ICICI Bank 2010 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F61

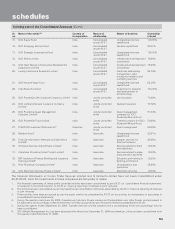

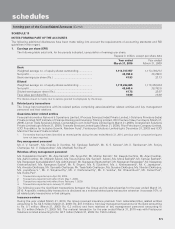

schedules

(Rs. in ‘000s)

forming part of the Consolidated Profit and Loss Account

Year ended

31.03.2010 Year ended

31.03.2009

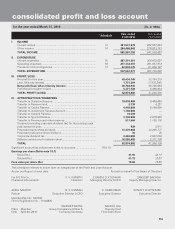

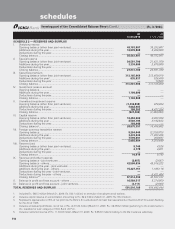

SCHEDULE 13 — INTEREST EARNED

I. Interest/discount on advances/bills ........................................................................ 203,626,416 251,907,185

II. Income on investments1 ......................................................................................... 78,164,417 93,690,339

III. Interest on balances with Reserve Bank of India and other inter-bank funds........ 7,111,651 7,685,387

IV. Others2,3 ................................................................................................................... 12,634,594 9,224,153

TOTAL INTEREST EARNED ........................................................................................... 301,537,078 362,507,064

1. Includes amortisation of premium on Government securities Rs. 8,121.5 million (March 31, 2009: Rs. 7,253.4 million).

2. Includes interest amounting to Rs. 1,241.8 million (March 31, 2009: Rs. 3,357.9 million) on income tax refunds.

3. Includes interest and amortisation of premium on non-trading interest rate swaps and foreign currency swaps.

SCHEDULE 14 — OTHER INCOME

I. Commission, exchange and brokerage .................................................................. 60,039,038 65,747,868

II. Profit/(loss) on sale of investments (net) ................................................................ 10,359,185 24,318,015

III. Profit/(loss) on revaluation of investments (net) ..................................................... 3,923,447 (4,431,761)

IV. Profit/(loss) on sale of land, buildings and other assets (net)1 ............................... 821,610 14,611

V. Profit/(loss) on foreign exchange transactions (net) ............................................... 11,911,507 1,964,929

VI. Premium and other operating income from insurance business ........................... 204,757,832 183,582,426

VII. Miscellaneous income (including lease income) .................................................... 2,648,029 7,827,655

TOTAL OTHER INCOME ................................................................................................ 294,460,648 279,023,743

1. Includes profit/(loss) on sale of assets given on lease.

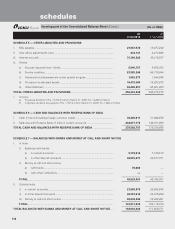

SCHEDULE 15 — INTEREST EXPENDED

I. Interest on deposits ................................................................................................ 135,093,359 182,506,979

II. Interest on Reserve Bank of India/inter-bank borrowings1 ..................................... 18,644,064 26,564,628

III. Others (including interest on borrowings of erstwhile ICICI Limited) .................... 53,554,438 55,800,920

TOTAL INTEREST EXPENDED ...................................................................................... 207,291,861 264,872,527

1. Includes interest paid on inter-bank deposits.

SCHEDULE 16 — OPERATING EXPENSES

I. Payments to and provisions for employees ........................................................... 36,784,297 39,043,015

II. Rent, taxes and lighting .......................................................................................... 10,168,540 10,766,322

III. Printing and stationery ............................................................................................ 1,609,042 2,103,465

IV. Advertisement and publicity ................................................................................... 4,421,935 3,311,278

V. Depreciation ............................................................................................................ 6,212,233 5,965,761

VI. Depreciation (including lease equalisation) on leased assets ................................ 1,416,505 2,101,070

VII. Directors’ fees, allowances and expenses ............................................................. 27,868 22,897

VIII. Auditors’ fees and expenses .................................................................................. 148,042 136,872

IX. Law charges ............................................................................................................ 1,396,354 1,425,366

X. Postages, telegrams, telephones, etc. ................................................................... 3,575,692 4,567,895

XI. Repairs and maintenance ....................................................................................... 6,685,665 6,831,997

XII. Insurance ................................................................................................................. 1,885,845 2,115,359

XIII. Direct marketing agency expenses ........................................................................ 2,413,170 6,121,823

XIV. Claims and benefits paid pertaining to insurance business ................................... 20,643,054 18,094,559

XV. Other expenses pertaining to insurance business ................................................. 158,516,684 147,404,509

XVI. Other expenditure ................................................................................................... 21,427,455 31,845,686

TOTAL OPERATING EXPENSES ................................................................................... 277,332,381 281,857,874

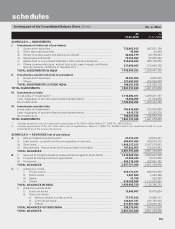

SCHEDULE 17 — PROVISIONS AND CONTINGENCIES

I. Income tax

– Current period tax ........................................................................................... 19,701,898 21,388,517

– Deferred tax adjustment ................................................................................. (2,349,787) (6,188,453)

– Fringe benefit tax ............................................................................................ (30,289) 659,192

II. Wealth tax 30,470 30,048

TOTAL INCOME TAX 17,352,292 15,889,304

III. Provision for investments (net) ............................................................................... 328,158 6,305,112

IV. Provision for advances (net)1................................................................................... 44,745,424 39,115,672

V. Others...................................................................................................................... 513,461 (303,901)

TOTAL PROVISIONS AND CONTINGENCIES.............................................................. 62,939,335 61,006,187

1. Includes provision on standard assets, non-performing advances, non-performing leased assets and others.