Vodafone 2014 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

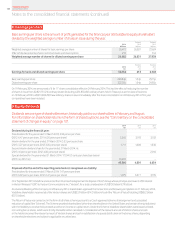

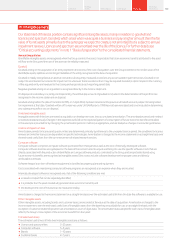

6. Taxation (continued)

Factors affecting the tax charge in future years

Factors that may affect the Group’s future tax charge include the impact of corporate restructurings, the resolution of open issues, future planning,

corporate acquisitions and disposals, the use of brought forward tax losses and changes in tax legislation and tax rates.

The Group is routinely subject to audit by tax authorities in the territories in which it operates and, specically, in India these are usually resolved

through the Indian legal system. The Group considers each issue on its merits and, where appropriate, holds provisions in respect of the potential

tax liability that may arise. However, the amount ultimately paid may differ materially from the amount accrued and could therefore affect the

Group’s overall protability and cash ows in future periods. See note 30 “Contingent liabilities” to the consolidated nancial statements.

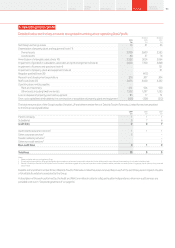

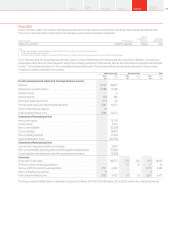

At 31 March 2014, the gross amount and expiry dates of losses available for carry forward are as follows:

Expiring Expiring

within within

5 years 6–10 years Unlimited Total

£m £m £m £m

Losses for which a deferred tax asset is recognised 274 461 79,115 79,850

Losses for which no deferred tax is recognised 1,281 519 26,318 28,118

1,555 980 105,433 107,968

At 31 March 2013, the gross amount and expiry dates of losses available for carry forward are as follows:

Expiring Expiring

within within

5 years 6–10 years Unlimited Total

£m £m £m £m

Losses for which a deferred tax asset is recognised 343 –8,423 8,766

Losses for which no deferred tax is recognised 1,845 691 94,135 96,671

2,188 691 102,558 105,437

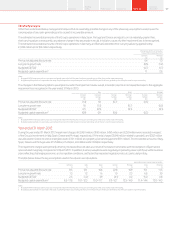

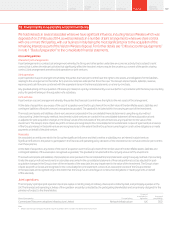

The losses arising on the write down of investments in Germany are available to use against both German federal and trade tax liabilities.

Losses of £15,290 million (2013: £3,236 million) are included in the above table on which we have recognised a deferred tax asset as we expect

the German business to continue to generate future taxable prots against which we can utilise these losses. In 2013 the Group did not recognise

a deferred tax asset on £12,346 million of the losses as it was uncertain that these losses would be utilised.

Included above are losses amounting to £6,651 million (2013: £7,104 million) in respect of UK subsidiaries which are only available for offset against

future capital gains and since it is uncertain whether these losses will be utilised, no deferred tax asset has been recognised. We have recognised

a deferred tax asset against £442 million of these losses in the current year.

The losses above also include £73,734 million (2013: £70,644 million) that have arisen in overseas holding companies as a result of revaluations

of those companies’ investments for local GAAP purposes. A deferred tax asset of £18,150 million (2013: £1,325 million) has been recognised

in respect of £62,980 million (2013: £4,535 million) of these losses which relate to tax groups in Luxembourg where we expect the members of these

tax groups to generate future taxable prots against which these losses will be used. No deferred tax asset is recognised in respect of the remaining

£10,754 million of these losses as it is uncertain whether these losses will be utilised.

In addition to the above, we hold £7,642 million of losses in overseas holding companies from a former Cable & Wireless Worldwide Group company,

for which no deferred tax asset has been recognised as it is uncertain whether these losses will be utilised.

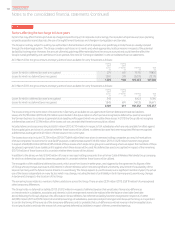

The recognition of the additional deferred tax assets, which arose from losses in earlier years, was triggered by the agreement to dispose of the

US Group whose principal asset was its 45% interest in Verizon Wireless, which removes signicant uncertainty around both the availability of the

losses in Germany and the future income streams in Luxembourg. The Group expects to use the losses over a signicant number of years; the actual

use of the losses is dependent on many factors which may change, including the level of protability in both Germany and Luxembourg, changes

in tax law and changes to the structure of the Group.

The remaining losses relate to a number of other jurisdictions across the Group. There are also £339 million (2013: £5,918 million) of unrecognised

other temporary differences.

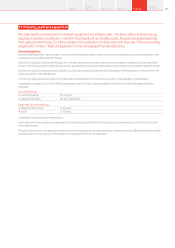

The Group holds no deferred tax liability (2013: £1,812 million) in respect of deferred taxation that would arise if temporary differences

on investments in subsidiaries, associates and interests in joint arrangements were to be realised after the balance sheet date (see table

above) following the Group’s disposal of its 45% stake in Verizon Wireless. No deferred tax liability has been recognised in respect of a further

£22,985 million (2013: £47,978 million) of unremitted earnings of subsidiaries, associates and joint arrangements because the Group is in a position

to control the timing of the reversal of the temporary difference and it is probable that such differences will not reverse in the foreseeable future.

It is not practicable to estimate the amount of unrecognised deferred tax liabilities in respect of these unremitted earnings.

Notes to the consolidated nancial statements (continued)

Vodafone Group Plc

Annual Report 2014122