Vodafone 2014 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Governance of the External Audit relationship

The Committee considers the reappointment of the external auditor

and also assesses their independence on an ongoing basis. The external

auditor is required to rotate the audit partner responsible for the Group

audit every ve years and the year ended 31 March 2014 will be the

current lead audit partner’s fth year. Accordingly, and in compliance

with the provisions outlined in the UK Corporate Governance Code and

the notes on best practice issued by the Financial Reporting Council

in July 2013, the Committee decided to put the audit for the 2015

nancial year out to tender in November 2013.

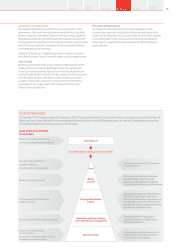

The tender process and the Committee’s involvement in that process

is outlined in the diagram on page 63. All of the ‘big 4’ audit rms

were invited to participate in the tender. Deloitte LLP withdrew

at a preliminary stage noting the longevity of their appointment, having

been the Group’s auditors since its stock market listing in 1988.

Having concluded the process in February 2014, the Committee

recommended to the Board that PricewaterhouseCoopers

LLP be appointed as the Group’s statutory auditor for the 2015

nancial year. Accordingly, a resolution proposing the appointment

of PricewaterhouseCoopers LLP as our auditor will be put to the

shareholders at the 2014 AGM. There are no contractual obligations

restricting the Committee’s choice of external auditor and we do not

indemnify our external auditor.

The Committee will continue to review the auditor appointment and

the need to tender the audit, ensuring the Group’s compliance with the

UK Corporate Governance Code and any reforms of the audit market

by the UK Competition Commission and the European Union.

In its assessment of the independence of the auditor and in accordance

with the US Public Company Accounting Oversight Board’s standard

on independence, the Committee receives details of any relationships

between the Company and Deloitte LLP that may have a bearing

on their independence and receives conrmation that they are

independent of the Company within the meaning of the securities laws

administered by the US Securities & Exchange Commission (‘SEC’).

During the year, Deloitte LLP and related member rms charged the

Group £9 million (2013: £8 million, 2012: £7 million) for statutory

audit services. The Committee approved these fees following review

of audit scope changes for the 2014 nancial year, including the

impact of business acquisitions and disposals which were primarily

in relation to Kabel Deutschland, the disposal of Verizon Wireless

and the acquisition of the remaining 23% interest in Vodafone Italy.

The Committee also received assurance from Deloitte LLP that the fees

were appropriate for the scope of the work required.

Non-audit services

As a further measure to protect the objectivity and independence of the

external auditor, the Committee has a policy governing the engagement

of the external auditor to provide non-audit services. This precludes

Deloitte LLP from providing certain services such as valuation work

or the provision of accounting services and also sets a presumption that

Deloitte should only be engaged for non-audit services where there

is no legal or practical alternative supplier. No material changes have

been made to this policy during the nancial year.

For certain specic permitted services, the Committee has

pre-approved that Deloitte LLP can be engaged by management,

subject to the policies set out above, and subject to specied fee limits

for individual engagements and fee limits, for each type of specic

service. For all other services or those permitted services that exceed

the specied fee limits, I, as Chairman, or in my absence another

member, can pre-approve permitted services.

In addition to the statutory audit fee, Deloitte LLP and related member

rms charged the Group £4 million (2013: £1 million) for audit-related

and other assurance services. These fees were materially higher than

in prior years as Deloitte acted as the Reporting Accountant in relation

to a number of shareholder and regulatory lings in connection with the

disposal of our interest in Verizon Wireless and the related acquisition

of the remaining 23% interest in Vodafone Italy. Further details of the

fees paid, for both audit and non-audit services, can be found in note 3

to the consolidated nancial statements.

For a number of years, PricewaterhouseCoopers LLP has provided

the Group with a wide range of consulting and assurance services.

Following the decision to appoint them as auditors for the 2015

nancial year, it was agreed by the Committee that any existing

permitted non-audit service engagements which were not in line

with the Group’s non-audit services policy should cease by 30 June

2014. This decision was made to allow a timely transition of these

services and minimise the impact on the business. From 1 April 2014,

PricewaterhouseCoopers LLP will only be engaged for non-audit

services which are in line with the Group’s non-audit services policy.

Nick Land

On behalf of the Audit and Risk Committee

20 May 2014

Vodafone Group Plc

Annual Report 201464

Corporate governance (continued)