Vodafone 2014 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

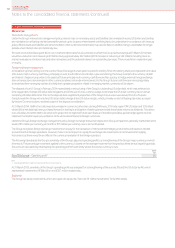

26. Post employment benets

We operate a number of dened benet and dened contribution pension plans for our employees. The Group’s

largest dened benet schemes are in the UK. For further details see “Critical accounting judgements” in note 1

“Basis of preparation” to the consolidated nancial statements.

Accounting policies

For dened benet retirement plans, the difference between the fair value of the plan assets and the present value of the plan liabilities is recognised

as an asset or liability on the statement of nancial position. Scheme liabilities are assessed using the projected unit funding method and applying

the principal actuarial assumptions at the reporting period date. Assets are valued at market value.

Actuarial gains and losses are taken to the statement of comprehensive income as incurred. For this purpose, actuarial gains and losses comprise

both the effects of changes in actuarial assumptions and experience adjustments arising because of differences between the previous actuarial

assumptions and what has actually occurred.

Other movements in the net surplus or decit are recognised in the income statement, including the current service cost, any past service cost

and the effect of any curtailment or settlements. The interest cost less the expected return on assets is also charged to the income statement.

The amount charged to the income statement in respect of these plans is included within operating costs or in the Group’s share of the results

of equity accounted operations, as appropriate.

The Group’s contributions to dened contribution pension plans are charged to the income statement as they fall due.

Cumulative actuarial gains and losses at 1 April 2004, the date of transition to IFRS, were recognised in the statement of nancial position.

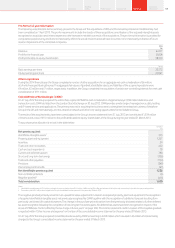

Background

At 31 March 2014 the Group operated a number of pension plans for the benet of its employees throughout the world, with varying rights and

obligations depending on the conditions and practices in the countries concerned. The Group’s pension plans are provided through both dened

benet and dened contribution arrangements. Dened benet schemes provide benets based on the employees’ length of pensionable service

and their nal pensionable salary or other criteria. Dened contribution schemes offer employees individual funds that are converted into benets

at the time of retirement.

The Group operates dened benet schemes in Germany, Ghana, India, Ireland, Italy, the UK and the United States. Dened contribution pension

schemes are currently provided in Australia, Egypt, Germany, Greece, Hungary, India, Ireland, Italy, the Netherlands, New Zealand, Portugal,

SouthAfrica, Spain and the UK.

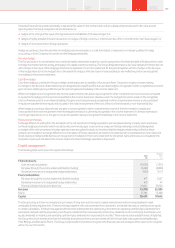

Income statement expense

2014

Restated

2013

Restated

2012

£m £m £m

Dened contribution schemes 124 118 113

Dened benet schemes 34 39 9

Total amount charged to income statement (note 25) 158 157 122

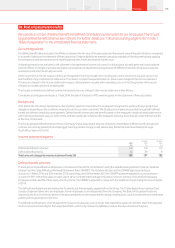

Dened benet schemes

The Group’s principal dened benet pension schemes are in the UK (the ‘UK Schemes’), being the Vodafone Group Pension Scheme (‘Vodafone

UK plan’) and the Cable & Wireless Worldwide Retirement Plan (‘CWWRP’). The Vodafone UK plan and the CWWRP plan closed to future

accrual on 31 March 2010 and 30 November 2013, respectively. Until 30 November 2013 the CWWRP allowed employees to accrue a pension

at a rate of 1/85th of their nal salary for each year of service until the retirement age of 60 with a maximum pension of two thirds of nal salary.

Employees contributed 5% of their salary into the scheme. The CWWRP is expected to merge with the Vodafone UK plan during the second quarter

of 2014.

The dened benet plans are administered by Trustee Boards that are legally separated from the Group. The Trustee Board of each pension fund

consists of representatives who are employees, former employees or are independent from the Company. The Board of the pension funds are

required by law to act in the best interest of the plan participants and are responsible for setting certain policies, such as investment and contribution

policies and the governance of the fund.

The dened benet pension schemes expose the Group to actuarial risks such as longer than expected longevity of members, lower than expected

return on investments and higher than expected ination, which may increase the liabilities or reduce the value of assets of the plans.

Vodafone Group Plc

Annual Report 2014 153Overview

Strategy

review Performance Governance Financials Additional

information