ICICI Bank 2010 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2010 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

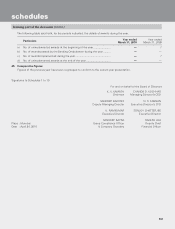

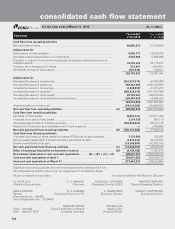

F54

consolidated cash flow statement

for the year ended March 31, 2010

Significant accounting policies and notes to accounts (refer schedule 18 & 19).

The schedules referred to above form an integral part of the Balance Sheet.

As per our Report of even date. For and on behalf of the Board of Directors

For B S R & Co. K. V. KAMATH CHANDA D. KOCHHAR SANDEEP BAKHSHI

Chartered Accountants Chairman Managing Director & CEO Deputy Managing Director

AKEEL MASTER N. S. KANNAN K. RAMKUMAR SONJOY CHATTERJEE

Partner Executive Director & CFO Executive Director Executive Director

Membership No.: 046768

Firm’s Registration No.: 101248W

SANDEEP BATRA RAKESH JHA

Place : Mumbai Group Compliance Officer & Deputy Chief

Date : April 24, 2010 Company Secretary Financial Officer

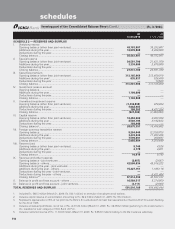

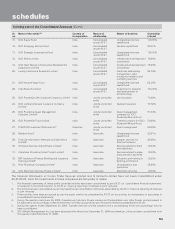

(Rs. in ‘000s)

Particulars Year ended

31.03.2010 Year ended

31.03.2009

Cash flow from operating activities

Net profit before taxes

.................................................................................................... 64,055,237 51,658,808

Adjustments for:

Depreciation and amortisation ........................................................................................ 9,085,111 10,034,785

Net (appreciation)/depreciation on investments............................................................. 4,526,200 17,990,288

Provision in respect of non-performing assets (including prudential provision on

standard assets) .............................................................................................................. 44,745,424 39,115,672

Provision for contingencies & others .............................................................................. 513,461 (303,901)

(Profit)/loss on sale of fixed assets ................................................................................. (821,610) (14,611)

122,103,823 118,481,041

Adjustments for:

(Increase)/decrease in investments ................................................................................ (216,921,819) (4,416,202)

(Increase)/decrease in advances ..................................................................................... 358,364,395 (185,733,697)

Increase/(decrease) in borrowings .................................................................................. (3,820,938) 41,331,233

Increase/(decrease) in deposits ...................................................................................... (202,834,572) (151,274,780)

(Increase)/decrease in other assets ................................................................................ 28,724,367 (39,234,654)

Increase/(decrease) in other liabilities and provisions .................................................... 229,307,649 16,998,654

192,819,082 (322,329,446)

(Payment)/refund of taxes (net) ....................................................................................... (19,414,369) (18,405,479)

Net cash flow from operating activities ...................................................................... (A) 295,508,536 (222,253,884)

Cash flow from investing activities

Purchase of fixed assets ................................................................................................. (6,654,131) (13,071,158)

Proceeds from sale of fixed assets ................................................................................ 3,374,730 897,114

(Purchase)/sale of held to maturity securities ................................................................ (152,852,224) 90,016,170

Acquisition of business by a subsidiary (net of cash acquired) ..................................... — (140,002)

Net cash generated from investing activities ............................................................. (B) (156,131,625) 77,702,124

Cash flow from financing activities

Proceeds from issue of share capital (including ESOPs) net of issue expense ............. 1,175,994 522,062

Net proceeds/(repayment) of bonds (including subordinated debt) .............................. (1,247,434) 44,144,641

Dividend and dividend tax paid ....................................................................................... (14,348,954) (14,229,374)

Net cash generated from financing activities.............................................................. (C) (14,420,394) 30,437,329

Effect of exchange fluctuation on translation reserve ................................................ (D) (4,129,160) 11,441,514

Net increase/(decrease) in cash and cash equivalents .............(A) + (B) + (C) + (D) 120,827,357 (102,672,917)

Cash and cash equivalents at April 1 ........................................................................... 350,613,856 453,286,773

Cash and cash equivalents at March 31 ...................................................................... 471,441,213 350,613,856