Vodafone 2014 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

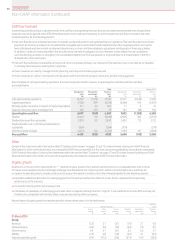

Management basis1

Statutory

basis1

Organic

change

%

Other

activity2

pps

Foreign

exchange

pps

Reported

change

%

Presentation

adjustments

pps

Reported

change

%

AMAP

Revenue 6.0 0.7 (7.7) (1.0) 0.3 (0.7)

Service revenue 5.5 (0.3) (7.5) (2.3) 1.1 (1.2)

Other revenue 10.3 10.3 (9.7) 10.9 (5.3) 5.6

India – service revenue 11.2 (0.1) (12.2) (1.1) –(1.1)

India – data revenue 19.8 –(13.5) 6.3 –6.3

Vodacom – service revenue 3.1 (3.2) (9.8) (9.9) –(9.9)

South Africa – service revenue (0.3) –(11.7) (12.0) –(12.0)

South Africa – data revenue 16.1 –(13.8) 2.3 –2.3

Vodacom’s international operations – service revenue 23.4 –(1.2) 22.2 –22.2

Turkey – service revenue 17.3 (1.8) (3.1) 12.4 –12.4

Egypt – service revenue 3.7 –(3.0) 0.7 –0.7

Egypt – data revenue 29.6 –(4.2) 25.4 –25.4

Egypt – xed line revenue 29.0 –(2.9) 26.1 –26.1

Ghana – service revenue 24.5 –(19.2) 5.3 –5.3

Qatar – service revenue 29.8 –1.7 31.5 –31.5

Other AMAP – service revenue 3.8 2.1 (2.0) 3.9 5.7 9.6

EBITDA 12.3 (0.1) (9.0) 3.2 1.1 4.3

India – EBITDA 24.0 (0.1) (13.4) 10.5 2.6 13.1

India – percentage point change in EBITDA margin 3.3 (1.0) 0.1 2.4 1.1 3.5

Vodacom – EBITDA 10.1 (0.1) (12.2) (2.2) –(2.2)

Vodacom – percentage point change in EBITDA margin 1.5 1.0 (0.5) 2.0 –2.0

Other AMAP – EBITDA 6.2 (0.1) (1.4) 4.7 3.2 7.9

Other AMAP – percentage point change in EBITDA margin 0.5 (0.4) 0.1 0.2 (0.5) (0.3)

Adjusted operating prot 20.3 (2.3) (10.3) 7.7 (0.6) 7.1

India – adjusted operating prot 291.1 (3.4) (19.4) 268.3 1,806.7 2,075.0

Vodacom – adjusted operating prot 12.7 0.2 (13.3) (0.4) –(0.4)

Other AMAP – adjusted operating prot 2.1 (9.5) 2.1 (5.3) (11.1) (16.4)

Verizon Wireless (‘VZW’)

Revenue 7.8 –1.0 8.8 (8.8) –

Service revenue 8.1 –1.1 9.2 (9.2) –

EBITDA 13.6 0.1 1.2 14.9 (14.9) –

Group’s share of result of VZW 29.8 –1.4 31.2 –31.2

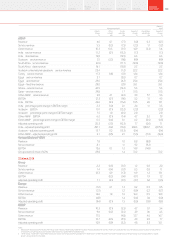

31 March 2012

Group

Revenue 2.2 (0.3) (0.7) 1.2 0.8 2.0

Service revenue 1.4 (0.4) (0.7) 0.3 0.8 1.1

Other revenue 12.3 0.9 (1.3) 11.9 1.2 13.1

EBITDA –(0.3) (0.4) (0.7) 1.9 1.2

Adjusted operating prot 1.1 (4.1) (0.7) (3.7) 0.4 (3.3)

Europe

Revenue (1.2) 0.1 1.3 0.2 0.3 0.5

Service revenue (2.1) –1.2 (0.9) 0.2 (0.7)

Other revenue 13.6 1.8 1.0 16.4 0.5 16.9

EBITDA (4.8) –1.4 (3.4) 0.4 (3.0)

Adjusted operating prot (9.4) (0.1) 1.5 (8.0) (0.9) (8.9)

AMAP

Revenue 10.3 (0.1) (5.5) 4.7 0.7 5.4

Service revenue 9.6 (0.2) (5.5) 3.9 0.6 4.5

Other revenue 17.5 –(4.8) 12.7 4.0 16.7

EBITDA 10.7 (0.3) (5.5) 4.9 2.8 7.7

Adjusted operating prot 10.9 (0.9) (5.2) 4.8 5.3 10.1

Notes:

1 Management basis includes the results of the Group’s joint ventures, Vodafone Italy, Vodafone Hutchison Australia, Vodafone Fiji and Indus Towers, on a proportionate basis. The statutory basis includes the results of these

joint ventures, using the equity accounting basis rather than on a proportionate consolidation basis.

2 “Other activity” includes the impact of M&A activity, the revision to intra-group roaming charges from 1 October 2011, and the impact of Indus Towers revising its accounting for energy cost recharges. Refer to “Organic

growth” on page 202 for further detail.

205Overview Strategy

review Performance Governance Financials Additional

information