Vodafone 2014 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216

|

|

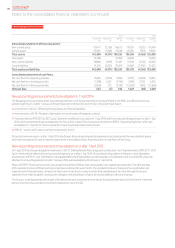

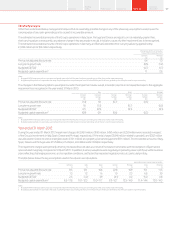

5. Investment income and nancing costs

Investment income comprises interest received from short-term investments, bank deposits, government bonds

and gains from foreign exchange contracts which are used to hedge net debt. Financing costs mainly arise from

interest due on bonds and commercial paper issued, bank loans and the results of hedging transactions used to

manage foreign exchange and interest rate movements.

2014

Restated

2013

Restated

2012

£m £m £m

Investment income:

Available-for-sale investments:

Dividends received 10 2 2

Loans and receivables at amortised cost 184 124 168

Fair value through the income statement (held for trading):

Derivatives – foreign exchange contracts 82 115 121

Other170 64 165

346 305 456

Financing costs:

Items in hedge relationships:

Other loans 265 228 210

Interest rate swaps (196) (184) (178)

Fair value hedging instrument 386 (81) (539)

Fair value of hedged item (363) 112 511

Other nancial liabilities held at amortised cost:

Bank loans and overdrafts2557 584 628

Other loans3770 736 785

Interest credit on settlement of tax issues4(15) (91) 23

Equity put rights and similar arrangements5143 136 81

Fair value through the income statement (held for trading):

Derivatives – forward starting swaps and futures 1105 244

Other1651 3

1,554 1,596 1,768

Net nancing costs 1,208 1,291 1,312

Notes:

1 Amounts for 2014 include net foreign exchange gains of £21 million (2013 £91 million loss; 2012 £55 million gain) arising from net foreign exchange movements on certain intercompany balances. Amounts for 2012 include

foreign exchange gains arising on investments held following the disposal of Vodafone Japan to SoftBank Corp.

2 The Group capitalised £3 million of interest expense in the year (2013: £8 million; 2012: £25 million). The interest rate used to determine the amount of borrowing costs eligible for capitalisation was 5.4%.

3 Amounts for 2014 include foreign exchange losses of £201 million.

4 Amounts for 2014 and 2013 include a reduction of the provision for potential interest on tax issues.

5 Includes amounts in relation to the Group’s arrangements with its non-controlling interest partners in India.

Notes to the consolidated nancial statements (continued)

Vodafone Group Plc

Annual Report 2014118