Vodafone 2014 Annual Report Download - page 203

Download and view the complete annual report

Please find page 203 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In the discussion of our reported nancial position, operating results and cash ows, information is presented to provide readers with additional

nancial information that is regularly reviewed by management. However, this additional information presented is not uniformly dened by all

companies including those in the Group’s industry. Accordingly, it may not be comparable with similarly titled measures and disclosures by other

companies. Additionally, certain information presented is derived from amounts calculated in accordance with IFRS but is not itself an expressly

permitted GAAP measure. Such non-GAAP measures should not be viewed in isolation or as an alternative to the equivalent GAAP measure.

Management basis

The discussion of our operating results and cash ows in the strategic report is shown on a management basis, consistent with how the business

is managed, operated and reviewed by management, and includes the results of the Group’s joint ventures, Vodafone Italy, Vodafone Hutchison

Australia, Vodafone Fiji and Indus Towers, on a proportionate basis. This differs to the “Consolidated nancial statements” on pages 96 to 170 which

are presented on a statutory basis, and includes the results of the Group’s joint ventures using the equity accounting basis.

We believe that the management basis metrics, which are not intended to be a substitute for, or superior to, our reported metrics, provide useful

and necessary information to investors and other interested parties as they are used internally for performance analysis and resource allocation

purposes of the operations where we have control or joint control. A reconciliation of the key operating metrics on a management basis to the

statutory results are summarised below and provided in detail in note 2 “Segmental analysis” to the consolidated nancial statements.

