Vodafone 2014 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

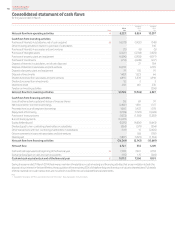

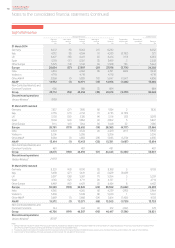

Consolidated statement of cash ows

for the years ended 31 March

2014

Restated1

2013

Restated1

2012

Note £m £m £m

Net cash ow from operating activities 19 6,227 8,824 10,297

Cash ows from investing activities

Purchase of interests in subsidiaries, net of cash acquired 28 (4,279) (1,432) (149)

Other investing activities in relation to purchase of subsidiaries – – 310

Purchase of interests in associates and joint ventures (11) (6) (5)

Purchase of intangible assets (2,327) (3,758) (1,876)

Purchase of property, plant and equipment (4,396) (3,958) (4,071)

Purchase of investments (214) (4,249) (417)

Disposal of interests in subsidiaries, net of cash disposed –27 784

Disposal of interests in associates and joint ventures 34,919 – 6,799

Disposal of property, plant and equipment 79 105 91

Disposal of investments 1,483 1,523 66

Dividends received from associates and joint ventures 4,897 5,539 4,916

Dividends received from investments 10 2 3

Interest received 582 461 336

Taxation on investing activities – – (206)

Net cash ow from investing activities 30,743 (5,746) 6,581

Cash ows from nancing activities

Issue of ordinary share capital and reissue of treasury shares 38 69 91

Net movement in short-term borrowings (2,887) 1,581 1,517

Proceeds from issue of long-term borrowings 1,060 5,422 1,578

Repayment of borrowing (9,788) (1,720) (3,424)

Purchase of treasury shares (1,033) (1,568) (3,583)

B and C share payments (14,291) – –

Equity dividends paid (5,076) (4,806) (6,643)

Dividends paid to non-controlling shareholders in subsidiaries (264) (379) (304)

Other transactions with non-controlling shareholders in subsidiaries (111) 15 (2,605)

Other movements in loans with associates and joint ventures –168 (792)

Interest paid (1,897) (1,525) (1,504)

Net cash ow from nancing activities (34,249) (2,743) (15,669)

Net cash ow 2,721 335 1,209

Cash and cash equivalents at beginning of the nancial year 20 7,506 7,001 6,138

Exchange (loss)/gain on cash and cash equivalents (115) 170 (346)

Cash and cash equivalents at end of the nancial year 20 10,112 7, 506 7,001

During the year ended 31 March 2014 there were a number of material non-cash investing and nancing activities that arose in relation to both the

disposal of our interest in Verizon Wireless, the acquisition of the remaining 23% of Vodafone Italy and the return of value to shareholders. Full details

of these material non-cash transactions are included in note 28 to the consolidated nancial statements.

Note:

1 Restated for the adoption of IFRS 11 and amendments to IAS 19. See note 1 “Basis of preparation” for further details.

Vodafone Group Plc

Annual Report 2014102