Vodafone 2014 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

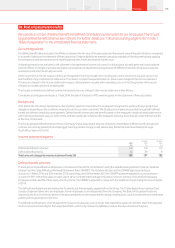

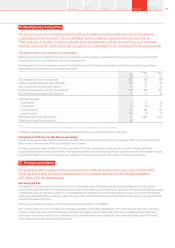

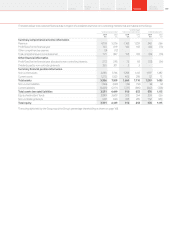

28. Acquisitions and disposals (continued)

TelstraClear Limited (‘TelstraClear’)

On 31 October 2012 the Group acquired the entire share capital of TelstraClear for cash consideration of NZ$863 million (£440 million). The primary

reasons for acquiring the business were to strengthen Vodafone New Zealand’s portfolio of xed communications solutions and to create a leading

total communications company in New Zealand.

The results of the acquired entity which have been consolidated in the income statement from 31 October 2012 contributed £136 million

of revenues and a loss of £23 million to the prot attributable to equity shareholders of the Group during the year ended 31 March 2013.

The purchase price allocation is set out in the table below:

Fair value

£m

Net assets acquired:

Identiable intangible assets184

Property, plant and equipment 345

Trade and other receivables 55

Cash and cash equivalents 5

Current and deferred taxation liabilities (19)

Trade and other payables (59)

Provisions (15)

Net identiable assets acquired 396

Goodwill244

Total consideration 440

Notes:

1 Identiable intangible assets of £84 million consist of licences and spectrum fees of £27 million , TelstraClear brand of £3 million and customer relationships of £54 million.

2 The goodwill is attributable to the expected protability of the acquired business and the synergies expected to arise after the Group’s acquisition of TelstraClear. None of the goodwill is expected to be deductible for

tax purposes.

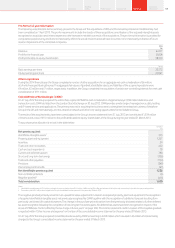

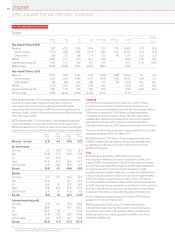

Disposals

Verizon Wireless (‘VZW’)

On 21 February 2014 the Group sold its US sub-group which included its entire 45% shareholding in VZW to Verizon Communications Inc. for a total

consideration of £76.7 billion before tax and transaction costs. The Group recognised a net gain on disposal of £44,996 million, reported in prot for

the nancial year from discontinued operations.

£m

Net assets disposed (27,957)

Total consideration176,716

Other effects2(3,763)

Net gain on disposal3,4 44,996

Notes:

1 Consideration of £76.7 billion comprises cash of £35.2 billion, shares in Verizon Communications Inc. of £36.7 billion, loan notes issued by Verizon communications Inc. of £3.1 billion and a 21.3% interest in Vodafone Italy

valued at £1.7 billion.

2 Other effects include foreign exchange losses transferred to the consolidated income statement.

3 Reported in prot for the nancial year from discontinued operations in the consolidated income statement.

4 Transaction costs of £100 million were charged in the Group’s consolidated income statement in the year ended 31 March 2014.

The Group did not separately value the embedded derivatives arising from the agreement to sell the US sub-group for a xed consideration

on 2 September 2013 because it was not able to make a reliable estimate of the valuation of this derivative due to the difculty in estimating the fair

value of the shares in an unlisted entity in the period between 2 September 2013 and transaction completion on 21 February 2014.

Vodafone Omnitel B.V. (‘Vodafone Italy’)

On 21 February 2014 the Group completed a deemed disposal of its entire 76.9% shareholding in Vodafone Italy as part of the VZW disposal deal

for a total consideration £5.5 billion before tax and transaction costs. The Group recognised a net loss on disposal of £712 million, reported in other

income and expense.

£m

Net assets disposed (8,480)

Total consideration 5,473

Other effects12,295

Net loss on disposal2(712)

Notes:

1 Other effects include foreign exchange gains transferred to the consolidated income statement.

2 Reported in other income and expense in the consolidated income statement.

Vodafone Group Plc

Annual Report 2014162

Notes to the consolidated nancial statements (continued)