Vodafone 2014 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

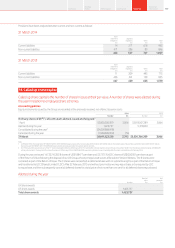

22. Liquidity and capital resources (continued)

Furthermore, certain of our subsidiaries are funded by external facilities which are non-recourse to any member of the Group other than the

borrower. These facilities may only be used to fund their operations. At 31 March 2014 Vodafone India had facilities of INR 207 billion (£2.1 billion)

of which INR 179 billion (£1.8 billion) was drawn. Vodafone Egypt had an undrawn revolving credit facility of US$120 million (£71 million) .

Vodacom had fully drawn facilities of ZAR 1.0 billion (£57 million) and US$37 million (£22 million). Ghana had a facility of US$217 million

(£130 million) which was fully drawn.

We believe that we have sufcient funding for our expected working capital requirements for at least the next 12 months. Further details regarding

the maturity, currency and interest rates of the Group’s gross borrowings at 31 March 2014 are included in note 21 “Borrowings”.

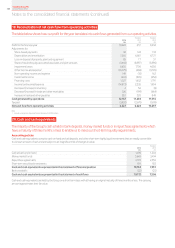

Dividends from associates and to non-controlling shareholders

Dividends from our associates are generally paid at the discretion of the Board of directors or shareholders of the individual operating and holding

companies and we have no rights to receive dividends except where specied within certain of the Group’s shareholders’ agreements. Similarly,

other than ongoing dividend obligations to the KDG minority shareholders should they continue to hold their minority stake, we do not have existing

obligations under shareholders’ agreements to pay dividends to non-controlling interest partners of our subsidiaries or joint ventures.

The amount of dividends received and paid in the year are disclosed in the consolidated statement of cash ows.

Potential cash outows from option agreements and similar arrangements

In respect of our interest in Vodafone India Limited (‘VIL’), Piramal Healthcare (‘Piramal’) acquired approximately 11% shareholding in VIL from Essar

during the 2012 nancial year. In April 2014 Piramal sold its total shareholding in VIL to Vodafone Group. The combined consideration for these

shares and the indirect equity interest held by Analjit Singh and Neelu Analjit Singh (completed in March 2014) was £1.0 billion.

Under the terms of the sale and purchase agreement governing the disposal of the US Group, including the 45% interest in Verizon Wireless,

the Group retains the responsibility for any tax liabilities of the US Group, excluding those relating to the Verizon Wireless partnership, for periods

up to the completion of the transaction on 21 February 2014.

Off-balance sheet arrangements

We do not have any material off-balance sheet arrangements as dened in item 5.E.2. of the SEC’s Form 20-F. Please refer to notes 29 and 30 for

a discussion of our commitments and contingent liabilities.

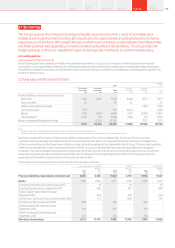

23. Capital and nancial risk management

This note details our treasury management and nancial risk management objectives and policies, as well as

theexposure and sensitivity of the Group to credit, liquidity, interest and foreign exchange risk, and the policies in

place to monitor and manage these risks.

Accounting policies

Financial instruments

Financial assets and nancial liabilities, in respect of nancial instruments, are recognised on the Group’s statement of nancial position when the

Group becomes a party to the contractual provisions of the instrument.

Financial liabilities and equity instruments

Financial liabilities and equity instruments issued by the Group are classied according to the substance of the contractual arrangements entered

into and the denitions of a nancial liability and an equity instrument. An equity instrument is any contract that evidences a residual interest in the

assets of the Group after deducting all of its liabilities and includes no obligation to deliver cash or other nancial assets. The accounting policies

adopted for specic nancial liabilities and equity instruments are set out below.

Put option arrangements

The potential cash payments related to put options issued by the Group over the equity of subsidiary companies are accounted for as nancial

liabilities when such options may only be settled by exchange of a xed amount of cash or another nancial asset for a xed number of shares

in the subsidiary.

The amount that may become payable under the option on exercise is initially recognised at present value within borrowings with a corresponding

charge directly to equity. The charge to equity is recognised separately as written put options over non-controlling interests, adjacent to non-

controlling interests in the net assets of consolidated subsidiaries. The Group recognises the cost of writing such put options, determined as the

excess of the present value of the option over any consideration received, as a nancing cost.

Such options are subsequently measured at amortised cost, using the effective interest rate method, in order to accrete the liability up to the

amount payable under the option at the date at which it rst becomes exercisable; the charge arising is recorded as a nancing cost. In the event that

the option expires unexercised, the liability is derecognised with a corresponding adjustment to equity.

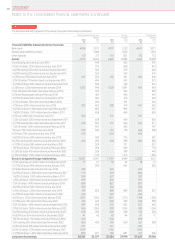

Derivative nancial instruments and hedge accounting

The Group’s activities expose it to the nancial risks of changes in foreign exchange rates and interest rates which it manages using derivative

nancial instruments.

The use of nancial derivatives is governed by the Group’s policies approved by the Board of directors, which provide written principles on the

use of nancial derivatives consistent with the Group’s risk management strategy. Changes in values of all derivatives of a nancing nature are

included within investment income and nancing costs in the income statement. The Group does not use derivative nancial instruments for

speculative purposes.

Notes to the consolidated nancial statements (continued)

Vodafone Group Plc

Annual Report 2014146