Vodafone 2014 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

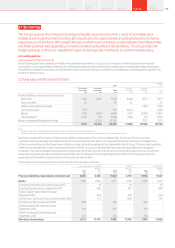

In the event of any default ownership of the cash collateral would revert to the respective holder at that point. Detailed below is the value of the cash

collateral, which is reported within short-term borrowings, held by the Group at 31 March 2014:

2014 2013

£m £m

Cash collateral 1,185 1,151

The majority of the Group’s trade receivables are due for maturity within 90 days and largely comprise amounts receivable from consumers and

business customers. At 31 March 2014 £2,360 million (2013: £1,733 million) of trade receivables were not yet due for payment. Totaltrade

receivables consisted of £1,219 million (2013: £1,265 million) relating to the Europe region, and £280 million (2013: £319 million) relating to the

AMAP region. Accounts are monitored by management and provisions for bad and doubtful debts raised where it is deemed appropriate.

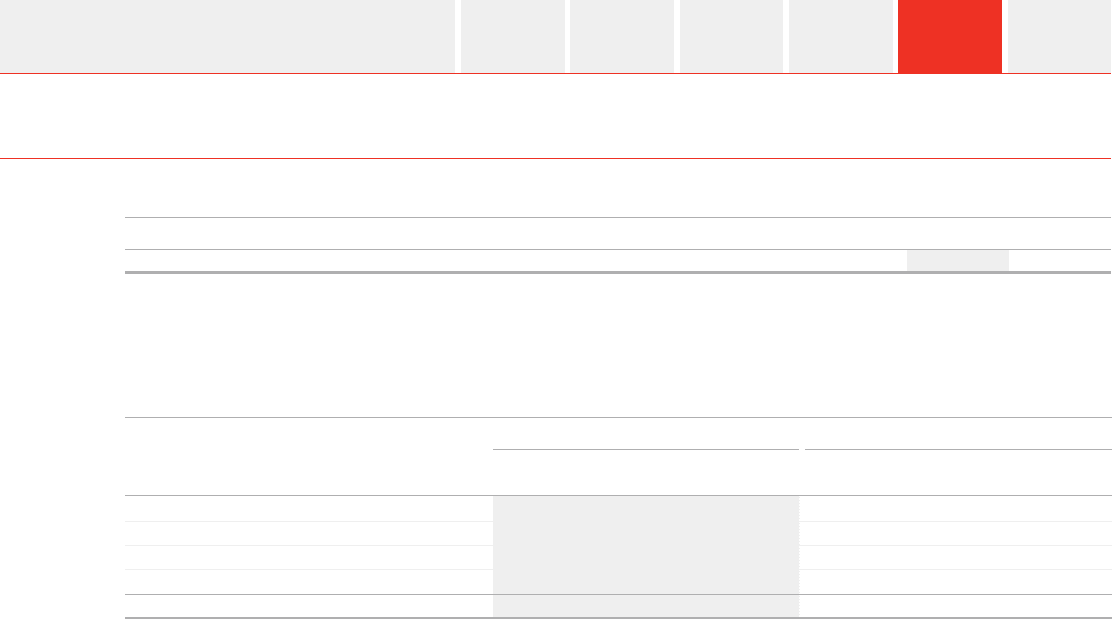

The following table presents ageing of receivables that are past due and provisions for doubtful receivables that have been established.

2014

Restated

2013

Gross

receivables

Less

provisions

Net

receivables

Gross

receivables

Less

provisions

Net

receivables

£m £m £m £m £m £m

30 days or less 1,327 (356) 971 1,460 (390) 1,070

Between 31–60 days 218 (27) 191 166 (14) 152

Between 61–180 days 187 (53) 134 222 (44) 178

Greater than 180 days 516 (313) 203 609 (424) 185

2,248 (749) 1,499 2,457 (872) 1,585

Concentrations of credit risk with respect to trade receivables are limited given that the Group’s customer base is large and unrelated. Due to this

management believes there is no further credit risk provision required in excess of the normal provision for bad and doubtful receivables.

Amounts charged to administrative expenses duringthe year ended 31 March 2014 were £347 million (2013: £360 million; 2012: £357 million)

(seenote 15 “Trade and other receivables”).

As discussed in note 30 “Contingent liabilities”, the Group has covenanted to provide security in favour of the Trustee of the Vodafone Group

UK Pension Scheme in respect of the funding decit in the scheme. The security takes the form of an English law pledge over UK index linked

government bonds.

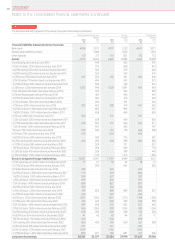

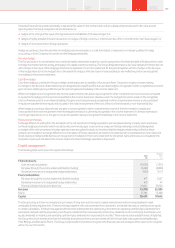

Liquidity risk

At 31 March 2014 the Group had €3.9 billion and US$4.2 billion syndicated committed undrawn bank facilities and US$15 billion and £5 billion

commercial paper programmes, supported by the €3.9 billion and US$4.2 billion syndicated committed bank facilities, available to manage its

liquidity. The Group uses commercial paper and bank facilities to manage short-term liquidity and manages long-term liquidity by raising funds

in the capital markets.

The €3.9 billion syndicated committed facility has a maturity date of 28 March 2019 with the option to (i) extend the facility for a further year

prior to the rst anniversary of the facility and should such extension be exercised, to (ii) extend the Facility for a further year prior to the second

anniversary of the Facility, in both cases if requested by the Company. The US$4.1 billion syndicated committed facility has a maturity of 9 March

2017; the remaining US$0.1 billion has a maturity of 9 March 2016. Both facilities have remained undrawn throughout the nancial year and since

year end and provide liquidity support.

The Group manages liquidity risk on long-term borrowings by maintaining a varied maturity prole with a cap on the level of debt maturing in any

one calendar year, therefore minimising renancing risk. Long-term borrowings mature between one and 29 years.

Liquidity is reviewed daily on at least a 12 month rolling basis and stress tested on the assumption that all commercial paper outstanding

matures and is not reissued. The Group maintains substantial cash and cash equivalents which at 31 March 2014, amounted to £10,134 million

(2013: £7,531 million).

Vodafone Group Plc

Annual Report 2014 149Overview

Strategy

review Performance Governance Financials Additional

information