Vodafone 2014 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

For the purpose of presenting consolidated nancial statements, the assets and liabilities of entities with a functional currency other than sterling

are expressed in sterling using exchange rates prevailing at the reporting period date. Income and expense items and cash ows are translated

at the average exchange rates for the period and exchange differences arising are recognised directly in equity. On disposal of a foreign entity,

the cumulative amount previously recognised in equity relating to that particular foreign operation is recognised in prot or loss.

Goodwill and fair value adjustments arising on the acquisition of a foreign operation are treated as assets and liabilities of the foreign operation and

translated accordingly.

In respect of all foreign operations, any exchange differences that have arisen before 1 April 2004, the date of transition to IFRS, are deemed to be nil

and will be excluded from the determination of any subsequent prot or loss on disposal.

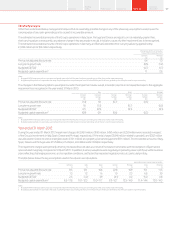

The net foreign exchange loss recognised in the consolidated income statement for the year ended 31 March 2014 is £1,688 million (31 March

2013: £117 million loss; 2012: £703 million gain). The net losses and net gains are recorded within operating prot (2014: £16 million charge;

2013: £21 million charge; 2012: £33 million charge), other income and expense and non-operating income and expense (2014: £1,493 million

charge; 2013: £1 million charge; 2012: £681 million credit), investment and nancing income (2014: £180 million charge; 2013: £91 million charge;

2012: £55 million credit) and income tax expense (2014: £1 million credit; 2013: £4 million charge; 2012: £nil). The foreign exchange gains and losses

included within other income and expense and non-operating income and expense arise on the disposal of interests in joint ventures, associates and

investments from the recycling of foreign exchange gains previously recorded in the consolidated statement of comprehensive income.

New accounting pronouncements adopted

On 1 April 2013 the Group adopted new accounting policies where necessary to comply with amendments to IFRS. Accounting pronouncements

considered by the Group as signicant on adoption are:

a Amendments to IAS 19, “Employee benets”, which requires revised accounting and disclosures for dened benet pension schemes, including

a different measurement basis for asset returns, replacing the expected return on plan assets and interest cost currently recorded in the consolidated

income statement with net interest. This results in a revised allocation of costs between the income statement and other comprehensive

income. The amendments also include a revised denition of short- and long-term benets to employees and revised criteria for the recognition

of termination benets. The consolidated nancial statements have been restated on the adoption of the amendments to IAS 19 (2013: reduced

prot for the year by £16 million, 2012: £9 million).

a Changes to the standards governing the accounting for subsidiaries, joint arrangements and associates, including the introduction of IFRS 10,

“Consolidated Financial Statements”, IFRS 11, “Joint Arrangements” and IFRS 12, “Disclosure of Interests in Other Entities” and amendments

to IAS 28, “Investments in Associates and Joint Ventures”. IFRS 11 generally requires interests in jointly controlled entities to be recorded using the

equity method, which is consistent with the accounting treatment applied to investments in associates. Under IFRS 11, the Group’s principal joint

arrangements, excluding Cornerstone Telecommunications Infrastructure Limited (see note 12 “Investments in associates and joint ventures”,

are incorporated into the consolidated nancial statements using the equity method of accounting rather than proportionate consolidation.

The consolidated nancial statements have been restated on the adoption of IFRS 11; the other changes to the standards governing the

accounting for subsidiaries, joint arrangements and associates do not have a material impact on the Group. Adoption on 1 April 2013 is considered

to be early adoption for the purposes of complying with IFRS as endorsed by the European Union.

In addition, during the year the Group has early-adopted amendments to IAS 36, “Impairment of Assets”, relating to recoverable amounts

disclosures, which corrects a previous amendment.

Other IFRS changes adopted on 1 April 2013, including the adoption of IFRS 13, “Fair Value Measurement”, have no material impact on the

consolidated results, nancial position or cash ows of the Group.

The previously reported comparative periods have been restated in the consolidated nancial statements for the amendments to IAS 19 and

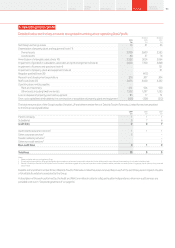

IFRS 11. The impact on key nancial information is detailed in the following tables; the impact on earnings per share is immaterial.

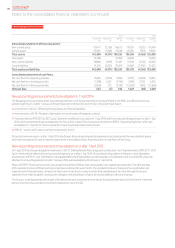

2013 2012

As reported

£m

Adjustments

£m

Discontinued

operations1

£m

Restated

£m

As reported

£m

Adjustments

£m

Discontinued

operations1

£m

Restated

£m

Consolidated income statement and statement

of comprehensive income

Revenue 44,445 (6,404) – 38,041 46,417 (7,596) – 38,821

Gross prot 13,940 (2,466) – 11,474 14,871 (3,251) – 11,620

Share of results of equity accounted associates and joint

ventures 6,477 520 (6,422) 575 4,963 1,033 (4,867) 1,129

Operating prot/(loss) 4,728 (508) (6,422) (2,202) 11,187 (702) (4,867) 5,618

Prot/(loss) before tax 3,255 (372) (6,366) (3,483) 9,549 (561) (4,844) 4,144

Prot/(loss) for the nancial year from continuing

operations 673 (16) (4,616) (3,959) 7,003 (9) (3,555) 3,439

Prot for the nancial year from discontinued operations – – 4,616 4,616 – – 3,555 3,555

Other comprehensive income/(expense) 76 16 – 92 (4,653) 9 – (4,644)

Total comprehensive income 749 – – 749 2,350 – – 2,350

Note:

1 Adjustments to disclose discontinued operations as a result of the disposal of the US Group, whose principal asset was its 45% interest in Verizon Wireless . See note 7 “Discontinued operations” for fur ther detail s.

Annual Report 2014 107Overview

Strategy

review Performance Governance Financials Additional

information