Vodafone 2014 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

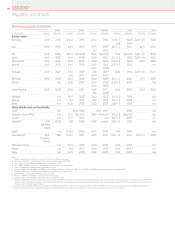

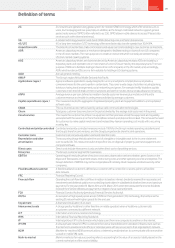

Management basis1

Statutory

basis1

Organic

change

%

Other

activity2

pps

Foreign

exchange

pps

Reported

change

%

Presentation

adjustments

pps

Reported

change

%

Europe

Revenue (9.3) 4.7 2.5 (2.1) 3.5 1.4

Service revenue (9.1) 4.6 2.5 (2.0) 4.0 2.0

Other revenue (10.8) 4.4 2.5 (3.9) (1.8) (5.7)

Europe – mobile in-bundle revenue 3.1 0.4 2.6 6.1 (0.1) 6.0

Europe – enterprise revenue (8.5) 14.2 2.8 8.5 4.4 12.9

Germany – service revenue (6.2) 9.0 3.6 6.4 –6.4

Germany – mobile in-bundle revenue 2.7 –3.5 6.2 –6.2

Germany – mobile out-of-bundle revenue (22.6) 0.3 2.9 (19.4) –(19.4)

Italy – service revenue (17.1) 2.2 3.1 (11.8) 11.8 –

Italy – mobile in-bundle revenue 15.2 4.0 3.8 23.0 (23.0) –

Italy – xed line revenue (3.2) 3.1 3.6 3.5 (3.5) –

Italy – operating expenses 7.1 (2.7) (3.5) 0.9 (0.9) –

UK – service revenue (4.4) 31.9 –27.5 –27.5

UK – mobile in-bundle revenue 0.6 – – 0.6 –0.6

UK – mobile out-of-bundle revenue (7.2) – – (7.2) –(7.2)

Spain – service revenue (13.4) (0.7) 3.1 (11.0) –(11.0)

Spain – mobile in-bundle revenue (0.4) –3.4 3.0 –3.0

Spain – xed line revenue (0.2) –3.4 3.2 –3.2

Spain – operating expenses 9.4 –(3.3) 6.1 –6.1

Netherlands – service revenue (5.6) (0.6) 3.4 (2.8) –(2.8)

Netherlands – mobile in-bundle revenue 3.4 –3.5 6.9 –6.9

Portugal – service revenue (8.4) (0.6) 3.3 (5.7) –(5.7)

Greece – service revenue (14.1) (0.8) 3.2 (11.7) –(11.7)

Other Europe – service revenue growth (7.1) (17.5) 1.8 (22.8) –(22.8)

EBITDA (18.3) 5.6 2.5 (10.2) 5.2 (5.0)

Germany – EBITDA (18.2) 10.2 3.3 (4.7) –(4.7)

Germany – percentage point change in EBITDA margin (4.3) 0.8 0.1 (3.4) –(3.4)

Italy – EBITDA (24.9) 2.2 2.8 (19.9) 19.9 –

Italy – percentage point change in EBITDA margin (4.8) –0.1 (4.7) 39.5 34.8

UK – EBITDA (9.8) 26.9 0.1 17.2 –17.2

UK – percentage point change in EBITDA margin (1.0) (0.4) –(1.4) –(1.4)

Spain – EBITDA (23.9) (1.8) 2.8 (22.9) –(22.9)

Spain – percentage point change in EBITDA margin (3.4) (0.4) 0.1 (3.7) –(3.7)

Other Europe – EBITDA growth (14.0) (6.2) 2.1 (18.1) (0.1) (18.2)

Other Europe – percentage point change in EBITDA margin (2.1) 3.6 0.1 1.6 –1.6

Adjusted operating prot (39.2) 1.3 2.3 (35.6) (2.1) (37.7)

Germany – adjusted operating prot (36.0) (1.1) 2.6 (34.5) –(34.5)

Italy – adjusted operating prot (41.6) 1.1 2.4 (38.1) (11.7) (49.8)

UK – adjusted operating prot (49.3) 11.0 –(38.3) –(38.3)

Spain – adjusted operating prot (56.4) (2.5) 1.9 (57.0) –(57.0)

Other Europe – adjusted operating prot growth (30.2) 4.8 2.4 (23.0) –(23.0)

AMAP

Revenue 8.4 0.7 (12.0) (2.9) 1.1 (1.8)

Service revenue 6.1 0.7 (11.5) (4.7) 1.2 (3.5)

Other revenue 27.4 0.6 (16.1) 11.9 4.9 16.8

India – service revenue 13.0 –(11.7) 1.3 –1.3

Vodacom – service revenue 4.1 (2.8) (13.7) (12.4) –(12.4)

South Africa – service revenue 0.3 –(16.2) (15.9) –(15.9)

South Africa – data revenue 23.5 –(20.3) 3.2 –3.2

South Africa – mobile in-bundle revenue 9.7 –(17.9) (8.2) –(8.2)

Vodacom’s international operations – service revenue 18.9 –(3.8) 15.1 –15.1

Turkey – service revenue 7.9 (0.5) (11.6) (4.2) –(4.2)

Turkey – mobile in-bundle revenue 25.0 –(14.1) 10.9 –10.9

Egypt – service revenue 2.6 –(11.2) (8.6) –(8.6)

Ghana – service revenue 19.3 (0.2) (17.3) 1.8 –1.8

Australia – service revenue (9.0) –(9.1) (18.1) 18.1 –

Other AMAP – service revenue 2.8 4.0 (9.4) (2.6) 4.0 1.4

203Overview Strategy

review Performance Governance Financials Additional

information