Vodafone 2014 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

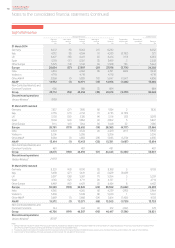

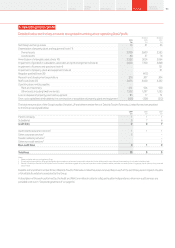

2013 2012

As reported

£m

Adjustments

£m

Restated

£m

As reported

£m

Adjustments

£m

Restated

£m

Consolidated statement of nancial position

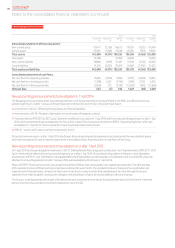

Non-current assets 119,411 (2,736) 116,675 119,551 (3,132) 116,419

Current assets 23,287 (1,638) 21,649 20,025 (994) 19,031

Total assets 142,698 (4,374) 138,324 139,576 (4,126) 135,450

Total equity 72,488 – 72,488 78,202 –78,202

Non-current liabilities 38,986 (1,519) 37,467 37,349 (1,724) 35,625

Current liabilities 31,224 (2,855) 28,369 24,025 (2,402) 21,623

Total equity and liabilities 142,698 (4,374) 138,324 139,576 (4,126) 135,450

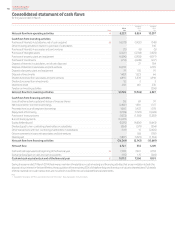

Consolidated statement of cash ows

Net cash ow from operating activities 10,694 (1,870) 8,824 12,755 (2,458) 10,297

Net cash ow from investing activities (7, 398) 1,652 (5,746) 3,843 2,738 6,581

Net cash ow from nancing activities (2,956) 213 (2,743) (15,369) (300) (15,669)

Net cash ow 340 (5) 335 1,229 (20) 1,209

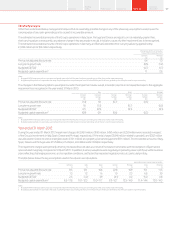

New accounting pronouncements to be adopted on 1 April 2014

The following pronouncements which are potentially relevant to the Group have been issued by the IASB or the IFRIC, are effective for annual

periods beginning on or after 1 January 2014 and have been endorsed for use in the EU unless otherwise stated:

a Amendment to IAS 32, “Offsetting nancial assets and nancial liabilities”.

a Amendments to IAS 39, “Novation of derivatives and continuation of hedge accounting”.

a “Improvements to IFRS 2010 to 2012 cycle”, elements are effective variously from 1 July 2014 and for annual periods beginning on or after 1 July

2014. All the amendments will be adopted by the Group from 1 April 2014, except an amendment to IFRS 8, “Operating Segments”, which will

be adopted on 1 April 2014. These amendments have not yet been endorsed by the EU.

a IFRIC 21, “Levies”, which has not yet been endorsed by the EU.

For periods commencing on or after 1 April 2014, the Group’s nancial reporting will be presented in accordance with the new standards above

which are not expected to have a material impact on the consolidated results, nancial position or cash ows of the Group.

New accounting pronouncements to be adopted on or after 1 April 2015

On 1 April 2015 the Group will adopt Amendments to IAS 19 “Dened Benet Plans: Employee Contributions” and “Improvements to IFRS 2011–2013

Cycle”, which are both effective for annual periods beginning on or after 1 July 2014. “Accounting for Acquisitions of Interests in Joint Operations,

Amendments to IFRS 11” and “Clarication of Acceptable Methods of Depreciation and Amortisation, Amendment to IAS 16 and IAS 38”, which are

effective for accounting periods on or after 1 January 2016, will be adopted by the Group on 1 April 2016.

Phase I of IFRS 9 “Financial Instruments” was issued in November 2009 and has subsequently been updated and amended. The effective date

of the standard is to be conrmed and has not yet been endorsed for use in the EU. The standard introduces changes to the classication and

measurement of nancial assets, removes the restriction on electing to measure certain nancial liabilities at fair value through the income

statement from initial recognition and requires changes to the presentation of gains and losses relating to fair value changes.

The Group is currently assessing the impact of the above new pronouncements on its results, nancial position and cash ows. None of the new

pronouncements discussed above have been endorsed for use in the EU.

1. Basis of preparation (continued)

Notes to the consolidated nancial statements (continued)

Vodafone Group Plc

Annual Report 2014108