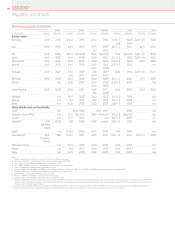

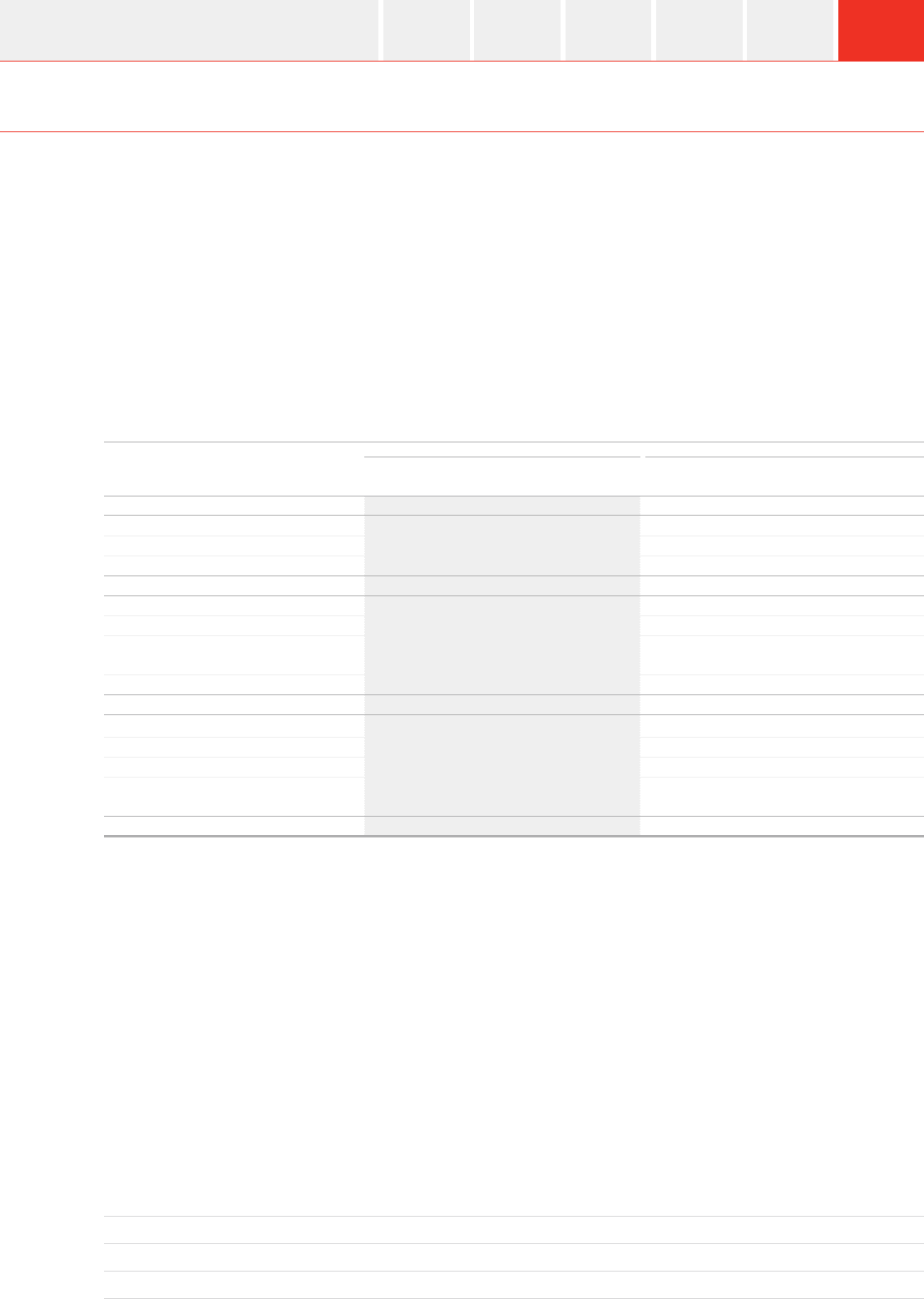

2014 Restated 2013

Management

basis

Presentation

adjustments

Discontinued

operations

Statutory

basis

Management

basis

Presentation

adjustments

Discontinued

operations

Statutory

basis

£m £m £m £m £m £m £m £m

Revenue 43,616 (5,270) –38,346 44,445 (6,404) –38,041

EBITDA 12,831 (1,747) –11,084 13,566 (2,100) –11,466

Depreciation and amortisation (8,181) 1,083 –(7,098) (7,543) 1,041 –(6,502)

Share of results in associates and joint ventures 3,224 269 (3,169) 324 6,554 572 (6,500) 626

Adjusted operating prot 7,874 (395) (3,169) 4,310 12,577 (487) (6,500) 5,590

Impairment loss (6,600) (7,700)

Restructuring costs (355) (311)

Amortisation of acquired customer base and

brand intangible assets (551) (249)

Other income and expense (717) 468

Operating loss (3,913) (2,202)

Non-operating income and expense (149) 10

Investment income and nancing costs (1,208) (1,291)

Income tax credit/(expense) 16,582 (476)

Prot for the nancial year from discontinued

activities 48,108 4,616

Prot for the nancial year 59,420 657

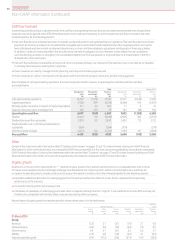

EBITDA

EBITDA is operating prot excluding share in results of associates, depreciation and amortisation, gains/losses on the disposal of xed assets,

impairment losses, restructuring costs, other operating income and expense and signicant items that are not considered by management

to be reective of the underlying performance of the Group. We use EBITDA, in conjunction with other GAAP and non-GAAP nancial measures

such as adjusted operating prot, operating prot and net prot, to assess our operating performance. We believe that EBITDA is an operating

performance measure, not a liquidity measure, as it includes non-cash changes in working capital and is reviewed by the Chief Executive to assess

internal performance in conjunction with EBITDA margin, which is an alternative sales margin gure. We believe it is both useful and necessary

to report EBITDA as a performance measure as it enhances the comparability of prot across segments.

Because EBITDA does not take into account certain items that affect operations and performance, EBITDA has inherent limitations as a performance

measure. To compensate for these limitations, we analyse EBITDA in conjunction with other GAAP and non-GAAP operating performance measures.

EBITDA should not be considered in isolation or as a substitute for a GAAP measure of operating performance. A reconciliation of EBITDA to the

closest equivalent GAAP measure, operating prot, is provided in above and in note 2 “Segmental analysis” to the consolidated nancial statements.

Group adjusted operating prot and adjusted earnings per share

Group adjusted operating prot excludes non-operating income of associates, impairment losses, restructuring costs, amortisation of customer

bases and brand intangible assets, other operating income and expense and other signicant one-off items. Adjusted earnings per share also

excludes certain foreign exchange rate differences, together with related tax effects. We believe that it is both useful and necessary to report these

measures for the following reasons:

a these measures are used for internal performance reporting;

a these measures are used in setting director and management remuneration; and

a they are useful in connection with discussion with the investment analyst community and debt rating agencies.

A reconciliation of adjusted operating prot to the respective closest equivalent GAAP measure, operating prot, is provided above and in note 2

“Segmental analysis” to the consolidated nancial statements. A reconciliation of adjusted earnings per share to basic earnings per share, is provided

in the “Operating Review” on page 45.

201Overview Strategy

review Performance Governance Financials Additional

information

Non-GAAP information