Vodafone 2014 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28. Acquisitions and disposals

We made a number of acquisitions during the year including the acquisition of a controlling interest

in KabelDeutschland Holding AG and the remaining interest in our business in Italy, Vodafone Omnitel B.V.

thus obtaining control. The note below provides details of these transactions as well as those in the prior year.

For further details see “Critical accounting judgements” in note 1 “Basis of preparation” to the consolidated

nancial statements.

Accounting policies

Business combinations

Acquisitions of subsidiaries are accounted for using the acquisition method. The cost of the acquisition is measured at the aggregate of the fair values

at the date of exchange of assets given, liabilities incurred or assumed and equity instruments issued by the Group. Acquisition-related costs are

recognised in the income statement as incurred. The acquiree’s identiable assets and liabilities are recognised at their fair values at the acquisition

date. Goodwill is measured as the excess of the sum of the consideration transferred, the amount of any non-controlling interests in the acquiree

and the fair value of the Group’s previously held equity interest in the acquiree, if any, over the net amounts of identiable assets acquired and

liabilities assumed at the acquisition date. The interest of the non-controlling shareholders in the acquiree may initially be measured either at fair

value or at the non-controlling shareholders’ proportion of the net fair value of the identiable assets acquired, liabilities and contingent liabilities

assumed. The choice of measurement basis is made on an acquisition-by-acquisition basis.

Acquisition of interests from non-controlling shareholders

In transactions with non-controlling parties that do not result in a change in control, the difference between the fair value of the consideration paid

or received and the amount by which the non-controlling interest is adjusted is recognised in equity.

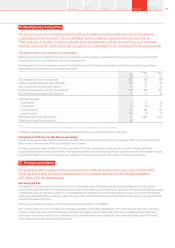

Acquisitions

The aggregate cash consideration in respect of purchases of interests in subsidiaries, net of cash acquired, is as follows:

£m

Cash consideration paid:

Kabel Deutschland Holding AG (including fees of £17 million) 4,872

Other acquisitions completed during the year 6

4,878

Net cash acquired (599)

4,279

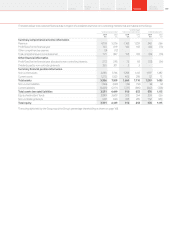

In addition, the Group acquired a 100% interest in Vodafone Omnitel B.V. as part of the disposal of the Group’s interest in Verizon Wireless for

consideration of £7,121 million. The purchase consideration has been determined based on the acquisition-date fair value of the equity in Vodafone

Omnitel B.V., being considered to be a more reliable method of determining fair value than estimating the attributable proportion of the fair value

of the investment in Verizon Wireless. The equity value has been determined on a value in use basis using discounted estimated cash ows using the

methodology and assumptions detailed in note 4 “Impairment losses”.

Total goodwill acquired was £6,859 million and included £3,848 million in relation to Kabel Deutschland Holding AG, £3,007 million in relation

to Vodafone Omnitel B.V. and £4 million in relation to other acquisitions completed during the year. Acquisitions and disposals (continued)

159Overview Strategy

review Performance Governance Financials Additional

information