Vodafone 2014 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

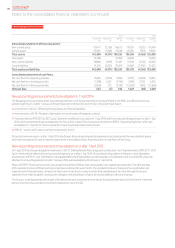

Commentary on the consolidated statement of changes in equity

The consolidated statement of changes in equity

shows the movements in equity shareholders’ funds

and non-controlling interests. Equity shareholders’

funds decreased by £0.7 billion as the prots on the

sale of our investment in Verizon Wireless (‘VZW’) and

from the recognition of a large deferred tax asset were

offset by the return of value to shareholders, regular

ordinary dividends and goodwill impairment charges.

The major movements in the year are described below:

Redemption and cancellation of shares

We cancelled 1 billion ordinary shares that had been repurchased by the

Company and held as treasury shares.

Purchase of own shares

We initiated a £1.5 billion share buyback programme following the

receipt of a US$3.8 billion (£2.4 billion) income dividend from VZW

in December 2012. Under this programme, which was completed

in June 2013, the Group placed irrevocable purchase instructions with

a third party in the prior year to enable shares to be repurchased on our

behalf when we may otherwise have been prohibited from buying in the

market. This led to a total of 552,050 purchased shares being settled

in the current year at an average price per share, including transaction

costs, of 189 pence.

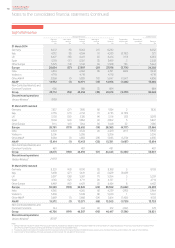

The movement in treasury shares during the year is shown below:

Number

Million £m

1 April 2013 4,902 9,029

Reissue of shares (104) (194)

Receipt of shares re-purchased in

prioryear 552 –

Cancellation of shares (1,000) (1,648)

Share consolidation (1,978) –

31 March 2014 2,372 7,187

The reissue of shares in the year was to satisfy obligations under

employee share schemes.

Issue of B and C shares

On 2 September 2013 Vodafone announced that it had reached

agreement to dispose of its US Group whose principal asset was its 45%

interest in Verizon Wireless for a total consideration of US$130 billion

(£79 billion).

Following completion on 21 February 2014, Vodafone shareholders

received all of the Verizon shares and US$23.9 billion (£14.3 billion)

of cash (the ‘Return of Value’) totalling US$85.2 billion (£51.0 billion).

The Return of Value was carried out through a B share and C share

scheme. Eligible shareholders were able to elect between receiving one

B share or one C share for each ordinary share that they held.

The B shares were cancelled by Vodafone in return for cash and Verizon

shares with a value no greater than the aggregate nominal value of the

B shares.

Holders of the C shares received a special dividend on their C shares,

consisting of cash and Verizon shares with an aggregate value, for each

C share, equal to the aggregate value of cash payable and Verizon

shares receivable on the cancellation of each B share. The special

B share distribution and C share dividend of £35.5 billion is included

within the £40.6 billion of dividends described paid to equity

shareholders in the year.

Transactions with non-controlling stakeholders in subsidiaries

During the year we acquired further non-controlling interests

in Vodafone India Limited and commenced the legal process

of acquiring the remaining shares in Kabel Deutschland.

Comprehensive income

The Group generated £56.7 billion of total comprehensive income

in the year, primarily a result of the prot for the year attributable

to equity shareholders of £59.3 billion. Total comprehensive income

increased by £56.0 billion compared to the previous year; the primary

reason underlying the increase being the prot realised on the disposal

of our investment in VZW of £45.0 billion and the prot arising from the

recognition of signicant deferred tax assets of £19.3 billion in relation

to losses incurred in Germany and Luxembourg (further details are

provided in note 6 “Taxation” to the consolidated nancial statements).

Dividends

Dividends of £40.6 billion include the special £35.5 billion B share

distribution and C share dividends distributed as part of the Return

of Value to shareholders and £5.1 billion of equity dividends.

We provide returns to shareholders through equity dividends and

historically have generally paid dividends in February and August

in each year. The directors expect that we will continue to pay dividends

semi-annually.

The £5.1 billion equity dividend in the current year comprises £3.4 billion

in relation to the nal dividend for the year ended 31 March 2013 and

£1.7 billion for the interim dividend for the year ended 31 March 2014.

This has increased from total dividends of £4.8 billion in the prior year,

with increases in the dividend per share more than offsetting reductions

in the number of shares in issue.

The interim dividend of 3.53 pence per share announced by the

directors in November 2013 represented an 8% increase over last

year’s interim dividend. The directors are proposing a nal dividend

of 7.47 pence per share. Total dividends for the year, excluding the

Return of Value in relation to the VZW disposal increased by 8%

to 11.00pence per share.

The nancial commentary on this page is unaudited.

Vodafone Group Plc 101Overview Strategy

review Performance Governance Financials

Additional

information