Vodafone 2014 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

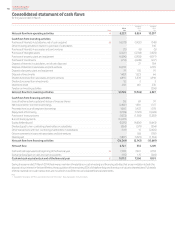

Commentary on the consolidated statement of cash ows

The consolidated statement of cash ows shows the

cash ows from operating, investing and nancing

activities for the year. Closing net debt has reduced

to £13.7 billion from £25.4 billion. The reduction

has primarily been achieved as the result of cash

retained from the sale of our interest in Verizon

Wireless after the return of value to shareholders.

Our liquidity and working capital may be affected by a material decrease

in cash ow due to a number of factors as outlined in “Principal

risk factors and uncertainties” on pages 196 to 200. We do not use

non-consolidated special purpose entities as a source of liquidity or for

other nancing purposes.

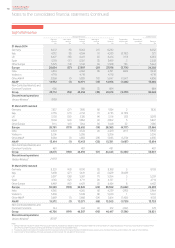

Purchase of interests in subsidiaries, net of cash acquired

During the year we acquired Kabel Deutschland for net cash

consideration of £4.3 billion. Further details on the assets and liabilities

acquired are outlined in note 28 ”Acquisitions and disposals”.

Purchase of intangible assets

Cash payments for the purchase of intangible assets comprise

£1.4 billion for purchases of computer software and £0.9 billion for

acquired spectrum.

Purchase of investments

The Group purchases short-term investments as part of its treasury

strategy. See note 13 “Other investments”.

Disposal of interests in associates and joint ventures

During the year, we disposed of our US Group whose principal asset was

its 45% interest in Verizon Wireless for consideration which included net

cash proceeds of £34.9 billion. There were no signicant disposals in the

prior year.

Disposal of investments

In the prior year we received the remaining consideration of £1.5 billion

from the disposal of our interests in SoftBank Mobile Corp.

Dividends received from joint ventures and associates

Dividends received from associates reduced by 11.6% to £4.9 billion.

Dividends received primarily comprise tax dividends and income

dividends from Verizon Wireless of £4.8 billion in both the current and

prior nancial years.

Movements in borrowings

Funds retained from the sale of our interest in Verizon Wireless, after the

return of value to shareholders, has enabled us to reduce the overall

amount of the Group’s borrowings.

Purchase of treasury shares

Cash payments of £1.0 billion relate to the completion of a £1.5 billion

share buyback programme that commenced following the receipt

of a US$3.8 billion (£2.4 billion) income dividend from VZW in December

2012. Further details are provided on page 101.

B and C share payments

B share payments formed part of the return of value to shareholders

following the disposal of the Group’s interest in Verizon Wireless.

Further details are provided on page 101.

Equity dividends paid

Equity dividends paid during the year increased by 5.6%. A special

dividend was paid during the year to 31 March 2012 following the

receipt of an income dividend from VZW. Further details on the

Group’s dividends are provided on page 101.

Other transactions with non-controlling shareholders

in subsidiaries

During the year we acquired the non-controlling interests in Vodafone

India Limited and commenced the legal process of acquiring the

remaining shares in Kabel Deutschland.

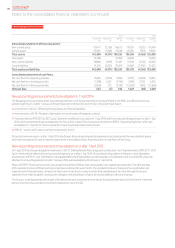

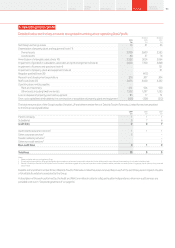

Cash ow reconciliation

A reconciliation of cash generated by operations to free cash ow

and net debt, two non-GAAP measures used by management, is

shown below. Cash generated by operations increased by 5.7% to

£12.1 billion, primarily driven by working capital improvements, partially

offset by a reduction in EBITDA. Free cash ow decreased by 24% to

£4.2 billion, the largest contributing factor being a £0.9 billion increase

in tax payments principally arising from the early settlement of certain

taxes payable in the United States due to the disposal of our US Group.

2014

Restated

2013

£m £m %

EBITDA 11,084 11,466 (3.3)

Working capital 1,381 177

Other (318) (149)

Cash generated by operations 12,147 11,494 5.7

Cash capital expenditure (5,857) (5,217)

Capital expenditure (6,313) (5,292)

Working capital movement in respect

of capital expenditure 456 75

Disposal of property, plant and

equipment 79 105

Operating free cash ow 6,369 6,382 (0.2)

Taxation (3,449) (2,570)

Dividends received from associates

and investments 2,842 3,132

Dividends paid to non-controlling

shareholders in subsidiaries (264) (379)

Interest received and paid (1,315) (1,064)

Free cash ow 4,183 5,501 (24.0)

Tax settlement (100) (100)

Licence and spectrum payments (862) (2,499)

Acquisitions and disposals 27,372 (1,723)

Equity dividends paid (5,076) (4,806)

Special return (14,291) –

Purchase of treasury shares (1,033) (1,568)

Foreign exchange 2,423 (716)

Income dividend from VZW 2,065 2,409

Other (3,027) 1,149

Net debt decrease/(increase) 11,654 (2,353)

Opening net debt (25,354) (23,001)

Closing net debt (13,700) (25,354)

Net debt

Net debt reduced by £11.7 billion to £13.7 billion, primarily as a result

of cash we have retained from the sale of our interest Verizon Wireless

after the return of value to shareholders, partially offset by cash

payments for the acquisition of Kabel Deutschland and also as a result

of the other cash movements discussed above.

The nancial commentary on this page is unaudited.

Vodafone Group Plc 103Overview Strategy

review Performance Governance Financials

Additional

information