Vodafone 2014 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

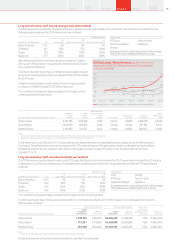

Long-term incentive (‘GLTI’) award vesting in June 2014 (audited)

The 2012 long-term incentive (‘GLTI’) awards which were made in June 2011 will partially vest in June 2014. The performance conditions for the

three year period ending in the 2014 nancial year are as follows:

TSR outperformance

Adjusted free cash ow measure £bn

0%

(Up to median)

4.5%

(65th percentile equivalent)

9%

(80th percentile equivalent)

Below threshold <16.7 0% 0% 0%

Threshold 16.7 50% 75% 100%

Target 19.2 100% 150% 200%

Maximum 21.7 200% 300% 400%

TSR peer group

BT Group Telecom Italia

Deutsche Telekom Telefónica

Orange

Emerging market composite (consists of the average

TSRperformance of Bharti, MTN and Turkcell)

Adjusted free cash ow for the three-year period ended on 31 March

2014 was £17.9 billion which compares with a threshold of £16.7 billion

and atarget of £19.2 billion.

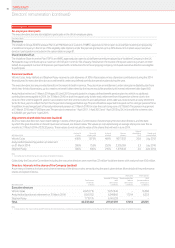

The chart to the right shows that our TSR performance against our peer

group for the same period resulted in an outperformance of the median

by 22.3% a year.

Using the combined payout matrix above, this performance resulted

in a payout of 148.8% of target (37.2% of the maximum).

The combined vesting percentages are applied to the target number

of shares granted as shown below.

2012 GLTI award TSR performance (growth in the value of

a hypothetical US$100 holding over the performance period,

six month averaging)

180

160

120

140

100

80

60 03/11 09/11 03/12 09/12 03/13 09/13 03/14

Vodafone Group Median of peer group Outperformance of median of 9% p.a.

100

103

101

99 96

107

87

114

92

80

111

100

83

129

100

79

165

115

88

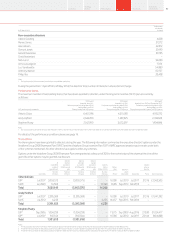

2012 GLTI performance share awards vesting in June 2014

Maximum

number

of shares

Target

number

of shares

Adjusted free cash

ow performance

payout

% of target TSR multiplier

Overall vesting

% of target1

Number of

shares vesting

Value of

shares vesting

(‘000)2

Vittorio Colao 6,461,396 1,615,349 74.4% 2 times 148.8% 2,403,638 £5,630

Andy Halford 2,643,290 660,822 74.4% 2 times 136.4% 901, 361 £2,111

Stephen Pusey 2,162,990 540,747 74.4% 2 times 148.8% 804,632 £1,885

Notes:

1 Andy Halford retired on 31 March 2014. His award has been prorated for the 33 months he served during the 36 month vesting period.

2 Valued using an average of the closing share prices over the last quarter of the 2014 nancial year of 234.23 pence.

These shares will vest on 28 June 2014. The adjusted free cash ow performance is audited by Deloitte and approved by the Remuneration

Committee. The performance assessment in respect of the TSR outperformance of the peer group median is undertaken by Towers Watson.

Dividend equivalents will also be paid in cash after the vesting date as shown on page 78. Details of how the plan works can be found

on pages72to 74.

Long-term incentive (‘GLTI’) awarded during the year (audited)

The 2014 long-term incentive awards made in July 2013 under the Global Long-Term Incentive Plan (‘GLTI’) were made in line with the 2014 policy

as disclosed in our 2013 remuneration report. The performance conditions are a combination of adjusted free cash ow and TSR performance

as follows:

TSR outperformance

Adjusted free cash ow measure £bn

0%

(Up to median)

4.5%

(65th percentile equivalent)

9%

(80th percentile equivalent)

Below threshold <12.4 0% 0% 0%

Threshold 12.4 50% 75% 100%

Target 14.4 100% 150% 200%

Maximum 16.4 150% 225% 300%

TSR peer group

AT&T Orange

BT Group Telecom Italia

Deutsche Telekom Telefónica

Emerging market composite (consists of the average

TSRperformance of Bharti, MTN and Turkcell)

The combined vesting percentages are applied to the target number of shares granted.

In order to participate fully in this award, executives had to co-invest personal shares worth 100% of salary. The resulting awards to executive

directors were as follows:

2014 GLTI performance share awards made in July 2013

Number of shares awarded Face value of shares awarded1Proportion of

maximum award

vesting at minimum

performance

Performance

period end

Target

vesting level

(1/3rd of max)

Maximum

vesting level

Target

vesting level

Maximum

vestinglevel

Vittorio Colao 1,395,123 4,185,370 £2,636,249 £7,908,748 1/6th 31 Mar 2016

Andy Halford 772,981 2,318,945 £1,469,998 £4,409,998 1/6th 31 Mar 2016

Stephen Pusey 634,948 1,904,846 £1,207,497 £3,622,495 1/6th 31 Mar 2016

Note:

1 Face value calculated based on the share prices at the dates of grant of 180.2 pence and 202.5 pence

Dividend equivalents on the shares that vest are paid in cash after the vesting date.

79Overview

Strategy

review Performance Governance Financials Additional

information