,907 26,000,683

v) Subsidiaries and/or joint ventures1 .......................................................... 62,226,766 61,194,621

vi) Others (commercial paper, mutual fund units, pass through certificates,

security receipts, certificate of deposits etc.) ........................................ 307,378,383 196,688,823

TOTAL INVESTMENTS IN INDIA ........................................................................... 1,117,552,852 934,783,766

II. Investments outside India [net of provisions]

i) Government securities ............................................................................. 1,645,046 953,347

ii) Subsidiaries and/or joint ventures abroad (includes equity and preference

shares) ...................................................................................................... 66,005,026 65,924,016

iii) Others ....................................................................................................... 23,725,081 28,921,951

TOTAL INVESTMENTS OUTSIDE INDIA ............................................................... 91,375,153 95,799,314

TOTAL INVESTMENTS ........................................................................................... 1,208,928,005 1,030,583,080

III. Investments in India

Gross value of investments ............................................................................. 1,129,332,338 947,314,476

Less: Aggregate of provision/depreciation ..................................................... 11,779,486 12,530,710

Net investments ............................................................................................... 1,117,552,852 934,783,766

IV. Investments outside India

Gross value of investments ............................................................................. 91,756,742 97,586,277

Less: Aggregate of provision/depreciation ..................................................... 381,589 1,786,963

Net investments ............................................................................................... 91,375,153 95,799,314

TOTAL INVESTMENTS ........................................................................................... 1,208,928,005 1,030,583,080

1. Includes application money of Rs. 1,000.0 million (March 31, 2009: Nil).

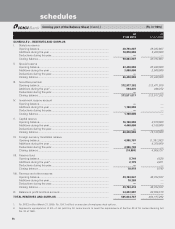

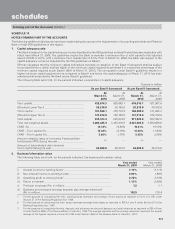

SCHEDULE 9 - ADVANCES [net of provisions]

A i) Bills purchased and discounted ............................................................... 44,531,591 40,610,992

ii) Cash credits, overdrafts and loans repayable on demand ...................... 255,552,276 343,945,509

iii) Term loans................................................................................................ 1,404,149,152 1,696,347,568

iv) Securitisation, finance lease and hire purchase receivables ................... 107,822,952 102,204,423

TOTAL ADVANCES ................................................................................................. 1,812,055,971 2,183,108,492

B. i) Secured by tangible assets (includes advances against book debts) ..... 1,336,426,827 1,575,653,288

ii) Covered by bank/government guarantees ............................................... 21,202,426 14,815,009

iii) Unsecured ................................................................................................ 454,426,718 592,640,195

TOTAL ADVANCES ................................................................................................. 1,812,055,971 2,183,108,492

C. I. Advances in India

i) Priority sector ................................................................................... 539,773,871 620,515,976

ii) Public sector ..................................................................................... 3,201,088 3,494,486

iii) Banks ................................................................................................ 41,790 252,580

iv) Others ............................................................................................... 817,672,519 1,015,930,993

TOTAL ADVANCES IN INDIA ................................................................................. 1,360,689,268 1,640,194,035

II. Advances outside India

i) Due from banks ................................................................................ 13,515,963 14,965,907

ii) Due from others

a) Bills purchased and discounted ............................................... 15,060,877 13,856,733

b) Commercial loans..................................................................... 206,115,152 283,420,282

c) Others ....................................................................................... 216,674,711 230,671,535

TOTAL ADVANCES OUTSIDE INDIA ..................................................................... 451,366,703 542,914,457

TOTAL ADVANCES ................................................................................................. 1,812,055,971 2,183,108,492