Vodafone 2014 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10. We may not satisfactorily resolve major tax disputes.

Risk: We operate in many jurisdictions around the world and from time

to time have disputes on the amount of tax due. In particular, in spite

of the positive India Supreme Court decision relating to an on-going

tax case in India, the Indian Government has introduced retroactive

tax legislation which would in effect overturn the Court’s decision

and has raised challenges around the pricing of capital transactions.

Such or similar types of action in other jurisdictions, including changes

in local or international tax rules or new challenges by tax authorities,

may expose us to signicant additional tax liabilities which would affect

the results of the business.

Assessment: This is a risk that could occur in any market but is currently

more relevant for emerging markets where the disputed tax payable

and any related penalties could be signicant.

Mitigation: We maintain constructive but robust engagement with

the tax authorities and relevant government representatives, as well

as active engagement with a wide range of international companies and

business organisations with similar issues. Where appropriate we engage

advisors and legal counsel to obtain opinions on tax legislation

and principles.

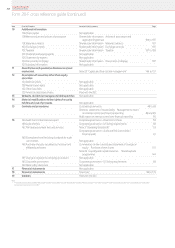

11. Changes in assumptions underlying the carrying value

of certain Group assets could result in impairment.

Risk: Due to the substantial carrying value of goodwill, revisions to the

assumptions used in assessing its recoverability, including discount

rates, estimated future cash ows or anticipated changes in operations,

could lead to the impairment of certain Group assets. While impairment

does not impact reported cash ows, it does result in a non-cash

charge in the consolidated income statement and thus no assurance

can be given that any future impairment would not affect our reported

distributable reserves and therefore, our ability to make dividend

distributions to our shareholders or repurchase our shares.

Assessment: This risk is relevant for the markets facing tough economic

conditions and increasing competition; where an impairment may have

a signicant impact on reported earnings.

Mitigation: We review the carrying value of the Group’s property, plant

and equipment, goodwill and other intangible assets at least annually,

or more frequently where the circumstances require, to assess

whether carrying values can be supported by the net present value

of future cash ows derived from such assets. This review considers the

continued appropriateness of the assumptions used in assessing for

impairment, including an assessment of discount rates and long-term

growth rates, future technological developments, and the timing

and amount of future capital expenditure. Other factors which may

affect revenue and protability (for example intensifying competition,

pricing pressures, regulatory changes and the timing for introducing

new products or services) are also considered. Discount rates are

in part derived from yields on government bonds, the level of which

may change substantially period to period and which may be affected

by political, economic and legal developments which are beyond our

control. For further details see “Critical accounting judgements and key

sources of estimation uncertainty” in note 1 “Basis of preparation” to the

consolidated nancial statements.

Currency related risks

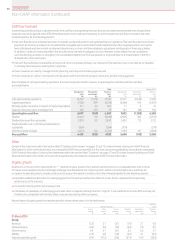

The Group continues to face currency, operational and nancial risks

resulting from the challenging economic conditions particularly in the

Eurozone. We continue to keep our policies and procedures under

review to endeavour to minimise the Group’s economic exposure and

to preserve our ability to operate in a range of potential conditions that

may exist in the future.

Our ability to manage these risks needs to take appropriate account

of our needs to deliver a high quality service to our customers, meet

licence obligations and the signicant capital investments we may

have made and may need to continue to make in the markets

most impacted.

While our share price is denominated in sterling, the majority of our

nancial results are generated in other currencies. As a result the

Group’s operating prot is sensitive to either a relative strengthening

or weakening of the major currencies in which we transact.

The “Operating results” section of the annual report on pages 40 to 45

sets out a discussion and analysis of the relative contributions from each

of our regions and the major geographical markets within each, to the

Group’s service revenue and EBITDA performance. On a management

basis our markets in Greece, Ireland, Italy, Portugal and Spain continue

to be the most directly impacted by the current market conditions and

in order of contribution represent 12% (Italy), 6% (Spain), 3% (Ireland

and Greece combined) and 2% (Portugal) of the Group’s EBITDA for

the year ended 31 March 2014. An average 3% decline in the sterling

equivalent of these combined geographical markets due to currency

revaluation would reduce the Group’s EBITDA by approximately

£0.1 billion. Our foreign currency earnings were for the year ended

31 March 2014, diversied through our 45% equity interest in Verizon

Wireless (‘VZW’), which operates in the United States and generates its

earnings in US dollars. Our interest in VZW, which was equity accounted

to 2 September 2013, contributed 40% of the Group’s adjusted

operating prot for the year ended 31 March 2014. Our interest

in VZWwas disposed of on 21 February 2014.

We employ a number of mechanisms to manage elements

of exchange rate risk at a transaction, translation and economic

level. At the transaction level our policies require foreign exchange

risks on transactions denominated in other currencies above certain

de minimis levels to be hedged. Further, since the Company’s sterling

share price represents the value of its future multi-currency cash

ows, principally in euro and to a lesser extent sterling, the Indian

rupee and South African rand following the disposal of our interest

in VZW, we aim to align the currency of our debt and interest charges

in proportion to our expected future principal multi-currency cash ows,

thereby providing an economic hedge in terms of reduced volatility

in the sterling equivalent value of the Group and a partial hedge

against income statement translation exposure, as interest costs will

be denominated in foreign currencies.

In the event of a country’s exit from the Eurozone, this may necessitate

changes in one or more of our entities’ functional currency and

potentially higher volatility of those entities’ trading results when

translated into sterling, potentially adding further currency risk.

A summary of this sensitivity of our operating results and our

foreign exchange risk management policies is set out within note

23 “Capital and nancial risk management” to the consolidated

nancial statements.

199Overview Strategy

review Performance Governance Financials Additional

information