Vodafone 2014 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Prior year operating results

This section presents our operating performance for the 2013 nancial year compared to the 2012 nancial

year, providing commentary on the revenue and EBITDA performance of the Group and its regions. The results

in this section are presented on a management basis, which includes the results of the Group’s joint ventures

on a proportionate basis, consistent with how the business is managed, operated and reviewed by management.

See note 2 “Segmental analysis” to the consolidated nancial statements for further information and

reconciliations between the management and statutory basis.

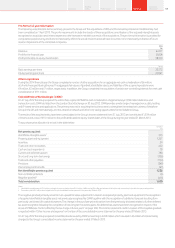

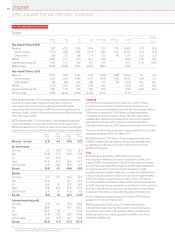

Group1,2

Europe

£m

AMAP

£m

Non-Controlled

Interests and

Common

Functions3

£m

Eliminations

£m

Restated1

2013

£m

Restated1

2012

£m

% change

£Organic

Revenue 28,602 15,413 481 (51) 44,445 4 6,417 (4.2) (1.4)

Service revenue 26,501 13,729 315 (50) 40,495 42,581 (4.9) (1.9)

Other revenue 2,101 1,684 166 (1) 3,950 3,836 3.0 4.0

EBITDA 9,099 4,532 (65) –13,566 14,606 (7.1) (1.9)

Adjusted operating prot 4,175 1,893 6,509 –12,577 12,030 4.5 9.5

Adjustments for:

Presentation adjustments4 (487) (690)

Discontinued operations5(6,500) (4,953)

Impairment loss (7,700) (4,050)

Restructuring costs and other one-off items (311) (144)

Amortisation of acquired customer base and brand intangible assets (249) (280)

Other income and expense 468 3,705

Operating (loss)/prot – statutory basis (2,202) 5,618

Notes:

1 All amounts are presented on the Group’s revised segment basis. EBITDA and adjusted operating prot have been restated to exclude restructuring costs and amortisation of customer base and brand intangible assets.

2 2013 results reect average foreign exchange rates of £1:€1.23 and £1:US$1.58 (2012: £1:€1.16 and £1:US$1.60).

3 Common Functions primarily represent the results of the partner markets and the net result of unallocated central Group costs

4 Presentation adjustments relate to the restatement of the Group’s joint ventures from a proportionate consolidation basis to an equity accounting basis.

5 Discontinued operations relate to the results of Verizon Wireless.

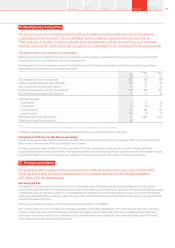

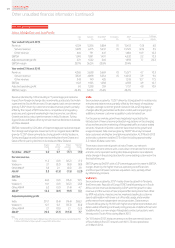

Revenue

Group revenue fell by 4.2% to £44.4 billion, with service revenue

of £40.5 billion, a decline of 1.9%* on an organic basis. Our performance

reected continued strong demand for data services and good

growth in our major emerging markets, offset by regulatory changes,

challenging macroeconomic conditions, particularly in Europe,

and continued competitive pressures.

In Europe service revenue declined by 5.8%* as growth in Germany

was offset by increased competition, macroeconomic pressure and

MTR cuts.

In AMAP service revenue increased by 5.5%* with continued growth

in all of our markets apart from Australia and New Zealand.

EBITDA and prot

Group EBITDA decreased by 7.1% to £13.6 billion, primarily driven

by lower revenue, partially offset by operating cost efciencies.

Adjusted operating prot grew by 4.5%, driven by 31.2% growth in our

share of prots of Verizon Wireless (‘VZW’) to £6.5 billion, partially offset

by lower EBITDA.

The operating (loss)/prot decreased from a prot £5.6 billion in the

prior year to a loss of £2.2 billion primarily due to the gains on the

disposal of the Group’s interests in SFR and Polkomtel in the prior year

and the higher impairment charges in the current year, partially offset

by the gain on acquisition of CWW of £0.5 billion.

An impairment loss of £7.7 billion was recorded in relation to Italy and

Spain, primarily driven by adverse performance against previous plans

and adverse movements in discount rates.

171Overview

Strategy

review Performance Governance Financials Additional

information

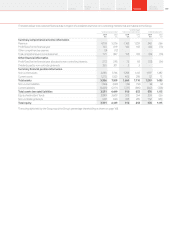

Other unaudited nancial information