Vodafone 2014 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Operating loss

Adjusted operating prot excludes certain income and expenses that

we have identied separately to allow their effect on the present results

of the Group to be assessed (see page 201). The items that are included

in operating loss but are excluded from adjusted operating prot are

discussed below.

Impairment losses of £6,600 million (2013: £7,700 million) recognised

in respect of Germany, Spain, Portugal, Czech Republic and Romania.

Further detail is provided in note 4 to the Group’s consolidated

nancial statements.

Restructuring costs of £355 million (2013: £311 million) have been

incurred to improve future business performance and reduce costs.

Amortisation of intangible assets in relation to customer bases and

brands are recognised under accounting rules after we acquire

businesses and amounted to £551 million (2013: £249 million).

Amortisation charges increased in the year as a result of the acquisition

of KDG and Vodafone Italy in the year.

Other income and expense comprises a loss of £0.7 billion arising

largelyfrom our acquisition of a controlling interest in Vodafone Italy.

The year ended 31 March 2013 includes a £0.5 billion gain on the

acquisition of CWW.

Including the above items, operating loss increased to £3.9 billion from

£2.2 billion as lower impairment charges were offset by lower revenue,

higher customer costs and higher amortisation.

Net nancing costs

2014

£m

2013

£m

Investment income 346 305

Financing costs (1,554) (1,596)

Net nancing costs (1,208) (1,291)

On a statutory basis, net nancing costs have decreased 6.4% primarily

due to the recognition of mark-to-market gains, offset by a £99 million

loss (2013: £nil) on the redemption of US$5.65 billion bonds as part

of the restructuring of the Group’s nancing arrangements following the

disposal of Verizon Wireless and lower interest income on settlement

of tax issues.

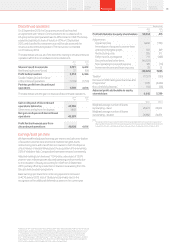

Taxation

2014

£m

2013

£m

Income tax expense:

Continuing operations before recognition of

deferred tax 2,736 476

Discontinued operations 1,709 1,750

Total income tax expense 4,445 2,226

Recognition of additional deferred tax –

continuing operations (19,318) –

Total tax (credit)/expense (14,873) 2,226

The recognition of the additional deferred tax assets, which arose from

losses in earlier years, was triggered by the agreement to dispose of the

US group whose principal asset was its 45% interest in VZW, which

removes signicant uncertainty around both the availability of the

losses in Germany and the future income streams in Luxembourg.

The Group expects to use these losses over a signicant number

of years; the actual use of these losses is dependent on many factors

which may change, including the level of protability in both Germany

and Luxembourg, changes in tax law and changes to the structure

of the Group.

2014

£m

2013

£m

Total tax (credit)/expense (14,873) 2,226

Tax on adjustments to derive adjusted prot

before tax 290 150

Removal of post-disposal VZW tax (1,019) –

Recognition of deferred tax asset for losses

inGermany and Luxembourg 19,318 –

Tax liability on US rationalisation

andreorganisation (2,210) –

Deferred tax on current year movement of

Luxembourg losses 113 –

Adjusted income tax expense 1,619 2,376

Share of associates’ and joint ventures’ tax 226 390

Adjusted income tax expense for

calculating adjusted tax rate 1,845 2,766

Prot before tax

– Continuing operations (5,270) (3,483)

– Discontinued operations 49,817 6,366

Total prot before tax 44,547 2,883

Adjustments to derive adjusted prot

beforetax (38,070) 7,833

Adjusted prot before tax 6,477 10,716

Share of associates’ and joint ventures’ taxand

non-controlling interest 281 575

Adjusted prot before tax for calculating

adjusted effective tax rate 6,758 11,291

Adjusted effective tax rate 27.3% 24.5%

The adjusted effective tax rate for the year ended 31 March 2014 was

27.3%, in line with our expectation for the year. The rate has been

adjusted to exclude tax arising in respect of our US group after the date

of the announcement of the disposal of VZW.

Our adjusted effective tax rate does not include the impact of the

recognition of an additional deferred tax asset in respect of the

Group’s historic tax losses in Germany (£1,916 million) and Luxembourg

(£17,402 million), and the estimated US tax liability (£2,210 million)

relating to the rationalisation and reorganisation of our non-US assets

prior to the disposal of our interest in VZW.

Vodafone Group Plc

Annual Report 201444

Operating results (continued)