Vodafone 2014 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Making good progress on unied communications strategy

Our strategy (continued)

Unied

Communications

Our roots are in mobile services, and these still represent the majority

of our revenues. However, more and more businesses and individual

consumers are seeking unied communications, or converged xed and

mobile services, and we are changing the shape of our Company to meet

thisdemand.

What is unied communications?

As customer demand for ubiquitous data and content grows rapidly

over the coming years, the most successful communications providers

will be the ones who can provide seamless high speed connectivity

at home, at work, at play and anywhere in between. This will require the

integration of multiple technologies – 3G, 4G, WiFi, cable and bre – into

a single meshed network offering the best, uninterrupted experience –

what we call “unied communications”.

Unied communications for enterprise

Combined xed and mobile services have been a feature of the

enterprise market, particularly for small- and medium-sized companies,

for several years. We have been a market leader with products such

as Vodafone One Net, which provides integrated xed and mobile

services which create signicant business efciencies for customers.

This year we have evolved One Net as an application that can also serve

the needs of larger national corporates as well.

With the acquisition of Cable & Wireless Worldwide in 2012, we have

made a step change in our ability to offer unied communications

services to customers in the UK and gained an extensive international

footprint. After successfully integrating sales forces this year, we are now

beginning to build a strong pipeline of new business.

Unied communications for consumers

Over the last few years, we have seen a signicant move towards

bundling of xed and mobile products for residential customers, often

including television in the package as well. Of our markets, Spain

and Portugal are the most advanced in this regard, but we expect

it to become prevalent in all our major European markets. This presents

us with a clear opportunity, as our share of xed services in our

European markets is under 10%, whereas our share of the mobile

market is well over 25%. In addition, mobile customer churn is typically

three times higher than that of customers taking combined xed and

mobile services.

However, unied communications is also a threat, particularly in the

residential market, as historically we have not owned or had access

to next-generation xed line infrastructure such as bre or cable.

This could allow cable operators with MVNO platforms, or integrated

xed and mobile incumbents, to take share in the market with

aggressively discounted offers.

Progressing our strategy

Our goal is to secure access to next-generation xed line infrastructure

in all our major European markets. Our approach is market-by-market,

based on the cost of building our own bre, the openness of the

incumbent provider to reasonable wholesale terms, the speed of market

development, and the availability of good quality businesses to acquire.

