Vodafone 2014 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

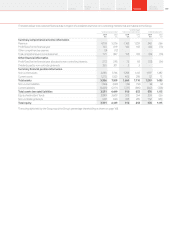

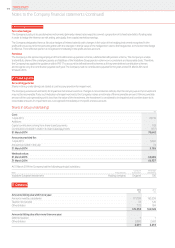

4. Other investments

Accounting policies

Gains and losses arising from changes in fair value of available-for-sale investments are recognised directly in equity, until the investment is disposed

of or is determined to be impaired, at which time the cumulative gain or loss previously recognised in equity, determined using the weighted average

cost method, is included in the net prot or loss for the period.

2014 2013

£m £m

Investments 130 117

5. Creditors

Accounting policies

Capital market and bank borrowings

Interest bearing loans and overdrafts are initially measured at fair value (which is equal to cost at inception) and are subsequently measured

at amortised cost using the effective interest rate method, except where they are identied as a hedged item in a fair value hedge. Any difference

between the proceeds net of transaction costs and the settlement or redemption of borrowings is recognised over the term of theborrowing.

2014 2013

£m £m

Amounts falling due within one year:

Bank loans and other loans 4,120 7,474

Amounts owed to subsidiaries 169,845 104,872

Other creditors 161 242

Accruals and deferred income 17 1,042

174,143 113,630

Amounts falling due after more than one year:

Other loans 17,504 24,594

Other creditors 751 912

18,255 25,506

Included in amounts falling due after more than one year are other loans of £8,584 million, which are due in more than ve years from 1 April 2014

and are payable otherwise than by instalments. Interest payable on these loans ranges from 2.5% to 7.875%.

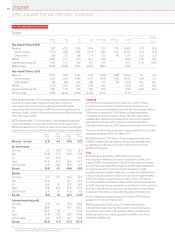

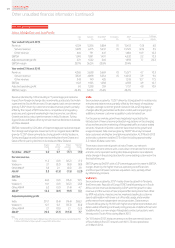

6. Share capital

Accounting policies

Equity instruments issued by the Company are recorded at the proceeds received, net of direct issuance costs.

2014 2013

Number £m Number £m

Ordinary shares of 2020/21 US cents each allotted,

issued and fully paid:1,2

1 April 53,820,386,309 3,866 53,815,007,289 3,866

Allotted during the year 1,423,737 –5,379,020 –

Consolidated during the year3(24,009,886,918) – – –

Cancelled during the year (1,000,000,000) (74) – –

31 March 28,811,923,128 3,792 53,820,386,309 3,866

Notes:

1 50,000 (2013: 50,000) 7% cumulative xed rate shares of £1 each were allotted, issued and fully paid by the Company.

2 At 31 March 2014 the Company held 2,371,962,907 (2013: 4,901,767,844) treasury shares with a nominal value of £312 million (2013: £352 million).

3 On 19 February 2014, we announced a “6 for 11” share consolidation effective 24 February 2014. This had the effect of reducing the number of shares in issue from 52,821,751,216 ordinary shares (including 4,351,833,492

ordinary shares held in Treasury) as at the close of business on 18 February 2014 to 28,811,864,298 new ordinary shares in issue immediately after the share consolidation on 24 February 2014.

During the year, we issued 14,732,741,283 B shares of $1.88477 per share and 33,737,176,433 C shares of $0.00001 per share as part of the

Return of Value following the disposal of our US Group, whose principal asset was its 45% stake in Verizon Wireless (‘VZW’). The B shares were

cancelled as part of the Return of Value. The C shares were reclassied as deferred shares with no substantive rights as part of the Return of Value

and transferred to LDC (Shares) Limited (‘LDC’). After 22 February 2015 and without prior notice we may repurchase, or be required by LDC

to repurchase, and then subsequently cancel all deferred shares for a total price of not more than one cent for all deferred shares repurchased.

Allotted during the year

Nominal Net

value proceeds

Number £m £m

UK share awards and option scheme awards – – –

US share awards and option scheme awards 1,423,737 – –

Total for share awards and option scheme awards 1,423,737 – –

179Overview Strategy

review Performance Governance Financials Additional

information