Vodafone 2014 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

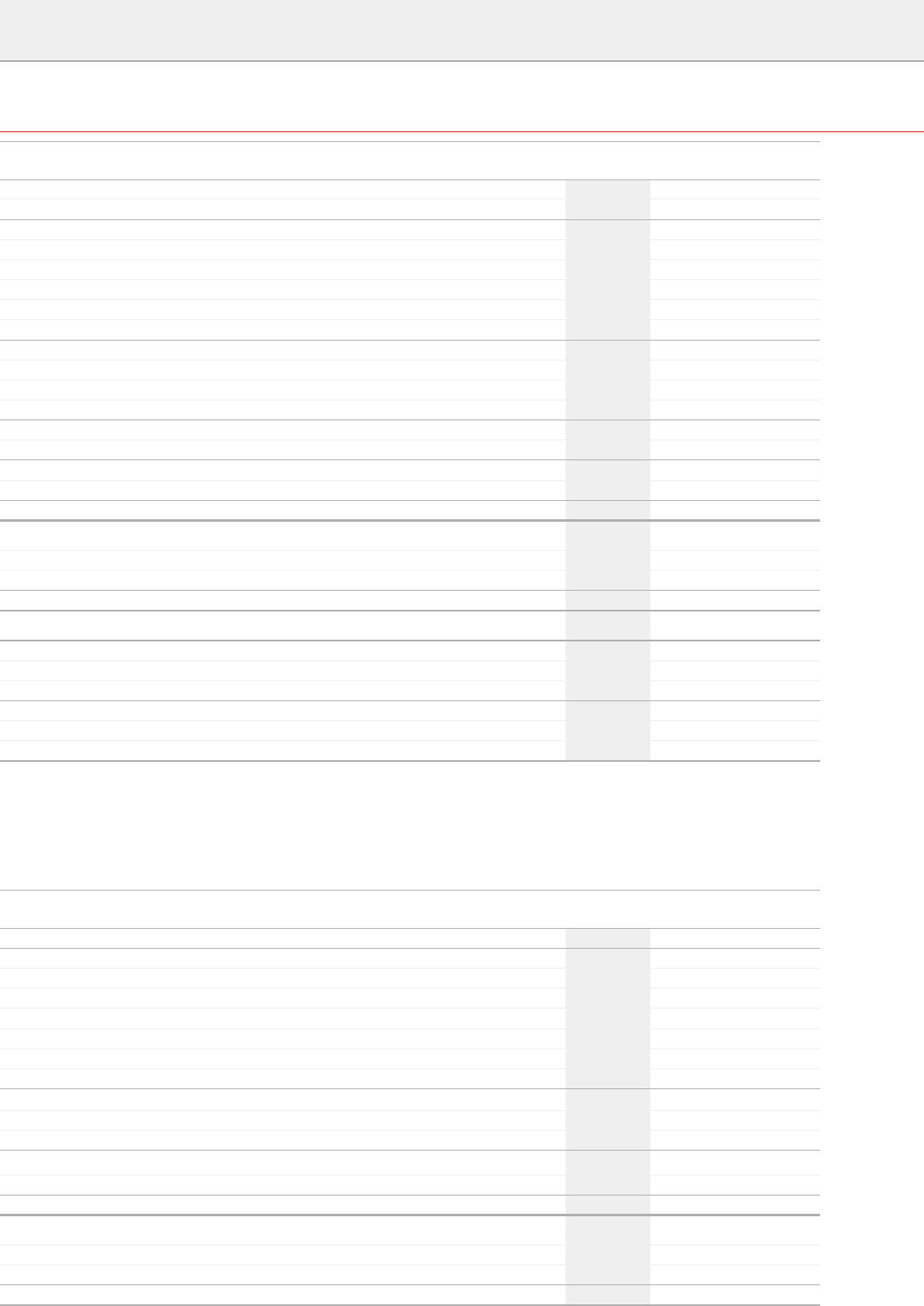

Consolidated income statement

for the years ended 31 March

2014

Restated1

2013

Restated1

2012

Note £m £m £m

Revenue 238,346 38,041 38,821

Cost of sales (27,942) (26,567) (27,201)

Gross prot 10,404 11,474 11,620

Selling and distribution expenses (3,033) (2,860) (2,755)

Administrative expenses (4,245) (4,159) (4,031)

Share of results of equity accounted associates and joint ventures 278 575 1,129

Impairment losses 4(6,600) (7,700) (4,050)

Other income and expense (717) 468 3,705

Operating (loss)/prot 3(3,913) (2,202) 5,618

Non-operating income and expense (149) 10 (162)

Investment income 5346 305 456

Financing costs 5(1,554) (1,596) (1,768)

(Loss)/prot before taxation (5,270) (3,483) 4,144

Income tax credit/(expense) 616,582 (476) (705)

Prot/(loss) for the nancial year from continuing operations 11,312 (3,959) 3,439

Prot for the nancial year from discontinued operations 748,108 4,616 3,555

Prot for the nancial year 59,420 657 6,994

Attributable to:

– Equity shareholders 59,254 413 6,948

– Non-controlling interests2166 244 46

Prot for the nancial year 59,420 657 6,994

Earnings/(loss) per share

From continuing operations:

– Basic 42.10p (15.66p) 12.28p

– Diluted 41.77p (15.66p) 12.14p

Total Group:

– Basic 8223.84p 1.54p 25.15p

– Diluted 8222.07p 1.54p 24.87p

Notes:

1 Restated to show the results of our US Group in discontinued operations, adoption of IFRS 11 and amendments to IAS 19. See note 1 “Basis of preparation” for further details.

2 Prot attributable to non-controlling interests solely derives from continuing operations.

Consolidated statement of comprehensive income

for the years ended 31 March

2014

Restated1

2013

Restated1

2012

£m £m £m

Prot for the nancial year 59,420 657 6,994

Other comprehensive income:

Items that may be reclassied to prot or loss in subsequent periods:

Losses on revaluation of available-for-sale investments, net of tax (119) (73) (17)

Foreign exchange translation differences, net of tax (4,104) 362 (3,673)

Foreign exchange losses/(gains) transferred to the income statement 1,493 1(681)

Fair value gains transferred to the income statement (25) (12) –

Other, net of tax –(4) (10)

Total items that may be reclassied to prot or loss in subsequent years (2,755) 274 (4,381)

Items that will not be reclassied to prot or loss in subsequent years:

Net actuarial gains/(losses) on dened benet pension schemes, net of tax 37 (182) (263)

Total items that will not be reclassied to prot or loss in subsequent years 37 (182) (263)

Other comprehensive (expense)/income (2,718) 92 (4,644)

Total comprehensive income for the year 56,702 749 2,350

Attributable to:

– Equity shareholders 56,711 604 2,383

– Non-controlling interests (9) 145 (33)

56,702 749 2,350

Note:

1 Restated to show the results of our US Group in discontinued operations, adoption of IFRS 11 and amendments to IAS 19. See note 1 “Basis of preparation” for further details.

Vodafone Group Plc

Annual Report 201496