Vodafone 2014 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2014 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11

Assets

Networks

We aim to have the best mobile network in each of our markets,

combined with competitive xed networks in our main markets.

This means giving our customers far-reaching coverage, a very reliable

connection, and increasing speeds and data capacity. We believe

that over time, offering a superior network experience will enable

us to secure a premium positioning in most of our markets. We combine

our ongoing high level of network investment with a commitment

to securing the best possible portfolio of spectrum. For more

information on our network strategy see page 30.

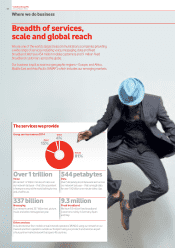

Distribution and customer service

We reach our customers through around 14,500 exclusive branded

stores including franchises, a broad network of distribution partners and

third party retailers. The Internet, whether accessed through a mobile

device or PC, is becoming an increasingly important channel for both

sales and after sales service. Our call centres are available 24hours

a day, seven days a week in all our European markets.

Supplier relationships

In the last nancial year we spent around £16 billion buying equipment,

devices and services. Given our large scale and global reach, we tend

to be a key strategic partner for many of our suppliers. We work closely

with them to build robust networks, develop innovative services and

offer the widest range of the latest devices.

People

During the year we employed an average of nearly 93,000 people.

We support, train and encourage our employees, ensuring they have

the right capabilities, commitment and enthusiasm to achieve our

targets and build on our success in delivering an outstanding experience

to all our customers. We are working hard to build a more diverse

workforce that is more representative of our customer base. For more

information on our people see page 36.

Brand

Today, Vodafone is the UK’s most valuable brand with an attributed

worth of US$30 billion (Source: 2014 Brand Finance Global 500).

The strength of our brand raises the prole of our distribution channels

and is a major driver of purchasing decisions for consumers and

enterprise customers alike.

Customers

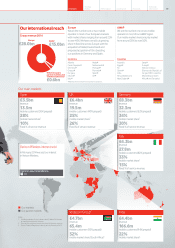

With 434 million customers globally, we are one of the biggest

mobile operators in the world. Over 90% of our mobile customers

are individuals and the rest are enterprise customers ranging from

large multinationals, to small and medium sized businesses, down

to the owner of the local corner shop. The majority and the growing

share of our mobile customers are in emerging markets. We also have

over nine million xed broadband customers, and most of these are

in Europe – in fact we are the fourth largest provider of xed broadband

services in Western Europe and will become the third following the

pending acquisition of Ono in Spain.

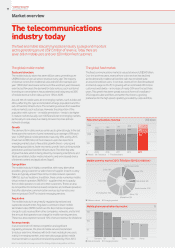

Revenue

Mobile consumers pay for our services either via contracts (typically

up to two years in length) or through buying their airtime in advance

(prepaid). Enterprise customers often have longer contracts.

Fixed customers typically pay via one to two year contracts.

We have a diverse service revenue stream with 51% from mobile

services in Europe, 30% from mobile operations in AMAP, 15% from

xed services and the remainder from other items such as MVNO

agreements. Within our mobile business, 51% of annual service revenue

arises from consumers’ monthly price plans, which we call in-bundled

revenue. In-bundled revenue is an increasing proportion of our business

and is relatively stable compared to out-of-bundle revenue, which

is much more vulnerable to competitive and economic pressure.

Cash ow

Our track record of converting revenue into cash ow is strong –

withsome £16 billion generated over the last three years. We achieve

this by operating efcient networks where we seek to minimise costs,

thus supporting our gross margin. We also have strong market share

positions – as we are typically the rst or second largest mobile operator

out of three or four in each market. This provides economies of scale

and is a key driver of cost efciencies and EBITDA margin, which in turn

provides healthy cash ow. See page 32 for more details of our plans

to improve our operating efciency.

Shareholder returns

The cash generated from operations allows us to sustain a generous

shareholder returns programme while also investing in the future

prosperity of the business – with almost £23 billion returned

to shareholders over the last three years, excluding the Verizon Wireless

return of value. With our strong nancial foundation, and as a sign of our

condence in our future performance, we intend to grow the annual

dividend per share each year going forward.

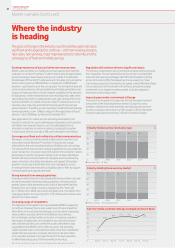

Reinvestment

We have maintained a high and consistent level of capex in recent years,

to support wider coverage, higher speeds and greater capacity in our

networks. Through our IT investment we are enhancing our customer

relationship capability and providing new customer billing services.

In addition, we have continued to invest in our stores, our internet and

social media presence and spectrum licences to support future services

and growth.

To boost our investment even more we started Project Spring,

our organic investment programme, which aims to accelerate and

extend our current strategy, and thereby strengthen further our

network and service differentiation. We expect total investments,

including Project Spring, to be around £19 billion over the next two

years. See page 13 for more details.

Want to nd out more?

Network

30

Operations

32

Our people

36

Financial review, including

revenue, cash ow and

shareholder returns

38

Risk management

and mitigation

46

11Overview Strategy

review Performance Governance Financials Additional

information