Vodafone 2014 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

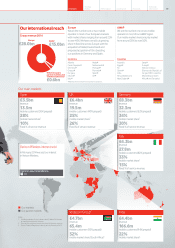

Financial highlights

Mixed nancial

performance

Our nancial performance this year reects the combination of good

performance in emerging markets and challenging conditions in Europe.

Due to changes in our business and accounting standards this year’s report

shows two views of our performance – management (how we run our

business) and statutory (how we are required to report).

Note:

1 Vodafone Italy became a 100% owned subsidiary on 21 February 2014.

Management basis

£43.6bn -1.9%

Revenue

Revenue decreased by 1.9% and fell by 3.5%*

on an organic basis as strong growth in emerging

markets was offset by competitive and regulatory

pressures and continued macroeconomic weakness

in Europe.

17.54p -12.8%

Adjusted earnings per share

Adjusted earnings per share was down 12.8% mainly

reecting both lower EBITDA and higher depreciation

and amortisation.

29.4% -1.1pp

EBITDA margin

EBITDA margin fell by 1.1 percentage points. On an

organic basis, margin was down 1.3* percentage points

as the impact of steep revenue declines in Europe offset

improving margins in our AMAP region, most notably

in India and Australia.

£7.1bn +13.3%

Capital expenditure

Cash capital expenditure increased by £0.8 billion driven

by the acquisition of Kabel Deutschland, the bre roll-out

in Spain, and initial Project Spring investment in India

and Germany.

£7.9bn -37.4%

Adjusted operating prot (‘AOP’)

The reported fall relates mainly to the sale of our interest

in Verizon Wireless during the year. On an organic basis,

AOP declined by 9.4%*, reecting the decline in EBITDA

and higher depreciation and amortisation.

£4.4bn -21.5%

Free cash ow

Free cash ow declined by 21.5%, reecting the fall

in EBITDA, increased capital expenditure and the impact

of weaker exchange rates in our emerging markets.

Read more 38

Statutory basis

£38.3bn +0.8%

Revenue

Revenues increased by 0.8% as growth in our AMAP

region and from business acquisitions offset revenue

declines in Europe.

£59.4bn N/A

Prot for the nancial year

Prot for the nancial year increased by £58.8 billion

primarily due to a pre-tax gain on disposal of our interest

in Verizon Wireless of £45.0 billion and recognition

of deferred tax assets of £19.3 billion.

£12.1bn +5.7%

Cash generated by operations

Cash generated by operations increased by 5.7%,

primarily as a result of higher working capital related

cash ows.

Read more 97, 103

This annual report contains nancial information on both

a statutorybasis, which under IFRS accounting principles include

the nancial results of our joint ventures (Vodafone Italy1, Vodafone

Hutchison Australia, Vodafone Fiji and Indus Towers) as one line

item in the incomestatement and in a limited number of lines in the

statement of cash ows, as well as on a management basis which

includes our share of these joint ventures in both these statements

on a line-by-line basis.

The discussion of our revenues, EBITDA, adjusted operating prot,

free cash ow and capital expenditure below is performed under the

management basis, as this is assessed as being the most insightful

presentation and is how the Group’s operating performance is reviewed

internally by management. The discussion of items of prot and losses

under adjusted operating prot is performed on a statutory basis.

See “Non-GAAP information” on page 201 for further information and

reconciliations between the management and statutory basis.

Ordinary dividend per share

We have announced a nal dividend per share

of 7.47pence, giving total dividends per share

for the year of 11.00 pence – an 8% increase

year-on-year.

03Overview Strategy

review Performance Governance Financials Additional

information