Vodafone 2014 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

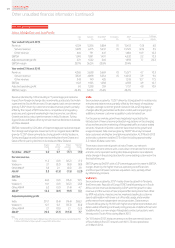

Vodacom’s mobile operations outside South Africa delivered strong

service revenue growth of 23.4%*, excluding Vodacom Business Africa,

driven by a larger customer base and increasing data take-up. M-Pesa

continues to perform well in Tanzania, with approximately 4.9 million

active users, and was launched in DRC in November 2012. During the

year Vodacom DRC became the rst operator to launch 3G services

in the DRC.

EBITDA grew by 10.1%*, with a 1.5* percentage point increase in EBITDA

margin, primarily driven by revenue growth in Vodacom’s mobile

operations outside South Africa and savings in network costs in South

Africa following investment in single RAN and transmission equipment.

Other AMAP

Organic service revenue grew by 3.8%* with growth in Turkey, Egypt,

Ghana and Qatar more than offset by revenue declines in Australia

and New Zealand. Service revenue in Turkey grew by 17.3%*, primarily

driven by growth in the contract customer base and an increase in data

revenue due to mobile internet and higher smartphone penetration.

Australia continued to experience steep revenue declines on the

back of ongoing service perception issues and a declining customer

base. There has been a strong focus on network improvement and

arresting the weakness in brand perception. In Egypt the launch

of value management initiatives, take-up of data services and the

increase in international incoming call volumes and rates drove

service revenue growth of 3.7%*, despite competitive pressures and

the uncertain political environment. Data revenue continued to show

strong growth of 29.6%* and xed line revenue grew by 29.0%*. In Qatar

service revenue grew by 29.8%*, driven by the growth in the customer

base, which is now over one million, supported by successful new

propositions. In Ghana, continued strong growth in the customer base

and the success of integrated tariffs led to service revenue growth

of 24.5%*.

EBITDA increased by 6.2%*, with EBITDA margin increasing by

0.5*percentage points with the impact of service revenue growth

in Turkey, Egypt, Qatar and Ghana offsetting declines in Australia and

New Zealand.

Non-Controlled Interests

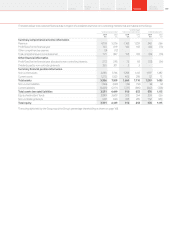

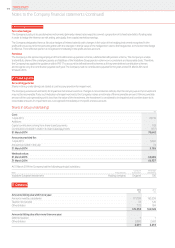

Verizon Wireless1

2013

£m

2012

£m

% change

£Organic

Revenue 21,972 20,187 8.8 7.8

Service revenue 19,697 18,039 9.2 8.1

Other revenue 2,275 2,148 5.9 5.2

EBITDA 8,831 7,689 14.9 13.6

Interest (25) (212) (88.2)

Tax213 (287) (104.5)

Group’s share of result

inVZW 6,500 4,953 31.2 29.8

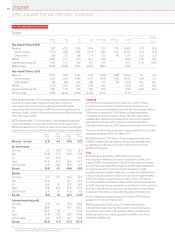

In the United States VZW reported 5.9 million net mobile retail

connection3 additions in the year, bringing its closing mobile retail

connection base to 98.9 million, up 6.4%.

Service revenue growth of 8.1%* continued to be driven by the

expanding number of accounts and ARPA4 growth from increased

smartphone penetration and a higher number of connections

per account.

EBITDA margin improved, with efciencies in operating expenses

and direct costs partially offset by higher acquisition and retention

costs reecting the increased new connections and demand

for smartphones.

VZW’s net debt at 31 March 2013 totalled US$6.2 billion5 (2012:

US$6.4 billion5). During the year VZW paid a US$8.5 billion income

dividend to its shareholders and completed the acquisition of spectrum

licences for US$3.7 billion (net).

Notes:

1 All amounts represent the Group’s share based on its 45% equity interest, unless otherwise stated.

2 The Group’s share of the tax attributable to VZW relates only to the corporate entities held by the VZW

partnership and certain state taxes which are levied on the partnership. The tax attributable to the

Group’s share of the partnership’s pre-tax prot is included within the Group tax charge.

3 The denition of “connections” reported by VZW is the same as “customers” as reported by Vodafone.

4 Average monthly revenue per account.

5 Net debt excludes pending credit card receipts.

Annual Report 2014 175Overview

Strategy

review Performance Governance Financials Additional

information