Vodafone 2014 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dear fellow shareholder

I am pleased to present you with Vodafone’s remuneration report for 2014.

This year will be the rst time we will ask shareholders to vote on our remuneration policy in addition to the rest of the remuneration report.

With the new remuneration disclosure regulations in mind we have changed the structure of our report to present rst our policy and then detail its

implementation. Apart from some changes which I outline below, our policy and practice remain essentially unchanged.

As always we have tried to ensure that the remuneration policy and practice atVodafone drive behaviours that are in the long-term interests

of the Company and its shareholders. The Remuneration Committee continues to be mindful of the considerable interest that exists in executive

compensation and we are very conscious of the many and varied concerns.

Our remuneration principles

Our remuneration principles, which our detailed policy supports, are as follows:

a we offer competitive and fair rates of pay and benets to attract and retain the best people;

a our policy and practices aim to drive behaviours that support our Company strategy and business objectives;

a our ‘pay for performance’ approach means that our incentive plans only deliver signicant rewards if and when they are justied by performance;

and

a our approach to share ownership is designed to help maintain commitment over the long-term, and to ensure that the interests of our senior

management team are aligned with those of shareholders.

Pay for performance

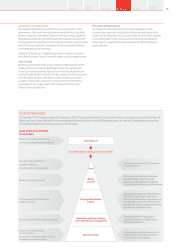

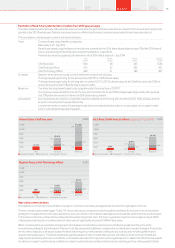

Pay for performance continues to be an important principle for Vodafone when setting remuneration policy.

A high proportion of total reward is awarded through short-term and long-term performance related remuneration. At target around 70% of the

package is delivered in the form of variable pay, which rises to around 85% if maximum payout is achieved.

We ensure our incentive plans only deliver signicant rewards if and when they are justied by performance. For the Remuneration Committee this

means two things:

a ensuring the targets we set for incentive plans are suitably challenging (as can be seen by the historic levels of achievement for both short-

and long-term incentive plans shown on page 82); and

a if needed, exercising discretion. The Committee reviews all incentive plans before any payments are made to executives and has full discretion

to adjust payments downwards if it believes circumstances warrant it.

Company performance and the link to incentives

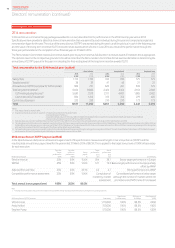

During the 2014 year our emerging markets businesses have delivered strong organic revenue growth along with good cash ow and EBITDA

performance. However, this has been offset by signicant ongoing competitive, regulatory and macroeconomic pressures in our European

operations where revenue has declined. Taken in the round this led to slightly below target performance which is reected in our annual bonus

payout of 88.5% of target. More details can be found on page 78.

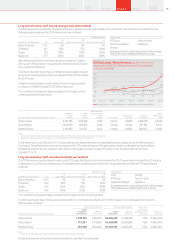

Over the last three years our adjusted free cash ow performance, although strong in our emerging markets, has been below our target levels

in Europe for similar reasons to those described above. However, we have taken signicant strategic steps which have led to strong growth in the

share price and Total Shareholder Return (‘TSR’) which, when combined with adjusted free cash ow, result in a payout for the executive directors’

long-term incentive awards of 37.2% of maximum. More details can be found on page 79. Strategic initiatives include:

a the sale of our 45% stake in Verizon Wireless;

a the record US$85 billion return to shareholders;

a the announcement of Project Spring – the acceleration of our capital investment to strengthen further our network and customer experience;

a the acquisition of a leading cable operator in Germany as well as xed line businesses such as CWW and TelstraClear;

a launching Vodafone Red which is now available in 20 markets; and

a developing our M-Pesa footprint.

Luc Vandevelde

Chairman of the Remuneration Committee

Letter from the Remuneration Committee Chairman

69Overview

Strategy

review Performance Governance Financials Additional

information

Directors’ remuneration