Vodafone 2014 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Prior year operating results (continued)

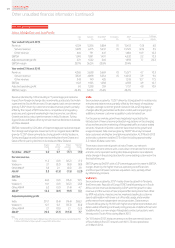

Europe

% change

Germany

£m

Italy

£m

UK

£m

Spain

£m

Other Europe

£m

Eliminations

£m

Europe

£m £Organic

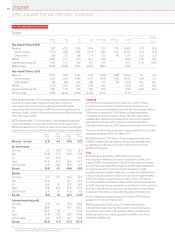

Year ended 31 March 2013

Revenue 7, 8 57 4,755 5,150 3,904 7,115 (179) 28,602 (5.7) (5.5)

Service revenue 7, 2 75 4,380 4,782 3,629 6, 610 (175) 26,501 (5.9) (5.8)

Other revenue 582 375 368 275 505 (4) 2,101 (3.2) (1.3)

EBITDA 2,831 1,917 1,210 1,021 2,120 –9,099 (11.0) (8.1)

Adjusted operating prot 1,401 1,172 303 421 878 –4,175 (21.4) (15.8)

EBITDA margin 36.0% 40.3% 23.5% 26.2% 29.8% 31.8%

Year ended 31 March 2012

Revenue 8,233 5,658 5,397 4,763 6,469 (198) 30,322 0.2 (1.2)

Service revenue 7, 6 69 5,329 4,996 4,357 5,994 (193) 28 ,152 (0.9) (2.1)

Other revenue 564 329 401 406 475 (5) 2 ,170 16.4 13.6

EBITDA 3,034 2,521 1,294 1,210 2 ,16 0 –10,219 (3.4) (4.8)

Adjusted operating prot 1, 561 1, 742 406 583 1,018 –5,310 (8.0) (9.4)

EBITDA margin 36.9% 44.6% 24.0% 25.4% 33.4% 33.7%

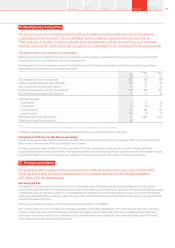

Revenue decreased by 5.7% including a 4.6 percentage point adverse

impact from unfavourable foreign exchange rate movements.

On an organic basis service revenue decreased by 5.8%* as data

revenue was offset by the impact of MTR cuts and competitive pricing

pressures. Organic growth in Germany was more than offset by declines

in all of the major markets.

EBITDA decreased by 11.0% including a 4.7 percentage point adverse

impact from foreign exchange rate movements. On an organic basis,

EBITDA decreased by 8.1%*, driven by lower service revenue and higher

customer investment due to the increased penetration of smartphones.

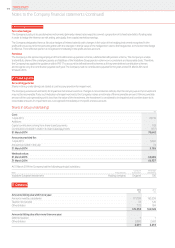

Organic

change

%

Other

activity1

pps

Foreign

exchange

pps

Reported

change

%

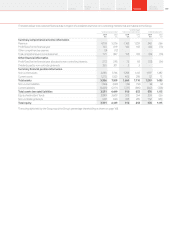

Revenue – Europe (5.5) 4.4 (4.6) (5.7)

Service revenue

Germany 0.5 (0.1) (5.5) (5.1)

Italy (12.8) (0.1) (4.9) (17.8)

UK (4.0) (0.3) –(4.3)

Spain (11.5) (0.2) (5.0) (16.7)

Other Europe (5.2) 22.4 (6.9) 10.3

Europe (5.8) 4.5 (4.6) (5.9)

EBITDA

Germany (1.7) 0.2 (5.2) (6.7)

Italy (19.3) –(4.7) (24.0)

UK (6.8) 0.4 (0.1) (6.5)

Spain (9.8) (0.5) (5.3) (15.6)

Other Europe (3.7) 8 .1 (6.3) (1.9)

Europe (8.1) 1.8 (4.7) (11.0)

Adjusted operating prot

Germany (5.5) 0.3 (5.0) (10.2)

Italy (28.5) –(4.2) (32.7)

UK (26.3) 0.9 –(25.4)

Spain (21.8) (1.0) (5.0) (27.8)

Other Europe (2.0) (6.1) (5.7) (13.8)

Europe (15.8) (1.1) (4.5) (21.4)

Note:

1 “Other activity” includes the impact of M&A activity and the revision to intra-group roaming charges from

1October 2011. Refer to “Organic growth” on page 202 for further detail.

Germany

Service revenue increased by 0.5%*, driven by a 1.3%* increase

in mobile revenue. Growth in enterprise and wholesale revenue,

despite intense price competition, was offset by lower prepaid revenue.

Data revenue increased by 13.6%* driven by higher penetration

of smartphones and an increase in those sold with a data bundle.

Vodafone Red, introduced in October 2012, performed in line with

expectations and had a positive impact on customer perception.

Enterprise revenue grew by 3.0%*, despite the competitive environment.

The roll-out of 4G services continued and was available in 81 cities, with

population coverage of 61% at 31 March 2013.

EBITDA declined by 1.7%*, with a 1.0* percentage point reduction

in EBITDA margin, driven by higher customer costs, partially offset

by operating cost efciencies and a one-off benet from a legal

settlement during Q2.

Italy

Service revenue declined by 12.8%* driven by the severe

macroeconomic weakness and intense competition, as well as the

impact of MTR cuts starting from 1 July 2012. Data revenue increased

by 4.4%* driven by mobile internet growth and the higher penetration

of smartphones, which more than offset the decline in mobile

broadband revenue. Vodafone Red plans, branded as “Vodafone Relax”

in Italy, continued to perform well and now account for approximately

30% of the contract customer base at 31 March 2013. The majority

of contract additions are Vodafone Relax tariffs. Fixed revenue declined

by 6.8%* driven by intense competition and a reduction in the customer

base due to the decision to stop consumer acquisitions in areas where

margins are impacted by unfavourable regulated wholesale prices.

4G commercial services were launched in October 2012 and were

available in 21 cities at 31 March 2013.

EBITDA declined by 19.3%*, with a 4.3* percentage point fall

in the EBITDA margin, driven by the decline in service revenue and

an increase in commercial costs, partially offset by operating cost

efciencies such as site sharing agreements and the outsourcing

of network maintenance.

Vodafone Group Plc

Annual Report 2014172

Other unaudited nancial information (continued)