Vodafone 2014 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Indian Government commissioned a committee of experts (the ‘Shome committee’) consisting of academics, and current and former Indian

government ofcials, to examine, and make recommendations in respect of, aspects of the Finance Act 2012 including the retrospective taxation

of transactions such as VIHBV’s transaction with HTIL referred to above. On 10 October 2012, the Shome committee published its draft report for

comment. The draft report concluded that tax legislation in the Finance Act 2012 should only be applied prospectively or, if applied retrospectively,

that only a seller who made a gain should be liable and, in that case, without any liability for interest or penalties. The Shome committee’s nal

report was submitted to the Indian Government on 31 October 2012, but no nal report has been published, and it remains unclear what the Indian

Government intends to do with the Shome committee’s nal report or its recommendations.

VIHBV has not received any formal demand for taxation following the Finance Act 2012, but it did receive a letter on 3 January 2013 reminding

it of the tax demand raised prior to the Indian Supreme Court’s judgement and purporting to update the interest element of that demand to a total

amount of INR 142 billion. The separate proceedings taken against VIHBV to seek to treat it as an agent of HTIL in respect of its alleged tax on the

same transaction, as well as penalties of up to 100% of the assessed withholding tax for the alleged failure to have withheld such taxes, remain

pending despite the issue having been ruled upon by the Indian Supreme Court. Should a further demand for taxation be received by VIHBV or any

member of the Group as a result of the new retrospective legislation, we believe it is probable that we will be able to make a successful claim under

the BIT. Although this would not result in any outow of economic benet from the Group, it could take several years for VIHBV to recover any

deposit required by an Indian Court as a condition for any stay of enforcement of a tax demand pending the outcome of VIHBV’s BIT claim. However,

VIHBV expects that it would be able to recover any such deposit. On 17 January 2014, VIHBV served on the Indian Government an amended trigger

notice under the BIT, supplementing the trigger notice led on 17 April 2012, to add claims relating to an attempt by the Indian Government to tax

aspects of the transaction with Hutchison under transfer pricing rules. On 17 April 2014, VIHBV served its notice of arbitration under the BIT, formally

commencing the BIT arbitration proceedings.

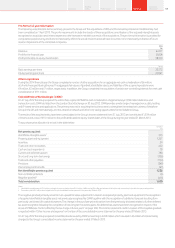

We did not carry a provision for this litigation or in respect of the retrospective legislation at 31 March 2014, or at previous reporting dates.

Other Indian tax cases

VIL and Vodafone India Services Private Limited (‘VISPL’) (formerly 3GSPL) are involved in a number of tax cases with total claims exceeding £1 billion

plus interest, and penalties of up to 300% of the principal.

VIL tax claims

The claims against VIL range from disputes concerning transfer pricing and the applicability of value-added tax to SIM cards, to the disallowance

of income tax holidays. The quantum of the tax claims against VIL is in the region of £0.9 billion. VIL is of the opinion that any nding of material

liability to tax, is not probable.

VISPL tax claims

VISPL has been assessed to owe tax of approximately £240 million (plus interest of £190 million) in respect of (i) a transfer pricing margin charged for

the international call centre of Hutchison prior to the transaction with Vodafone; (ii) the sale of the international call centre by VISPL to Hutchison and

(iii) the alleged transfer of options held by VISPL for VIL equity shares. The rst two of the three heads of tax are subject to an indemnity by Hutchison

under the VIHBV Tax Deed of Indemnity. The larger part of the potential claim is not subject to any indemnity. VISPL unsuccessfully challenged the

merits of the tax demand in the statutory tax tribunal and the jurisdiction of the tax ofce to make the demand in the High Court. The case is now

in the Tax Appeal Tribunal after VISPL obtained a stay of the tax demand on a deposit of £20 million and a corporate guarantee by VIHBV for the

balance. If VISPL loses the appeal, its terms of the stay of demand may be revisited (and could be increased) while VISPL pursues further appeals

in the High Court and the Supreme Court.

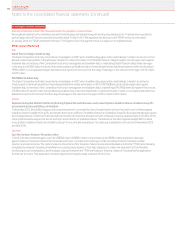

Indian regulatory cases

Litigation remains pending in the Telecommunications Dispute Settlement Appellate Tribunal (‘TDSAT’), High Courts and the Supreme Court

in relation to a number of signicant regulatory issues including mobile termination rates (‘MTRs’), spectrum and licence fees, licence extension and

3G intra-circle roaming (‘ICR’).

Public interest litigation: Yakesh Anand v Union of India, Vodafone and others

The Petitioner has brought a special leave petition in the Indian Supreme Court on 30 January 2012 against the Government of India and mobile

network operators, including VIL, seeking recovery of the alleged excess spectrum allocated to the operators, compensation for the alleged excess

spectrum held in the amount of approximately €4.7 billion and a criminal investigation of an alleged conspiracy between government ofcials and

the network operators. A claim with similar allegations was dismissed by the Supreme Court in March 2012, with an order that the Petitioner should

pay a ne for abuse of process. The case is pending before the Supreme Court and is expected to be called for hearing at some uncertain future date.

One time spectrum charges: Vodafone India v Union of India

The Government of India has sought to impose one time spectrum charges of approximately €525 million on certain operating subsidiaries of VIL.

We led a petition before the TDSAT challenging the one time spectrum charges on the basis that they are illegal, violate Vodafone’s licence terms

and are arbitrary, unreasonable and discriminatory. The tribunal stayed enforcement of the Government’s spectrum demand pending resolution

of the dispute. The case is now ready for trial.

3G inter-circle roaming: Vodafone India and others v Union of India

In April 2013, the Indian Department of Telecommunications issued a stoppage notice to VIL’s operating subsidiaries and other mobile operators

requiring the immediate stoppage of the provision of 3G services on other operators’ mobile networks in an alleged breach of licences. The regulator

also imposed a ne of approximately €5.5 million. We applied to the Delhi High Court for an order quashing the regulator’s notice. Interim relief

from the notice has been granted (but limited to existing customers at the time with the effect that VIL was not able to provide 3G services to new

customers on other operators’ 3G networks pending a decision on the issue). The dispute was referred to the TDSAT for decision, which ruled

on 28 April 2014 that VIL and the other operators were permitted to provide 3G services to their customers (current and future) on other operators’

networks. An appeal by the Department of Telecommunications is possible.

Annual Report 2014 165Overview Strategy

review Performance Governance Financials Additional

information