Vodafone 2014 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

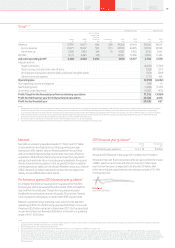

Group1,2,3

Management basis1Statutory basis1

Europe

£m

AMAP

£m

Non-Controlled

Interests and

Common

Functions4

£m

Eliminations

£m

2014

£m

2013

£m

2014

£m

2013

£m

Revenue 27, 997 14,971 686 (38) 43 ,616 44,445 38,346 38,041

Service revenue 25,977 13,087 502 (37) 39,529 40,495 35,190 34,999

Other revenue 2,020 1,884 184 (1) 4,087 3,950 3,156 3,042

EBITDA28 ,175 4,680 (24) –12, 831 13,566 11,084 11,466

Adjusted operating prot22,688 2,092 3,094 –7,874 12,577 4,310 5,590

Adjustments for:

Impairment losses (6,600) (7,700)

Restructuring costs and other one-off items (355) (311)

Amortisation of acquired customer bases and brand intangible assets (551) (249)

Other income and expense (717) 468

Operating loss (3,913) (2,202)

Non-operating income and expense (149) 10

Net nancing costs (1,208) (1,291)

Income tax credit/(expense) 16,582 (476)

Prot/(loss) for the nancial year from continuing operations 11,312 (3,959)

Prot for the nancial year from discontinued operations 48,108 4,616

Prot for the nancial year 59,420 657

Notes:

1 Management basis amounts and growth rates are calculated consistent with how the business is managed and operated, and include the results of the Group’s joint ventures, Vodafone Italy, Vodafone Hutchison Australia,

Vodafone Fiji and Indus Towers, on a proportionate basis, including the prot contribution from Verizon Wireless to 2 September 2013. Statutory basis includes the results of the Group’s joint ventures using the equity

accounting basis rather than on a proportionate consolidation basis, with the prot contribution from Verizon Wireless being classied within discontinued operations. See “Non-GAAP information” on page 201 for details.

2 All amounts are presented on the Group’s revised segment basis. EBITDA and adjusted operating prot have been restated to exclude restructuring costs. Adjusted operating prot has also been redened to exclude

amortisation of customer base and brand intangible assets. See page 201 for “Non-GAAP nancial information”.

3 2014 results reect average foreign exchange rates of £1:€1.19 and £1:US$1.59 (2013: £1:€1.23 and £1:US$1.58).

4 Common Functions primarily represent the results of the partner markets and the net result of unallocated central Group costs.

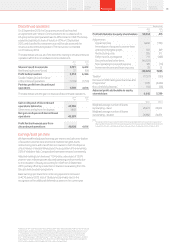

Net debt

Net debt on a statutory basis decreased £11.7 billion to £13.7 billion

as proceeds from the disposal of our US group, whose principal

asset was its 45% stake in Verizon Wireless, positive free cash ow

and favourable foreign exchange movements more than offset the

acquisition of Kabel Deutschland, licences and spectrum payments

and equity shareholder returns including equity dividends, the special

distribution and share buybacks. In Q4, we paid £2.4 billion in relation

to the expected tax liability for the Verizon Wireless transaction, of which

US$3.3 billion (£2.0 billion) was paid to Verizon. We now expect this

liability to total US$3.6 billion (£2.2 billion).

Performance against 2014 nancial year guidance2

On 2 September 2013 we issued pro forma guidance for the 2014

nancial year, which excluded VZW and included 100% of Vodafone

Italy, both for the whole year. This pro forma guidance included

Vodafone’s remaining joint ventures (Australia, Fiji and Indus Towers),

on an equity accounting basis, consistent with IFRS requirements.

Based on guidance foreign exchange rates, our pro forma adjusted

operating prot for the 2014 nancial year was £4.9 billion2, in line with

the around £5.0 billion range set in September 2013. On the same basis

our pro forma free cash ow was £4.8 billion2, in line with our guidance

range of £4.5–£5.0 billion.

2015 nancial year guidance3

EBITDA

£bn

Free cash ow

£bn

2015 nancial year guidance 11.4–11.9 Positive

We expect EBITDA to be in the range of £11.4 billion to £11.9 billion.

We expect free cash ow to be positive after all capex, before the impact

of M&A, spectrum purchases and restructuring costs. Total capex

over the next two years is expected to be around £19 billion, after

which we anticipate capital intensity normalising to a level of 13–14%

of annual revenue.

Nick Read

Chief Financial Ofcer

Annual Report 2014 39Overview

Strategy

review Performance Governance Financials

Additional

information

Notes:

* All amounts in this document marked with an “*” represent organic growth which presents performance on a comparable basis, both in terms of merger and acquisition activity and movements in foreign exchange rates.

See page 202 “Non-GAAP nancial information” for further details.

1 Please see page 201 for “Non-GAAP nancial information”.

2 Guidance foreign exchange rates for the year ended 31 March 2014 were £1:€1.17, £1=US$1.52, £1:INR 84.9 and £1:ZAR 14.3.

3 We have based guidance for the 2015 nancial year on our current assessment of the global macroeconomic outlook and assume foreign exchange rates of £1:€1.21, £1:INR 105.8 and £1:ZAR 18.4. It excludes the impact

of licences and spectrum purchases, material one-off tax-related payments, restructuring costs and any fundamental structural change to the Eurozone. It also assumes no material change to the current structure of the

Group. Actual foreign exchange rates may vary from the foreign exchange rate assumptions used. A 1% change in the euro to sterling exchange rate would impact EBITDA by £60 million and have no material impact on free

cash ow. A 1% change in the Indian rupee to sterling exchange rate would impact EBITDA by £10 million and free cash ow by £5 million. A 1% change in the South African Rand to sterling exchange rate would impact EBITDA

by £15 million and free cash ow by £5 million. Guidance for the year ending 31 March 2015 includes the results of Vodafone’s remaining joint ventures (Australia, Fiji and Indus Towers) on an equity basis, consistent with

IFRS requirements.