ICICI Bank 2010 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F107

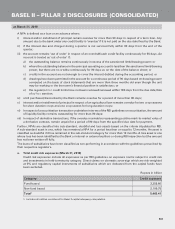

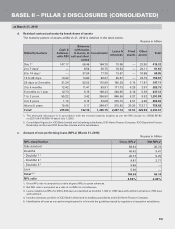

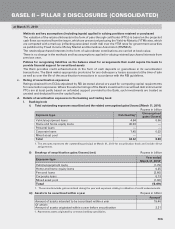

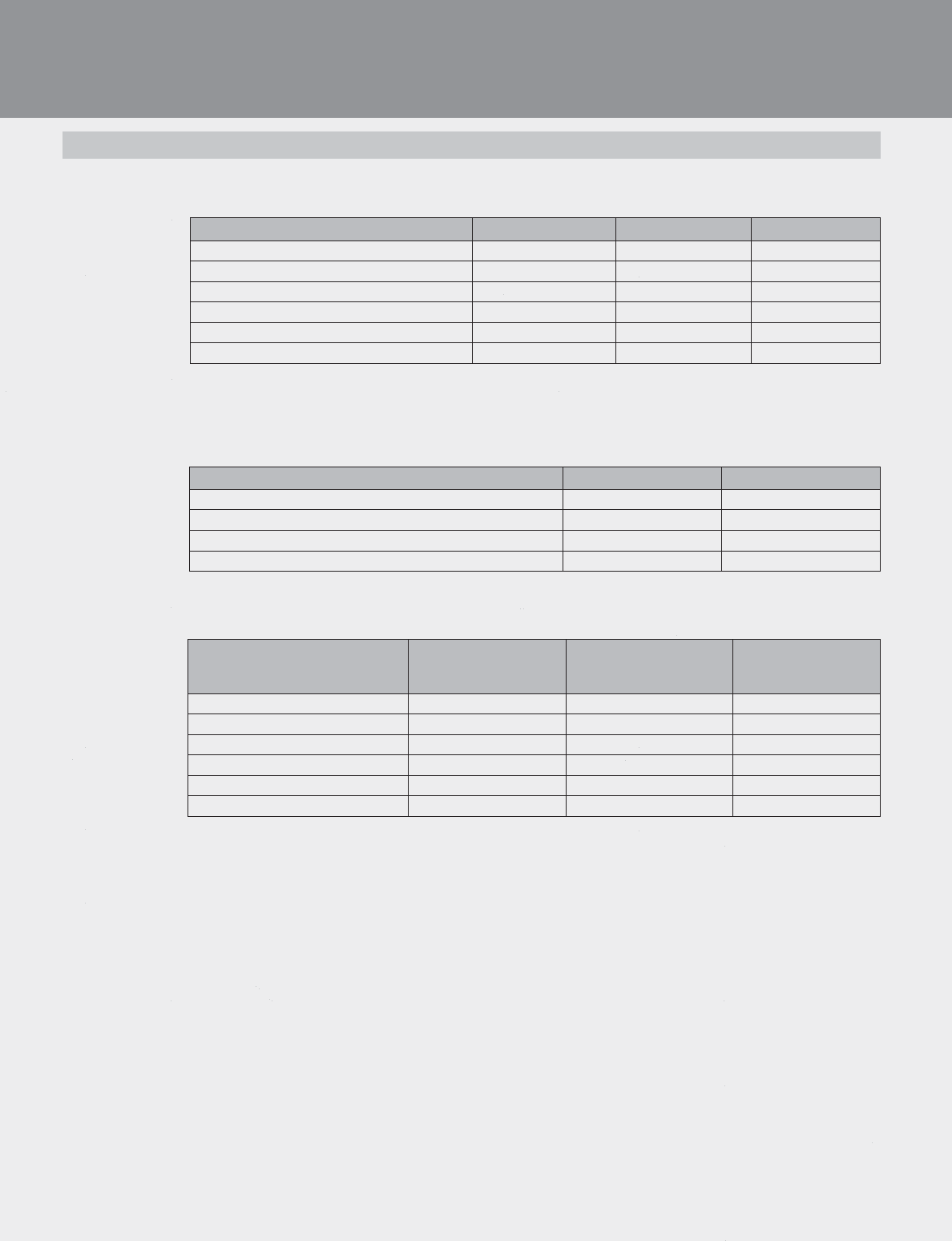

ii) Securitisation exposures retained or purchased (March 31, 2010)

Rupees in billion

Exposure type1On-balance sheet Off-balance sheet Total

Vehicle/equipment loans 8.28 — 8.28

Home and home equity loans 17.14 — 17.14

Personal loans 2.70 — 2.70

Corporate loans — — —

Mixed asset pool 13.67 — 13.67

Total 41.79 — 41.79

1. Securitisation exposures include PTCs originated by the Bank as well as PTCs purchased in case of third party

originated securitisation transactions.

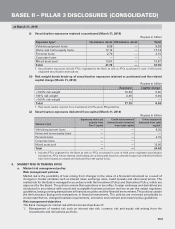

iii) Risk weight bands break-up of securitisation exposures retained or purchased and the related

capital charge (March 31, 2010)

Rupees in billion

Exposure Capital charge1

<100% risk weight 16.69 0.30

100% risk weight 0.46 0.04

>100% risk weight — —

Total 17.15 0.34

1. Represents capital required to be maintained at 9.0% as per RBI guidelines.

iv) Securitisation exposures deducted from capital (March 31, 2010)

Rupees in billion

Exposure type

Exposures deducted

entirely from

Tier-1 capital

Credit enhancement

(interest only) deducted

from total capital

Other exposures

deducted from total

capital1

Vehicle/equipment loans — — 8.28

Home and home equity loans — — —

Personal loans — — 2.70

Corporate loans — — —

Mixed asset pool — — 13.66

Total — — 24.64

1. Includes PTCs originated by the Bank as well as PTCs purchased in case of third party originated securitisation

transactions. PTCs whose external credit ratings are at least partly based on unfunded support provided by the Bank

have been treated as unrated and deducted from the capital funds.

9. MARKET RISK IN TRADING BOOK

a. Market risk management policy

Risk management policies

Market risk is the possibility of loss arising from changes in the value of a financial instrument as a result of

changes in market variables such as interest rates, exchange rates, credit spreads and other asset prices. The

market risk for the Bank is managed in accordance with the Investment Policy and Derivatives Policy, which are

approved by the Board. The policies ensure that operations in securities, foreign exchange and derivatives are

conducted in accordance with sound and acceptable business practices and are as per the extant regulatory

guidelines, laws governing transactions in financial securities and the financial environment. The policies contain

the limit structure that govern transactions in financial instruments. The policies are reviewed periodically to

incorporate therein, changed business requirements, economic environment and revised policy guidelines.

Risk management objectives

The Bank manages its market risk with the broad objectives of:

1. Management of market risk such as interest rate risk, currency risk and equity risk arising from the

investments and derivatives portfolio.

BASEL II – PILLAR 3 DISCLOSURES (CONSOLIDATED)

at March 31, 2010