Vodafone 2014 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

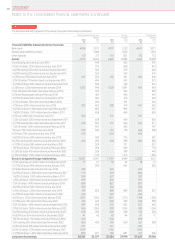

23. Capital and nancial risk management (continued)

Market risk

Interest rate management

Under the Group’s interest rate management policy, interest rates on monetary assets and liabilities denominated in euros, US dollars and sterling

are maintained on a oating rate basis except for periods up to six years where interest rate xing has to be undertaken in accordance with treasury

policy. Where assets and liabilities are denominated in other currencies interest rates may also be xed. In addition, xing is undertaken for longer

periods when interest rates are statistically low.

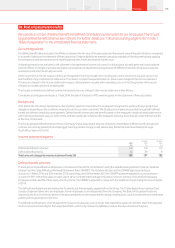

For each one hundred basis point fall or rise in market interest rates for all currencies in which the Group had borrowings at 31 March 2014 there

would be a reduction or increase in prot before tax by approximately £42 million (2013: increase or reduce by £144 million) including mark-to-

market revaluations of interest rate and other derivatives and the potential interest on outstanding tax issues. There would be no material impact

on equity.

Foreign exchange management

As Vodafone’s primary listing is on the London Stock Exchange its share price is quoted in sterling. Since the sterling share price represents the value

of its future multi-currency cash ows, principally in euro, South African rand, Indian rupee and sterling, the Group maintains the currency of debt

and interest charges in proportion to its expected future principal multi-currency cash ows and has a policy to hedge external foreign exchange

risks on transactions denominated in other currencies above certain de minimis levels. As the Group’s future cash ows are increasingly likely

to be derived from emerging markets it is likely that a greater proportion of debt in emerging market currencies will be drawn.

The disposal of our US Group in February 2014 necessitated a restructuring of the Group’s outstanding US dollar debt, which was achieved via

i) the repayment of certain US dollar debt obligations and ii) the use of cross currency swaps to eliminate the US dollar currency risk on certain

remaining US dollar debt items. Prior to the disposal date a signicant proportion of the Group’s future value was derived from its US assets.

Going forward the Group will only hold US dollar debt to hedge future US dollar receipts, which primarily consist of oating rate notes as issued

by Verizon Communications, received as part of the disposal consideration.

At 31 March 2014, 164% of net debt was denominated in currencies other than sterling (96% euro, 37% India rupee 19% US dollar and 12% other)

while 64% of net debt had been purchased forward in sterling in anticipation of sterling denominated shareholder returns via dividends. This allows

euro, US dollar and other debt to be serviced in proportion to expected future cash ows and therefore provides a partial hedge against income

statement translation exposure, as interest costs will be denominated in foreign currencies.

Under the Group’s foreign exchange management policy, foreign exchange transaction exposure in Group companies is generally maintained at the

lower of €5 million per currency per month or €15 million per currency over a six month period.

The Group recognises foreign exchange movements in equity for the translation of net investment hedging instruments and balances treated

as investments in foreign operations. However, there is no net impact on equity for exchange rate movements on net investment hedging

instruments as there would be an offset in the currency translation of the foreign operation.

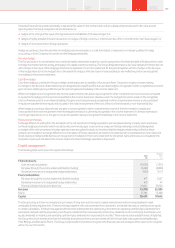

The following table details the Group’s sensitivity of the Group’s adjusted operating prot to a strengthening of the Group’s major currency in which

it transacts. The percentage movement applied to the currency is based on the average movements in the previous three annual reporting periods.

Amounts are calculated by retranslating the operating prot of each entity whose functional currency is euro.

2014

£m

Euro 3% change – Operating prot160

Note:

1 Operating prot before impairment losses and other income and expense.

At 31 March 2013, sensitivity of the Group’s operating prot was analysed for a strengthening of the euro by 3% and the US dollar by 4%, which

represented movements of £106 million and £257 million respectively.

Equity risk

The Group has equity investments, which are subject to equity risk. See note 13 “Other investments” for further details.

Notes to the consolidated nancial statements (continued)

Vodafone Group Plc

Annual Report 2014150