Vodafone 2014 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

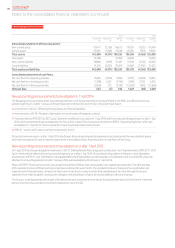

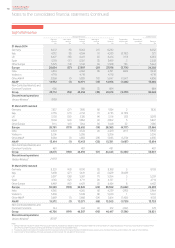

Consolidated statement of changes in equity

for the years ended 31 March

Other comprehensive income Equity

Additional share- Non-

Share paid-in Treasur y Retained Currency Pensions Investment Revaluation holders’ controlling

capital capital2shares losses reserve reserve reserve surplus Other funds interests Total

£m £m £m £m £m £m £m £m £m £m £m £m

1 April 2011 restated14,082 153,760 (8,171) (77,685) 14,417 (203) 237 1,040 78 87,555 6 87,561

Issue or reissue of shares – 2 277 (208) – – – – – 71 – 71

Redemption or cancellation

ofshares (216) 216 4,724 (4,724) – – – – – – – –

Purchase of own shares – – (4,671)4– – – – – – (4,671) – (4,671)

Share-based payment – 1453 – – – – – – – 145 – 145

Transactions with non-controlling

interests in subsidiaries – – – (1,908) – – – – – (1,908) 1,599 (309)

Comprehensive income – – – 6,948 (4,279) (263) (17) – (6) 2,383 (33) 2,350

Prot – – – 6,948 – – – – – 6,948 46 6,994

OCI – before tax – – – – (3,629) (352) (17) – (14) (4,012) (71) (4,083)

OCI – taxes – – – – 31 89 – – 8 128 (8) 120

Transfer to the income

statement – – – – (681) – – – – (681) – (681)

Dividends – – – (6,654) – – – – – (6,654) (305) (6,959)

Other – – – 14 – – – – – 14 – 14

31 March 2012 restated13,866 154,123 (7,841) (84,217) 10,138 (466) 220 1,040 72 76,935 1,267 78,202

Issue or reissue of shares – 2 287 (237) – – – – – 52 – 52

Purchase of own shares – – (1,475)4– – – – – – (1,475) – (1,475)

Share-based payment – 1523 – – – – – – – 152 – 152

Transactions with non-controlling

interests in subsidiaries – – – (7) – – – – – (7) (17) (24)

Comprehensive income – – – 413 462 (182) (85) – (4) 604 145 749

Prot – – – 413 – – – – – 413 244 657

OCI – before tax – – – – 482 (238) (73) – (6) 165 (95) 70

OCI – taxes – – – – (21) 56 – – 2 37 (4) 33

Transfer to the income

statement – – – – 1 – (12) – – (11) – (11)

Dividends – – – (4,801) – – – – – (4,801) (384) (5,185)

Other – 2 – 15 – – – – – 17 – 17

31 March 2013 restated13,866 154,279 (9,029) (88,834) 10,600 (648) 135 1,040 68 71,477 1,011 72,488

Issue or reissue of shares – 2 194 (173) – – – – – 23 – 23

Redemption or cancellation of

shares (74) 74 1,648 (1,648) – – – – – – – –

Capital reduction and creation of

B and C shares 16,613 (37,470) – 20,857 – – – – – – – –

Cancellation of B shares (16,613) – – 1,115 – – – – – (15,498) – (15,498)

Share-based payment – 883 – – – – – – – 88 – 88

Transactions with non-controlling

interests in subsidiaries – – – (1,451) – – – – – (1,451) 260 (1,191)

Comprehensive income – – – 59,254 (2,436) 37 (119) – (25) 56,711 (9) 56,702

Prot – – – 59,254 – – – – – 59,254 166 59,420

OCI – before tax – – – – (3,932) 57 (119) – 3 (3,991) (172) (4,163)

OCI – taxes – – – – 3 (20) – – (3) (20) (3) (23)

Transfer to the income

statement – – – – 1,493 – – – (25) 1,468 – 1,468

Dividends – – – (40,566) – – – – – (40,566) (284) (40,850)

Other – – – 18 – – – – – 18 1 19

31 March 2014 3,792 116,973 (7,187) (51,428) 8,164 (611) 16 1,040 43 70,802 979 71,781

Notes:

1 Restated for the adoption of IFRS 11 and amendments to IAS 19. Retained losses have increased and the pensions reserve losses have reduced by £49 million for the year ended 31 March 2013 and by £33 million for the year

ended 31 March 2012. See note 1 “Basis of preparation” for further details.

2 Includes share premium, capital redemption reserve and merger reserve. The merger reserve was derived from acquisitions made prior to 31 March 2004 and subsequently allocated to additional paid-in capital on adoption

of IFRS.

3 Includes £12 million tax charge (2013: £18 million credit; 2012: £2 million credit).

4 Amount for 2013 includes a commitment for the purchase of own shares of £1,026 million; 2012: £1,091 million).

Vodafone Group Plc

Annual Report 2014100