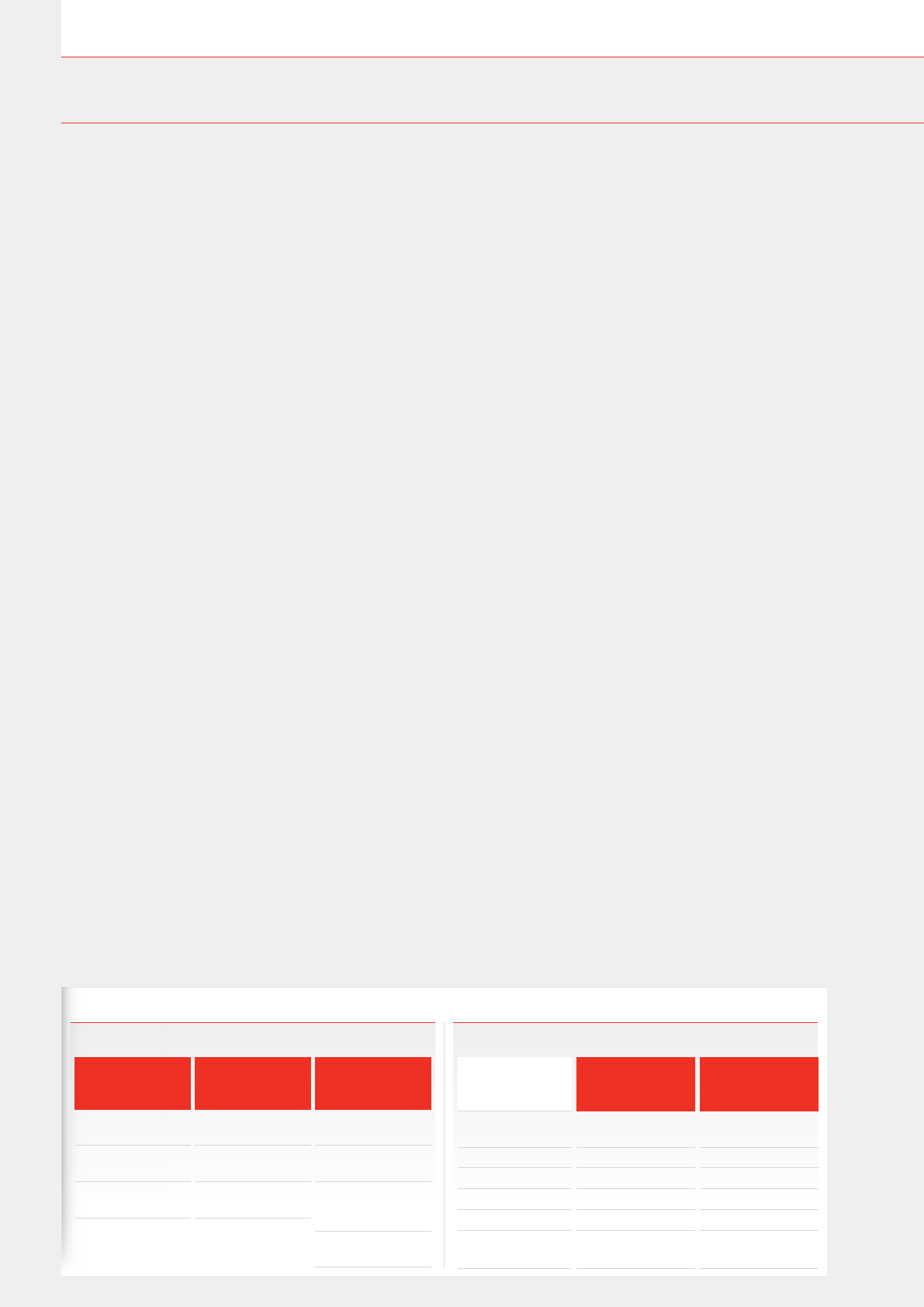

The table below shows the progress we have made this year. We have

made signicant strides in most of our major markets, through three

routes to market – wholesaling (or renting), our own bre deployment,

or acquisitions. In particular, the acquisition of Kabel Deutschland and

the proposed purchase of Ono will signicantly strengthen our position

in Germany and Spain respectively. At the year end, we had nine million

xed broadband customers, and the proposed acquisition of Ono will

increase this to 11 million.

Outside Europe, we acquired TelstraClear in New Zealand, the second

largest xed operator, in 2012 to strengthen our portfolio of xed

products and services and create a leading total communications

company. We also intend to expand selectively high speed bre services

to urban areas in emerging markets to enable converged services

in key business areas. And our subsidiary, Vodacom, proposes to acquire

Neotel, the second largest provider of xed telecommunications

services in South Africa, for a total cash consideration of ZAR 7.0 billion

(£0.4 billion) to accelerate its growth in unied communications

products and services.

Our recent acquisitions

Data to March 2014 Kabel

Deutschland Ono (proposed)

Market position Largest cable

operator in Germany Largest cable

operator in Spain

Purchase price €10.7bn €7.2bn

Annual revenue €1.9bn €1.6bn

Homes passed 15.2m 7.2m

Total customers 8.3m 1.9m

Fixed broadband

customers

2.3m 1.6m

Our strategic approach to next-generation xed access

Italy

(2013)

Germany

(2013)

Netherlands

(2013)

Wholesale

Italy

(planned for 2014)

Spain

(2014)

Portugal

(2010)

Fibre deployment

Spain

Ono (proposed 2014)

Germany

Kabel Deutschland (2013)

UK

Cable & Wireless

Worldwide (2012)

New Zealand

TelstraClear (2012)

Acquisitions

Vodafone Group Plc

Annual Report 2014

Vodafone Group Plc

Annual Report 20142424