United Airlines 2009 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2009 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

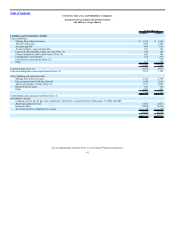

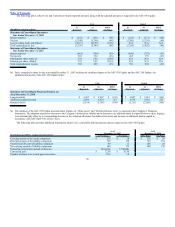

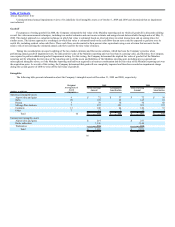

The following tables reflect UAL and United’s previously reported amounts, along with the adjusted amounts as required by the ASC 470 Update.

UAL United

(In millions, except per share)

As

Reported

As

Adjusted

Effect

of Change

As

Reported

As

Adjusted

Effect

of Change

Statement of Consolidated Operations

Year Ended December 31, 2008

Interest expense $ (523) $ (571) $ (48) $ (523) $ (571) $ (48)

Net loss (5,348) (5,396) (48) (5,306) (5,354) (48)

Loss per share, basic and diluted (42.21) (42.59) (0.38) N/A N/A N/A

Total comprehensive loss (5,396) (5,444) (48) (5,354) (5,402) (48)

Statement of Consolidated Operations

Year Ended December 31, 2007

Interest expense (661) (704) (43) (660) (703) (43)

Net income 403 360 (43) 402 359 (43)

Earnings per share, basic (a) 3.34 2.94 (0.40) N/A N/A N/A

Earnings per share, diluted 2.79 2.65 (0.14) N/A N/A N/A

Total comprehensive income 502 459 (43) 501 458 (43)

(a) Basic earnings per share for the year ended December 31, 2007 includes the combined impact of the ASC 470 Update and the ASC 260 Update. See

additional discussion of the ASC 260 Update below.

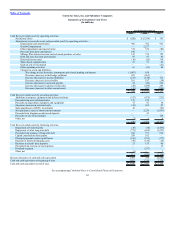

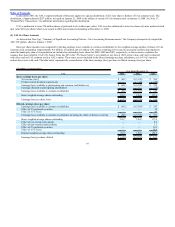

UAL United

As

Reported

As

Adjusted

Effect

of Change

As

Reported

As

Adjusted

Effect

of Change

Statement of Consolidated Financial Position (a)

As of December 31, 2008

Long-term debt $ 6,007 $ 5,862 $ (145) $ 6,007 $ 5,861 $ (146)

Additional capital invested 2,666 2,919 253 2,578 2,831 253

Retained deficit (5,199) (5,308) (109) (5,151) (5,260) (109)

(a) The adoption of the ASC 470 Update also had minor impacts on “Other assets” and “Deferred income taxes” as reported in the Company’s Financial

Statements. The adoption required an increase to the Company’s deferred tax liability and a decrease to its additional paid in capital. However, these impacts

were substantially offset by a corresponding decrease in the valuation allowance for deferred tax assets and increase to additional paid in capital in

accordance with ASC Topic 740, Income Taxes.

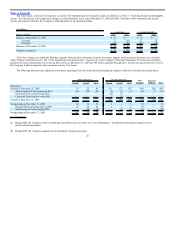

The following table provides additional information about UAL’s convertible debt instruments that are subject to the ASC 470 Update:

($ and shares in millions, except conversion prices)

As of

December 31, 2009

As of

December 31, 2008

4.5% Notes 5% Notes 4.5% Notes 5% Notes

Carrying amount of the equity component $ 216 $ 38 $ 216 $ 38

Principal amount of the liability component 726 150 726 150

Unamortized discount of liability component 80 11 126 20

Net carrying amount of liability component 646 139 600 130

Remaining amortization period of discount 18 months 13 months

Conversion price $ 32.64 $ 43.90

Number of shares to be issued upon conversion 22.2 3.4

90