Vodafone 2014 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Derivative nancial instruments are initially measured at fair value on the contract date and are subsequently remeasured to fair value at each

reporting date. The Group designates certain derivatives as:

a hedges of the change of fair value of recognised assets and liabilities (“fair value hedges”); or

a hedges of highly probable forecast transactions or hedges of foreign currency or interest rate risks of rm commitments (“cash ow hedges”); or

a hedges of net investments in foreign operations.

Hedge accounting is discontinued when the hedging instrument expires or is sold, terminated, or exercised, or no longer qualies for hedge

accounting, or if the Company chooses to end the hedging relationship.

Fair value hedges

The Group’s policy is to use derivative instruments (primarily interest rate swaps) to convert a proportion of its xed rate debt to oating rates in order

to hedge the interest rate risk arising, principally, from capital market borrowings. The Group designates these as fair value hedges of interest rate risk

with changes in fair value of the hedging instrument recognised in the income statement for the period together with the changes in the fair value

of the hedged item due to the hedged risk, to the extent the hedge is effective. Gains or losses relating to any ineffective portion are recognised

immediately in the income statement.

Cash ow hedges

Cash ow hedging is used by the Group to hedge certain exposures to variability in future cash ows. The portion of gains or losses relating

to changes in the fair value of derivatives that are designated and qualify as effective cash ow hedges is recognised in other comprehensive income;

gains or losses relating to any ineffective portion are recognised immediately in the income statement.

When the hedged item is recognised in the income statement amounts previously recognised in other comprehensive income and accumulated

in equity for the hedging instrument are reclassied to the income statement. However, when the hedged transaction results in the recognition

of a non-nancial asset or a non-nancial liability, the gains and losses previously recognised in other comprehensive income and accumulated

in equity are transferred from equity and included in the initial measurement of the cost of the non-nancial asset or non-nancial liability.

When hedge accounting is discontinued, any gain or loss recognised in other comprehensive income at that time remains in equity and

is recognised in the income statement when the hedged transaction is ultimately recognised in the income statement. If a forecast transaction

is no longer expected to occur, the gain or loss accumulated in equity is recognised immediately in the income statement.

Net investment hedges

Exchange differences arising from the translation of the net investment in foreign operations are recognised directly in equity. Gains and losses

on those hedging instruments (which include bonds, commercial paper, cross currency swaps and foreign exchange contracts) designated

as hedges of the net investments in foreign operations are recognised in equity to the extent that the hedging relationship is effective; these

amounts are included in exchange differences on translation of foreign operations as stated in the statement of comprehensive income. Gains and

losses relating to hedge ineffectiveness are recognised immediately in the income statement for the period. Gains and losses accumulated in the

translation reserve are included in the income statement when the foreign operation is disposed of.

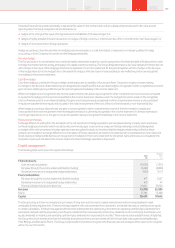

Capital management

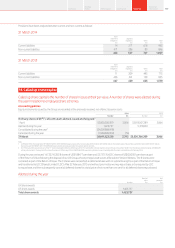

The following table summarises the capital of the Group:

2014

Restated

2013

£m £m

Financial assets:

Cash and cash equivalents (10,134) (7,531)

Fair value through the income statement (held for trading) (5,293) (6,803)

Derivative instruments in designated hedge relationships (955) (1,117)

Financial liabilities:

Fair value through the income statements (held for trading) 471 1,057

Derivative instruments in designated hedge relationships 410 44

Financial liabilities held at amortised cost 29,201 39,704

Net debt 13,700 25,354

Equity 71,781 72,488

Capital 85,481 97,842

The Group’s policy is to borrow centrally using a mixture of long-term and short-term capital market issues and borrowing facilities to meet

anticipated funding requirements. These borrowings, together with cash generated from operations, are loaned internally or contributed as equity

to certain subsidiaries. The Board has approved three internal debt protection ratios being: net interest to operating cash ow (plus dividends from

associates); retained cash ow (operating cash ow plus dividends from associates less interest, tax, dividends to non-controlling shareholders and

equity dividends) to net debt; and operating cash ow (plus dividends from associates) to net debt. These internal ratios establish levels of debt that

the Group should not exceed other than for relatively short periods of time and are shared with the Group’s debt rating agencies being Moody’s,

FitchRatings and Standard & Poor’s. The Group complied with these ratios throughout the nancial year and we expect these ratios to be complied

with in the next 12 months.

Vodafone Group Plc

Annual Report 2014 147Overview

Strategy

review Performance Governance Financials Additional

information