United Airlines 2009 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

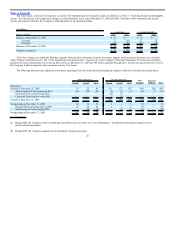

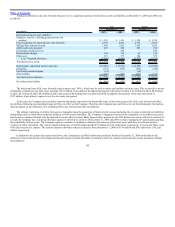

Annual Impairment Tests

United performed annual impairment reviews of its indefinite-lived intangible assets as of October 1, 2009 and 2008 and determined that no impairment

was indicated.

Goodwill

For purposes of testing goodwill in 2008, the Company estimated the fair value of the Mainline reporting unit (to which all goodwill is allocated) utilizing

several fair value measurement techniques, including two market estimates and one income estimate and using relevant data available through and as of May 31,

2008. The market approach is a valuation technique in which fair value is estimated based on observed prices in actual transactions and on asking prices for

similar assets. The income approach is a technique in which fair value is estimated based on the cash flows that an asset could be expected to generate over its

useful life, including residual value cash flows. These cash flows are discounted to their present value equivalents using a rate of return that accounts for the

relative risk of not realizing the estimated annual cash flows and for the time value of money.

Taking into consideration an equal weighting of the two market estimates and the income estimate, which has been the Company’s practice when

performing annual goodwill impairment tests, the indicated fair value of the Mainline reporting unit was less than its carrying value, and therefore, the Company

was required to perform additional goodwill impairment testing. For this testing, the Company determined the implied fair value of goodwill of the Mainline

reporting unit by allocating the fair value of the reporting unit to all the assets and liabilities of the Mainline reporting unit, including any recognized and

unrecognized intangible assets, as if the Mainline reporting unit had been acquired in a business combination and the fair value of the Mainline reporting unit was

the acquisition price. As a result of this testing, the Company determined that goodwill was completely impaired and therefore recorded an impairment charge

during the second quarter of 2008 to write-off the full value of goodwill.

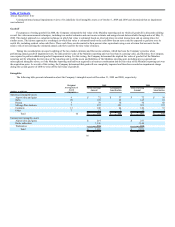

Intangibles

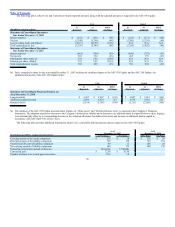

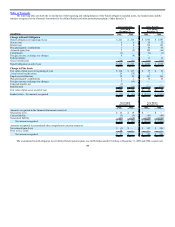

The following table presents information about the Company’s intangible assets at December 31, 2009 and 2008, respectively:

(Dollars in millions)

Weighted

Average Life of

Assets

(in years)

2009 2008

Gross Carrying

Amount

Accumulated

Amortization

Gross Carrying

Amount

Accumulated

Amortization

Amortized intangible assets

Airport slots and gates 9 $ 72 $ 37 $ 72 $ 30

Hubs 20 145 29 145 22

Patents 3 70 70 70 68

Mileage Plus database 7 521 221 521 179

Contracts 13 140 44 140 35

Other 7 12 7 13 5

Total 10 $ 960 $ 408 $ 961 $ 339

Unamortized intangible assets

Airport slots and gates $ 219 $ 237

Route authorities 1,146 1,146

Tradenames 538 688

Total $ 1,903 $ 2,071

95