Vodafone 2014 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216

|

|

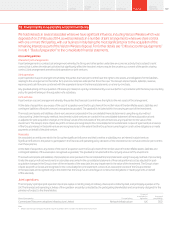

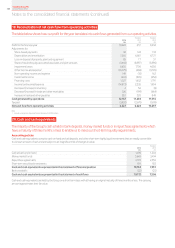

19. Reconciliation of net cash ow from operating activities

The table below shows how our prot for the year translates into cash ows generated from our operating activities.

2014

Restated

2013

Restated

2012

£m £m £m

Prot for the nancial year 59,420 657 6,994

Adjustments for:

Share-based payments 92 124 133

Depreciation and amortisation 7,560 6,661 6,721

Loss on disposal of property, plant and equipment 85 77 51

Share of result of equity accounted associates and joint ventures (3,469) (6,997) (5,996)

Impairment losses 6,600 7,700 4,050

Other income and expense1(45,979) (468) (3,705)

Non-operating income and expense 149 (10) 162

Investment income (346) (305) (456)

Financing costs 1,527 1,652 1,791

Income tax (income)/expense (14,873) 2,226 1,994

Decrease/(increase) in inventory 456 (8)

Decrease/(increase) in trade and other receivables 526 (199) (664)

Increase in trade and other payables 851 320 849

Cash generated by operations 12,147 11,494 11,916

Tax paid (5,920) (2,670) (1,619)

Net cash ow from operating activities 6,227 8,824 10,297

Note:

1 Includes a net gain on disposal of Verizon Wireless of £44,996 million..

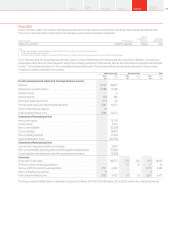

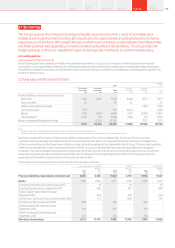

20. Cash and cash equivalents

The majority of the Group’s cash is held in bank deposits, money market funds or in repurchase agreements which

have a maturity of three months or less to enable us to meet our short-term liquidity requirements.

Accounting policies

Cash and cash equivalents comprise cash on hand and call deposits, and other short-term highly liquid investments that are readily convertible

to a known amount of cash and are subject to an insignicant risk of changes in value.

2014

Restated

2013

£m £m

Cash at bank and in hand 1,498 1,304

Money market funds 3,648 3,494

Repurchase agreements 4,799 2,550

Short-term securitised investments 189 183

Cash and cash equivalents as presented in the statement of nancial position 10,134 7,531

Bank overdrafts (22) (25)

Cash and cash equivalents as presented in the statement of cash ows 10,112 7,506

Cash and cash equivalents are held by the Group on a short-term basis with all having an original maturity of three months or less. The carrying

amount approximates their fair value.

Notes to the consolidated nancial statements (continued)

Vodafone Group Plc

Annual Report 2014138