Vodafone 2014 Annual Report Download - page 202

Download and view the complete annual report

Please find page 202 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

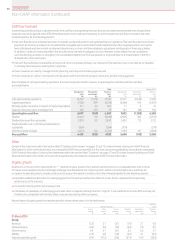

Risk of change in carrying amount of assets and liabilities

The main potential short-term nancial statement impact of the current

economic uncertainties is the potential impairment of non-nancial and

nancial assets.

We have signicant amounts of goodwill, other intangible assets and

plant, property and equipment allocated to, or held by, companies

operating in the Eurozone.

We have performed impairment testing for each country in Europe

as at 31 March 2014 and identified aggregate impairment charges

of £6.6 billion in relation to Vodafone Germany, Spain, Portugal, Czech

Republic and Romania. See note 4 “Impairment losses” to the consolidated

financial statements for further detail on this exercise, together with the

sensitivity of the results to reasonably possible adverse assumptions.

Our operating companies in Italy, Ireland, Greece, Portugal and Spain have

billed and unbilled trade receivables totalling £2.1 billion. IFRS contains

specific requirements for impairment assessments of financial assets.

We have a range of credit exposures and provisions for doubtful debts that

are generally made by reference to consistently applied methodologies

overlaid with judgements determined on a case-by-case basis reflecting

the specific facts and circumstances of the receivable. See note 23 “Capital

and financial risk management” to the consolidated financial statements

for detailed disclosures on provisions against loans and receivables as well

as disclosures about any loans and receivables that are past due at the end

of the period, concentrations of risk and credit risk more generally.

Additional risk

The signicant areas of additional risk for the Group are investment risk,

particularly in relation to the management of the counterparties holding

our cash and liquid investments; trading risks primarily in relation

to procurement and related contractual matters; and business

continuity risks focused on cash management in the event of disruption

to banking systems.

Financial/investment risk: We remain focused on counterparty risk

management and in particular the protection and availability of cash

deposits and investments. We carefully manage counterparty limits

with nancial institutions holding the Group’s liquid investments and

maintain a signicant proportion of liquid investments in sterling and

US dollar denominated holdings. Our policies require cash sweep

arrangements, to ensure no operating company has more than

€5 million on deposit on any one day. Further, we have had collateral

support agreements in place for a number of years, with a signicant

number of counterparties, to pass collateral to the Group under certain

circumstances. We have a net £1,055 million of collateral assets in our

statement of nancial position at 31 March 2014. For further details

see note 13 “Other investments” and note 23 “Capital and nancial risk

management” to the consolidated nancial statements.

Trading risks: We continue to monitor and assess the structure of certain

procurement contracts to place the Group in a better position in the

event of the exit of a country from the Eurozone.

Business continuity risks: Key business continuity priorities are focused

on planning to facilitate migration to a more cash-based business model

in the event banking systems are frozen, developing dual currency

capability in contract customer billing systems or ensuring the ability

to move these contract customers to prepaid methods of billing,

and the consequential impacts to tariff structures. We also have in place

contingency plans with key suppliers that would assist us to continue

to support our network infrastructure, retail operations and employees.

We continue to maintain appropriate levels of cash and short-term

investments in many currencies, with a carefully controlled group

of counterparties, to minimise the risks to the ongoing access to that

liquidity and therefore our ability to settle debts as they become due.

For further details see “Capital and nancial risk management” in note

23 to the consolidated nancial statements.

Going concern

The Group believes it adequately manages or mitigates its solvency and

liquidity risks through two primary processes, described below.

Business planning process and performance management

The Group’s forecasting and planning cycle consists of three in year

forecasts, a budget and a long range plan. These cycles all consist

of a bottom up process whereby the Group’s operating companies

submit income statement, cash ow and net debt projections. These are

then consolidated and the results assessed by Group management and

the Board.

Each forecast is compared with prior forecasts and actual results

so as to identify variances and understand the drivers of the changes

and their future impact so as to allow management to take action where

appropriate. Additional analysis is undertaken to review and sense check

the key assumptions underpinning the forecasts as well as stress-testing

the results through sensitivity analysis.

Cash ow and liquidity reviews

The business planning process provides outputs for detailed cash ow

and liquidity reviews, to ensure that the Group maintains adequate

liquidity throughout the forecast periods. The prime output is a two year

liquidity forecast which is prepared and updated on a daily basis which

highlights the extent of the Group’s liquidity based on controlled cash

ows and the headroom under the Group’s undrawn revolving credit

facility (‘RCF’).

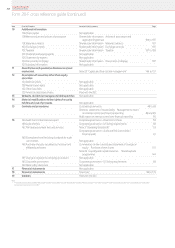

The key inputs into this forecast are:

a free cash ow forecasts, with the rst three months inputs being

sourced directly from the operating companies (analysed on a daily

basis), with information beyond this taken from the latest forecast/

budget cycle;

a bond and other debt maturities; and

a expectations for shareholder returns, spectrum auctions and

M&A activity.

The liquidity forecast shows two scenarios assuming either maturing

commercial paper is renanced or no new commercial paper issuance.

The liquidity forecast is reviewed by the Group CFO and included in each

of his reports to the Board.

In addition, the Group continues to manage its foreign exchange and

interest rate risks within the framework of policies and guidelines

authorised and reviewed by the Board, with oversight provided by the

Treasury Risk Committee.

Vodafone Group Plc

Annual Report 2014200

Principal risk factors and uncertainties (continued)