Vodafone 2014 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Key performance indicators

Monitoring our progress

and performance

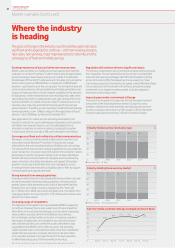

We track our performance against 12 key nancial, operational and

commercial metrics which we judge to be the best indicators of how we are

doing. The pressures we have faced in Europe are reected in the decline in

service revenue and EBITDA margin and the loss of market position. Despite

this we met our nancial guidance and increased our dividend per share and

we have made clear progress in our operational and commercial KPIs.

Growth in the top line demonstrates our

ability to grow our customer base and

stabilise or increase ARPU. It also helps

to maintain margins. We aim to return

to service revenue growth.

Growth in our EBITDA margin magnies

the impact of revenue growth on the

protability of our business. We expected

this year’s margin to be lower than

lastyear’s.

AOP includes the impact of depreciation

and amortisation and includes the results

of our non-controlling interests.

We gave guidance of around £5 billion for

the year on a pro forma basis, see page 39.

Maintaining a high level of cash

generation is key to delivering strong

shareholder returns.

We gave guidance of £4.5–£5 billion for

the year on a pro forma basis, see page 39.

Our strategic push towards bundling

voice, text and data allows us to defend

our revenue base from substitution,

and to monetise future data demand

growth. We aim to increase this proportion

eachyear.

Smartphones are key to giving our

customers access to data; the more our

customers have them, the bigger our data

opportunity becomes. We aim to increase

penetration to over 50% by 2015.

More work to do

Achieved

Achieved

Achieved

Achieved

201220132014

£6.1bn

£5.6bn

£4.4bn

201220132014

Data not available

51%

58%

201220132014

28%

38%

45%

201220132014

+1.5%*

-1.9%*

-4.3%*

201220132014

31.2%

30.5%

29.4%

201220132014

£11.9bn

£12.6bn

£7.9bn

More work to do

Organic service revenue growth

We were unable to grow our service revenue

this year, as the competitive, regulatory and

macroeconomic pressures in Europe seen last

year continued.

As expected, competitive, regulatory and

macroeconomic pressures in Europe

offset improvements in AMAP and our

margin declined.

The fall in AOP reects the disposal of Verizon

Wireless during the year, the decline in EBITDA

and higher depreciation and amortisation.

On a guidance basis, AOP was £4.9 billion

(seepage 39 for details).

Free cash ow fell in the year as a result

of exchange rate movements in some of our

emerging markets and lower EBITDA.

On a guidance basis, free cash ow was

£4.8 billion (see page 39 for details).

We continue to make great progress in this

area, helped by the rapid adoption of our

Vodafone Red plans (see page 22).

Our customers increasingly want

smartphones as data becomes more and

more crucial to everyday life. We are on course

to meet our target of half of our European

customers using smartphones by next year.

See pages 22 and 23 for more information.

EBITDA margin1

Adjusted operating prot (‘AOP’)1

Free cash ow

% of European mobile service revenue in-bundle2

Smartphone penetration (March 2014, Europe2)

Vodafone Group Plc

Annual Report 2014

Vodafone Group Plc

Annual Report 20141616