Vodafone 2014 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

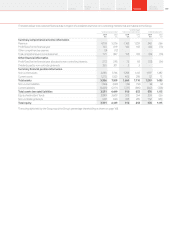

Prior year operating results (continued)

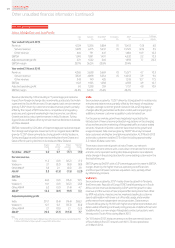

Africa, Middle East and Asia Pacic

India

£m

Vodacom

£m

Other AMAP

£m

Eliminations

£m

AMAP

£m

% change

£Organic

Year ended 31 March 2013

Revenue 4,324 5,206 5,884 (1) 15,413 (1.0) 6.0

Service revenue 3,878 4,415 5,437 (1) 13,729 (2.3) 5.5

Other revenue 446 791 447 –1,684 10.9 10.3

EBITDA 1,240 1,891 1,401 –4,532 3.2 12. 3

Adjusted operating prot 221 1,332 340 –1,893 7.7 20.3

EBITDA margin 28.7% 36.3% 23.8% 29.4%

Year ended 31 March 2012

Revenue 4,265 5,638 5,669 (1) 15, 571 4.7 10.3

Service revenue 3,922 4,898 5,234 (1) 14,053 3.9 9.6

Other revenue 343 74 0 435 –1, 518 12.7 17. 5

EBITDA 1,12 2 1,933 1,338 –4,393 4.9 10.7

Adjusted operating prot 60 1,338 359 –1,757 4.8 10.9

EBITDA margin 26.3% 34.3% 23.6% 28.2%

Revenue declined by 1.0% including a 7.7 percentage point adverse

impact from foreign exchange rate movements, particularly the Indian

rupee and the South African rand. On an organic basis service revenue

grew by 5.5%* driven by customer and data revenue growth, partially

offset by the impact of MTR reductions, competitive and regulatory

pressures, and a general weakening in macroeconomic conditions.

Growth was led by robust performances in India, Vodacom, Turkey,

Egypt, Ghana and Qatar, offset by service revenue declines in Australia

and New Zealand.

EBITDA increased by 3.2% after a 9.0 percentage point adverse impact

from foreign exchange rate movements. On an organic basis, EBITDA

grew by 12.3%* driven primarily by strong growth in India, Vodacom,

Turkey and Egypt as well as improved contributions from Ghana and

Qatar, offset in part by declines in Australia and New Zealand.

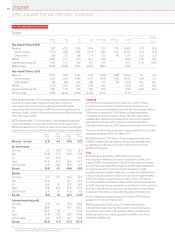

Organic

change

%

Other

activity1

pps

Foreign

exchange

pps

Reported

change

%

Revenue – AMAP 6.0 0.7 (7.7) (1.0)

Service revenue

India 11.2 (0.1) (12.2) (1.1)

Vodacom 3 .1 (3.2) (9.8) (9.9)

Other AMAP 3.8 2 .1 (2.0) 3.9

AMAP 5.5 (0.3) (7.5) (2.3)

EBITDA

India 24.0 (0.1) (13.4) 10.5

Vodacom 10.1 (0.1) (12.2) (2.2)

Other AMAP 6.2 (0.1) (1.4) 4.7

AMAP 12.3 (0.1) (9.0) 3.2

Adjusted operating prot

India 291.1 (3.4) (19.4) 268.3

Vodacom 12.7 0.2 (13.3) (0.4)

Other AMAP 2.1 (9.5) 2 .1 (5.3)

AMAP 20.3 (2.3) (10.3) 7.7

Note:

1 “Other activity” includes the impact of M&A activity and the revision to intra-group roaming charges from

1October 2011. Refer to “Organic growth” on page 202 for further detail.

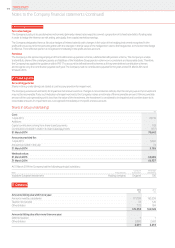

India

Service revenue grew by 11.2%* driven by strong growth in mobile voice

minutes and data revenue, partially offset by the impact of regulatory

changes. Average customer growth slowed in Q4, as Q3 regulatory

changes affecting subscriber verication continued to impact gross

additions, however customer acquisition costs remained low.

For the year as a whole, growth was negatively impacted by the

introduction of new consumer protection regulations on the charging

of access fees and the marketing of integrated tariffs and value-added

services. However, in Q4 the customer base returned to growth and

usage increased. Data revenue grew by 19.8%* driven by increased

data customers and higher smartphone penetration. At 31 March 2013

active data customers totalled 37.3 million including approximately

3.3 million 3G data customers.

There was a lower rate of growth at Indus Towers, our network

infrastructure joint venture, with a slow down in tenancies from smaller

entrants, some operators exiting sites following licence cancellations

and a change in the pricing structure for some existing customers in the

rst half of the year.

EBITDA grew by 24.0%*, with a 3.3* percentage point increase in EBITDA

margin, driven by the higher revenue, operating cost efciencies

and the impact of lower customer acquisition costs, partially offset

by inationary pressure.

Vodacom

Service revenue grew by 3.1%* mainly driven by growth in Tanzania,

the Democratic Republic of Congo (‘DRC’) and Mozambique. In South

Africa, service revenue decreased by 0.3%*, with the growth in data

revenue and the success of new prepaid offers being more than offset

by MTR reductions, macroeconomic weakness leading to customer

spend optimisation with lower out-of-bundle usage, and a weaker

performance from independent service providers. Data revenue

in South Africa grew by 16.1%*, with higher smartphone penetration and

data bundles offsetting continued pricing pressure. Vodafone Smart and

Vodafone Red, our new range of integrated contract price plans, were

introduced in South Africa during March 2013.

On 10 October 2012, Vodacom announced the commercial launch

of South Africa’s rst LTE network, with 601 LTE sites operational

at 31 March 2013.

Vodafone Group Plc

Annual Report 2014174

Other unaudited nancial information (continued)