Vodafone 2014 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

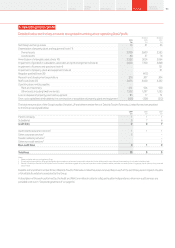

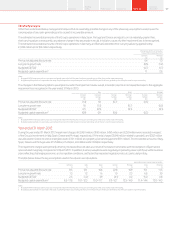

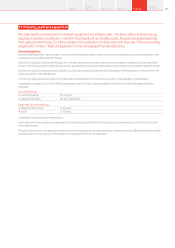

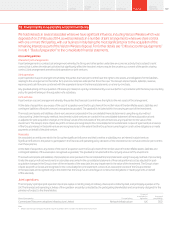

6. Taxation

This note explains how our Group tax charge arises. The deferred tax section of the note also provides information

on our expected future tax charges and sets out the tax assets held across the Group together with our view on

whether or not we expect to be able to make use of these in the future.

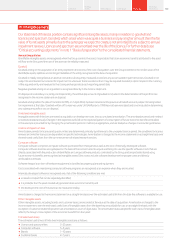

Accounting policies

Income tax expense represents the sum of the current tax payable and deferred tax.

Current tax payable or recoverable is based on taxable prot for the year. Taxable prot differs from prot as reported in the income statement

because some items of income or expense are taxable or deductible in different years or may never be taxable or deductible. The Group’s liability for

current tax is calculated using UK and foreign tax rates and laws that have been enacted or substantively enacted by the reporting period date.

Deferred tax is the tax expected to be payable or recoverable in the future arising from temporary differences between the carrying amounts

of assets and liabilities in the nancial statements and the corresponding tax bases used in the computation of taxable prot. It is accounted for using

the statement of nancial position liability method. Deferred tax liabilities are generally recognised for all taxable temporary differences and deferred

tax assets are recognised to the extent that it is probable that temporary differences or taxable prots will be available against which deductible

temporary differences can be utilised.

Such assets and liabilities are not recognised if the temporary difference arises from the initial recognition (other than in a business combination)

of assets and liabilities in a transaction that affects neither the taxable prot nor the accounting prot. Deferred tax liabilities are not recognised to the

extent they arise from the initial recognition of non-tax deductible goodwill.

Deferred tax liabilities are recognised for taxable temporary differences arising on investments in subsidiaries and associates, and interests in joint

arrangements, except where the Group is able to control the reversal of the temporary difference and it is probable that the temporary difference

will not reverse in the foreseeable future.

The carrying amount of deferred tax assets is reviewed at each reporting period date and adjusted to reect changes in the Group’s assessment that

sufcient taxable prots will be available to allow all or part of the asset to be recovered.

Deferred tax is calculated at the tax rates that are expected to apply in the period when the liability is settled or the asset realised, based on tax rates

that have been enacted or substantively enacted by the reporting period date.

Tax assets and liabilities are offset when there is a legally enforceable right to set off current tax assets against current tax liabilities and when they

either relate to income taxes levied by the same taxation authority on either the same taxable entity or on different taxable entities which intend

to settle the current tax assets and liabilities on a net basis.

Tax is charged or credited to the income statement, except when it relates to items charged or credited to other comprehensive income or directly

to equity, in which case the tax is recognised in other comprehensive income or in equity.

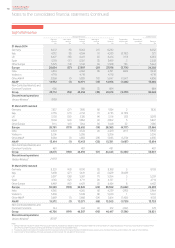

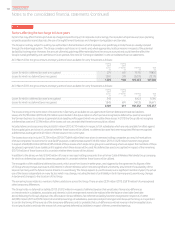

Income tax expense

2014

Restated

2013

Restated

2012

£m £m £m

United Kingdom corporation tax expense/(income):

Current year –––

Adjustments in respect of prior years 17 24 (4)

17 24 (4)

Overseas current tax expense/(income):

Current year 3 ,114 1,062 1,118

Adjustments in respect of prior years (25) (249) (42)

3,089 813 1,076

Total current tax expense 3,106 837 1,072

Deferred tax on origination and reversal of temporary differences:

United Kingdom deferred tax 57 (52) (8)

Overseas deferred tax (19,745) (309) (359)

Total deferred tax income (19,688) (361) (367)

Total income tax (income)/expense (16,582) 476 705

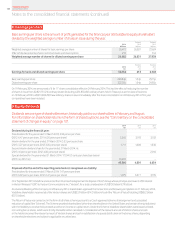

UK operating prots are more than offset by statutory allowances for capital investment in the UK network and systems plus ongoing interest costs

including those arising from the £6.8 billion of spectrum payments to the UK government in 2000 and 2013.

Annual Report 2014 119Overview Strategy

review Performance Governance Financials Additional

information